今日最推

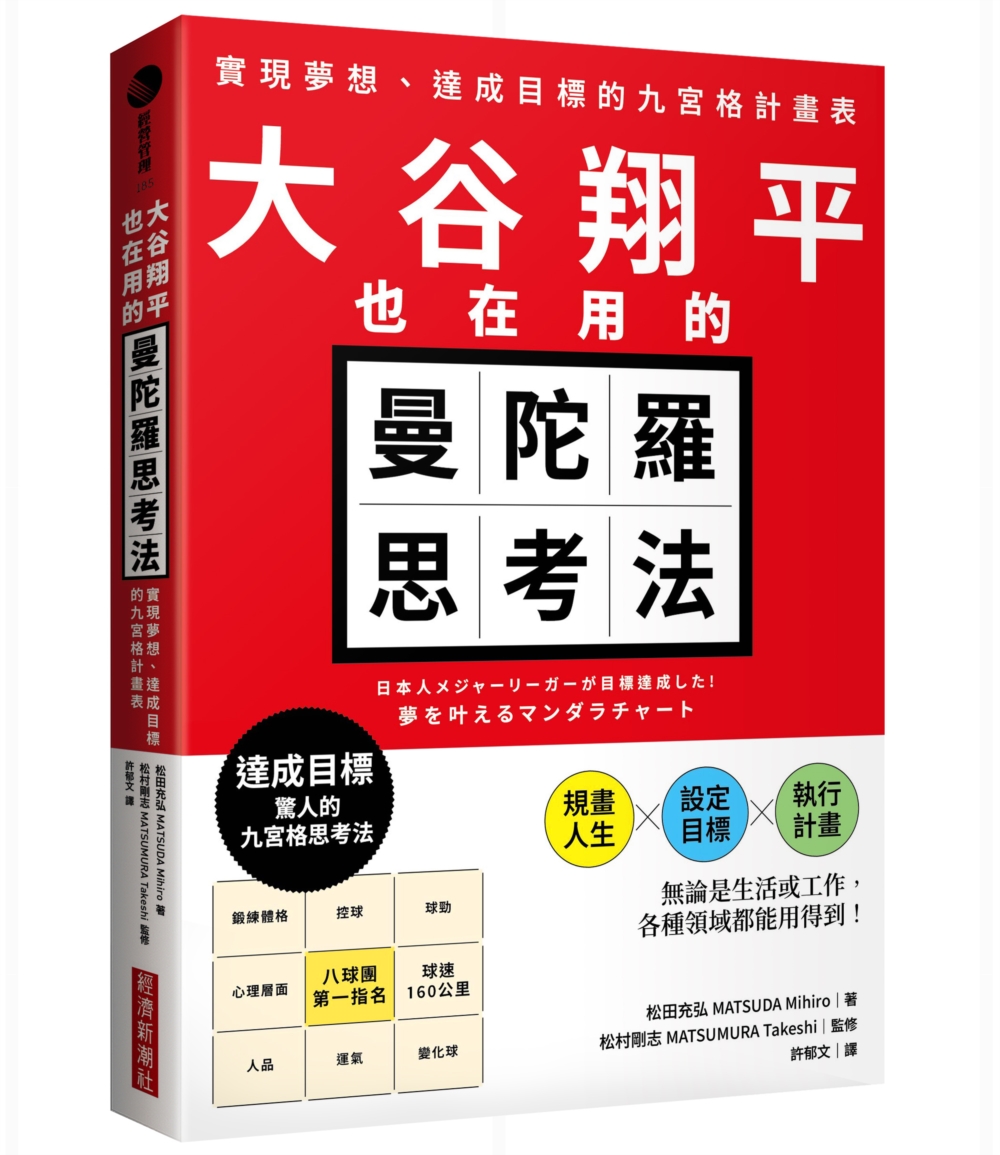

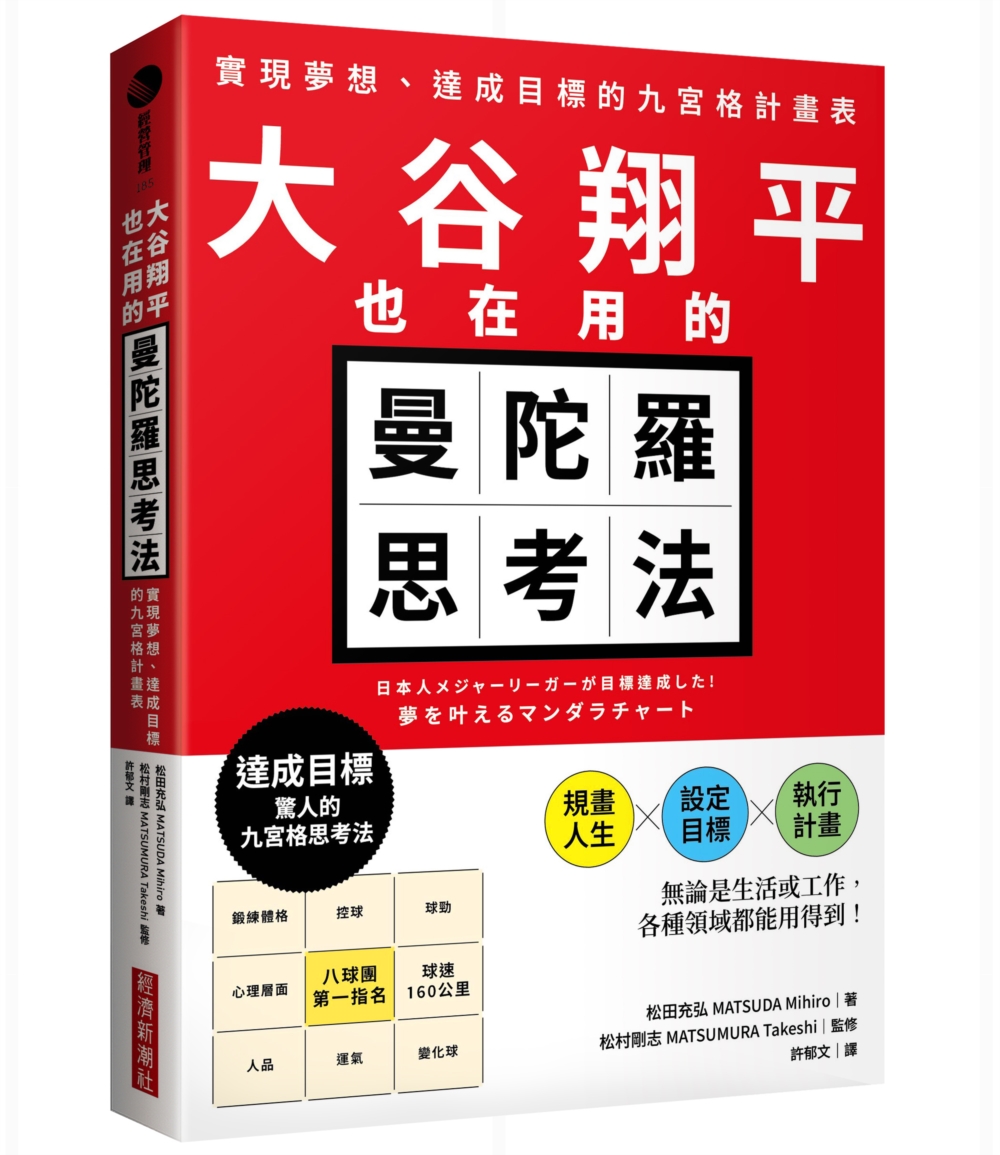

大谷翔平的逐夢思考法|大谷翔平也在用的曼陀羅思考法: 實現夢想、達成目標的九宮格計畫表

規畫人生、設定目標、執行計畫,

無論是生活或工作,各種領域都能用得到!

「不曉得該如何設定目標、擬定計畫。」

「即使有計畫,卻無法順利執行。」

可能你也遇過這種情形,這時候,你需要曼陀羅表格。

曼陀羅表格分為3×3的九宮格,以及從九宮格延伸的9×9表格,正中央通常會寫這張曼陀羅表格的主題,旁邊填入達成主題的實踐方法。曼陀羅表格是松村寧雄先生在1979年開發出來的,只要將想到的事情填入,就能幫助人們達成任何目標。

知名的職棒選手大谷翔平高中時期,就親手寫下了9×9曼陀羅表格,正中央寫的是「八個球團第一指名」,為了達成這個目標,大谷在這個主題的周圍,寫下實踐方法,分別是:運氣、心理、控球、球速160公里、人品、鍛練體格、球勁和變化球,接著再將這八個領域都再展開成九宮格,逐一寫下方法,讓行動化為習慣,進而實現目標。

本書作者松田充弘的人生,也是因為和曼陀羅表格開發者松村寧雄相遇而改變。松田認為,曼陀羅表格除了達成目標、實現夢想,也能當成創意發想的工具使用,從中可以學到了解自我、經營人生的方法。松田顛覆PDCA(Plan規畫→Do執行→Check查核→Action行動)的觀念,鼓勵我們改以CAPD(Check查核→Action行動→Plan規畫→Do執行)的方式使用曼陀羅表格。

在書中,松田分享「什麼是世界級人物都在應用的曼陀羅表格?」「大谷翔平的曼陀羅表格有什麼厲害的地方?」「曼陀羅表格為什麼是九宮格?」並且將曼陀羅表格結合提問,開發出「魔法提問曼陀羅表格」,光是回答提問,就能讓人生與職場變得更豐富。

松田認為,曼陀羅表格具有八種特性,包括:

1.全面關照

2.了解整體與局部的關係

3.解決各種問題

4.一邊腦力激盪、一邊整理創意

5.掌握階層化資訊

6.掌握本質

7.分享資訊

8.視覺化

書中也附有空白的曼陀羅表格,讓你可以一步步填寫,重新想一想自己沒想過或是不曾發現的問題。讓你也能像大谷翔平一樣,改變人生、實現夢想!

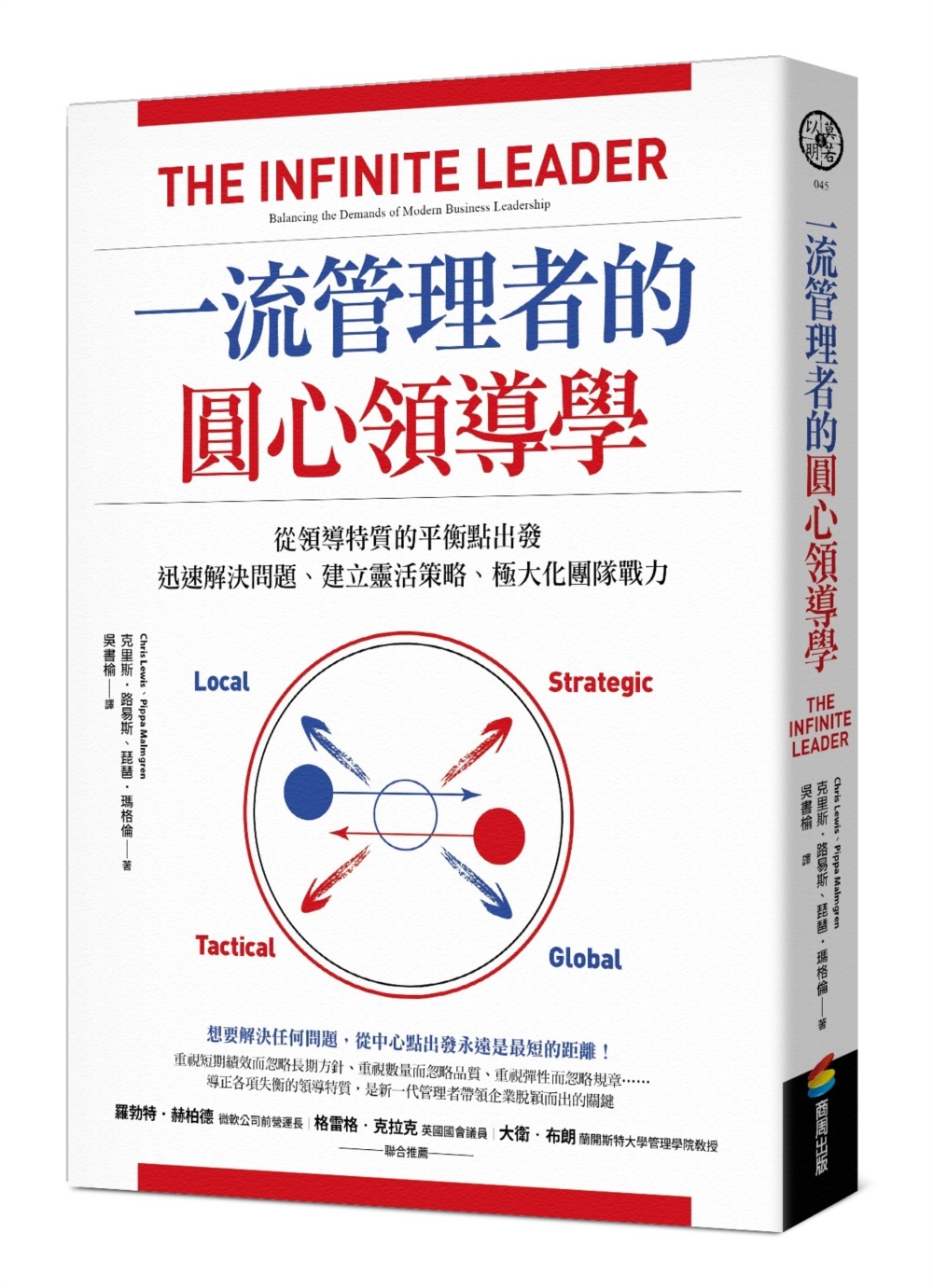

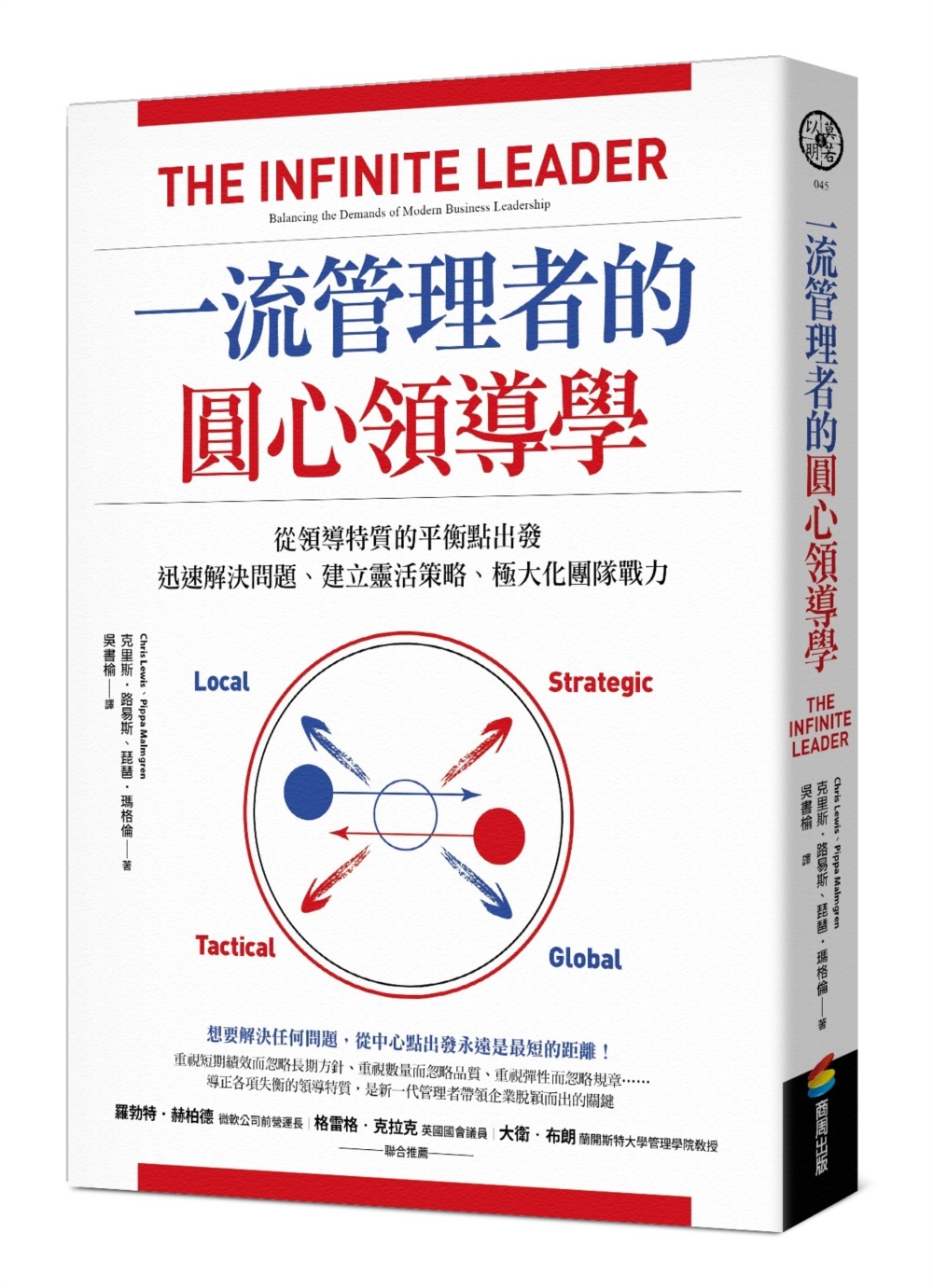

圓心領導學|一流管理者的圓心領導學: 從領導特質的平衡點出發, 迅速解決問題、建立靈活策略、極大化團隊戰力

想要解決任何問題,從中心點出發永遠是最短的距離!

────────────

重視短期績效而忽略長期方針、

重視數量而忽略品質、重視彈性而忽略規章……

導正各項失衡的領導特質,

是新一代管理者帶領企業脫穎而出的關鍵

────────────

想像一位管理者所具備的領導能力,如一個圓一樣向四周的各個面向擴展,距離圓上每一個點最近的位置,就在圓心,也就是原點。從原點出發,平衡各項領導特質,才不會讓管理走向極端。

過於重視短期績效而忽略長期經營方針、過於重視數量而忽略品質、過於重視規劃而忽略執行、過於重視彈性而忽略規章……這些都是阻礙企業永續經營的現象。身為管理者,有責任在這些特質中找到平衡點,讓策略運用更靈活,最佳化團隊的運作。

====== 平衡的領導力 ======

個人←─→團隊

地區性←─→全球化

大方向策略←─→局部性戰略

維持緊密←─→保持距離

述說←─→傾聽

規劃←─→執行

結構化體制←─→非固定結構

專精←─→全能

短期←─→長期

重質←─→重量

────────────

領導不是非黑即白

管理者必須平衡各項特質,才能發揮最大的影響力

────────────

【克里斯‧路易斯和琵琶‧瑪格倫向來對重要領導議題與當今趨勢有獨到且中肯的見解,本書也不例外,我大力推薦。】

── 羅勃特.赫柏德(Robert J Herbold)∣微軟公司前營運長

【兩位作者帶領我們踏上一段旅程,挑戰我們的認知,啟發出想法並激盪出新概念,他們身體力行了他們在《一流管理者的圓心領導學》中倡導的理念。】

── 格雷格‧克拉克(Rt Hon Greg Clark MP)∣英國國會議員

【身為教育人員,讀了本書前幾頁就看到傳統商學院在處理領導議題上的限制暴露出來,真是讓人深感不安。兩位作者的命題極具說服力:二十一世紀的領導必須能帶領人們安度前所未見的複雜性與曖昧不明,需要具備「流暢掌握情境」的能力,以支持並激勵人們行動。】

── 大衛‧布朗(Professor David Brown)∣蘭開斯特大學管理學院教授

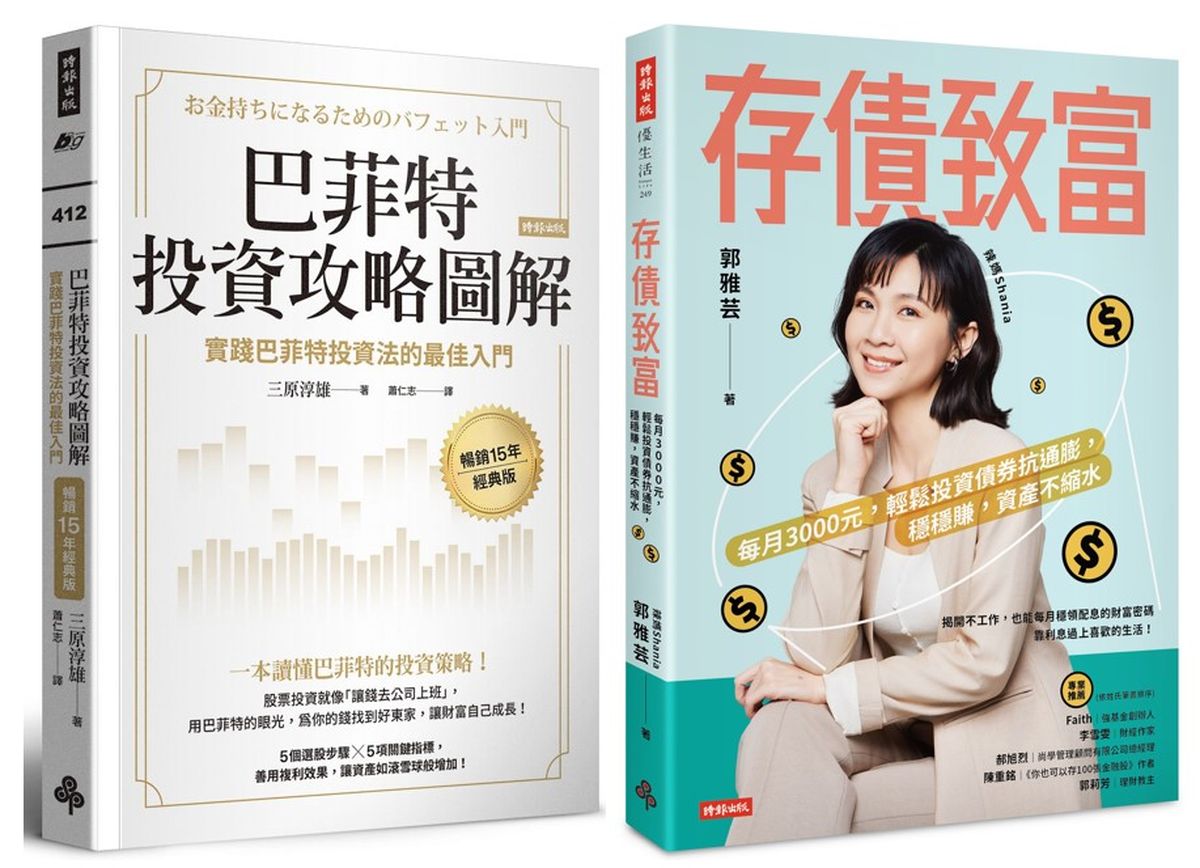

股票攻略75折套書|超完美! 股債平衡才能精準致富: 巴菲特投資攻略圖解+存債致富 (2冊合售)

《巴菲特投資攻略圖解》 內容介紹

★ 暢銷15年經典版 ★

一本讀懂巴菲特的投資攻略!

股票投資就像「讓錢去公司上班」,

用巴菲特的眼光,為你的錢找到好東家,

讓財富自己成長!

5個選股步驟 ╳ 5項關鍵指標,

善用複利效果,讓資產如滾雪球般增加!

▌「你買的是公司,而不是股票。」──華倫.巴菲特

巴菲特從不隨著行情起舞,因為他追隨的不是市場,而是企業!

★最簡明好懂的基礎入門書,一窺股神的長勝投資心法:

‧什麼是企業的「護城河」?

‧誰是「市場先生」?

‧巴菲特如何精選個股,兼顧「價值型投資」和「成長型投資」?

‧如何從數字找出巴菲特概念股,計算「股東權益報酬率」、「營業利益率」、「業主盈餘」?

‧巴菲特以終生持有的打算買進股票,但在什麼情況下必須出脫?

股票投資,形同擁有企業的一部分。股票的價值就等於企業的價值,因此,投資時必須重視企業的內涵與本質。

有些個人投資者經常會感嘆「忙到連看盤的時間都沒有」,其實,是他們誤以為每天看盤才叫作「股票投資」。忙到無法看盤反而是幸運的,因為只要找到好的股票,不輕易受股價波動和經濟動向的影響而混淆方向,不管發生什麼事都處之泰然,才是最好的做法。

本書將揭開巴菲特的選股原則,一步步帶你了解巴菲特如何解讀資訊、挑選企業、鑑定經營者,兼顧「價值型投資」和「成長型投資」,並落實「核心投資」。任何人都可以磨練出精準的投資眼光,找出具備未來成長可能性的公司!

★調查新發現潛力股的5大步驟

STEP 1──詳閱「企業網頁」,了解事業内容

STEP 2──檢視「股東權益報酬率」,了解是否為了股東而經營

STEP 3──檢視「營業利益」,了解是否穩定創造獲利

STEP 4──檢視「現金流量」,了解事業是否成功經營

STEP 5──檢查「股價K線圖」,了解股價表現好壞

用最簡單易懂的說明,讓你了解巴菲特投資哲學的精華!

用每個人都能輕易執行的步驟,帶你找到巴菲特概念股!

《存債致富》 內容介紹

【一本寫給小資族、退休族最詳盡的「債券」知識】

揭開不工作,每月穩領配息的財富密碼

靠利息過上喜歡的生活!

曾在龍頭券商與外商銀行等大型金融機構服務近14年的實戰經驗,

出版過11本暢銷著作的自媒體人「辣媽Shania」,

第一本結合個人專業金融知識的理財書

◆穩當的資產配置,是致富的不敗法則

在這個什麼都漲、只有薪水不漲的年代,進可攻,退可守的穩當「資產配置」,是致富不敗法則。

「債券」是一種固定收益的投資工具,在經濟不確定時提供保值功能,且利於風險管理。適合追求穩定現金流的人,以及追求風險分散和長期投資的人。所以,無論是「保守型投資人」或是「有資產配置需求的人」都適合買債券!

「誰說債券一定很難懂?」本書將透過辣媽shania親切的文字,

輕鬆愉快地探討債券投資的奧秘,不再讓投資、理財變成高不可攀的難題!

教你如何善用「債券」做好資產配置

靠利息提前退休!

內容特色:

◆了解什麼是債券?為什麼我要買債券?

以最簡單易懂的文字,將債券的複雜概念化繁為簡,使讀者能夠輕鬆理解債券的本質及其在金融體系中的角色。解答債券在投資組合中的獨特地位以及其所帶來的穩健回報。

◆我要怎麼投資債券相關的商品呢?

全方面介紹債券3大標的:債券型ETF、債券型基金、單一發行債券有哪些差異?有哪些必懂的重點?透過實例和案例的呈現,讀者將獲得實戰經驗,更能掌握風險特性以及預期收益。

◆一一破解債券迷思與常見投資問題?

‧我數學不好,真的看得懂債券嗎?

‧只要抱牢信用好的債券,就穩賺不賠?時間,真的是債券最好的朋友嗎?

‧萬一公司倒了,我是不是血本無歸?購買債券的風險究竟是什麼?

‧當票面和利率都是不變的,為什麼債券價格還會出現波動呢?

‧哪時候最適合投資債券呢?

‧該跟投信買還是跟銀行買債券?

‧如何不讓各種理財專員的話術影響?

本書將帶領讀者深入了解債券投資的核心觀念、探尋債券與股票的平衡術,讓每位理財者在這波經濟浪潮中找到保值、增值的最佳策略。

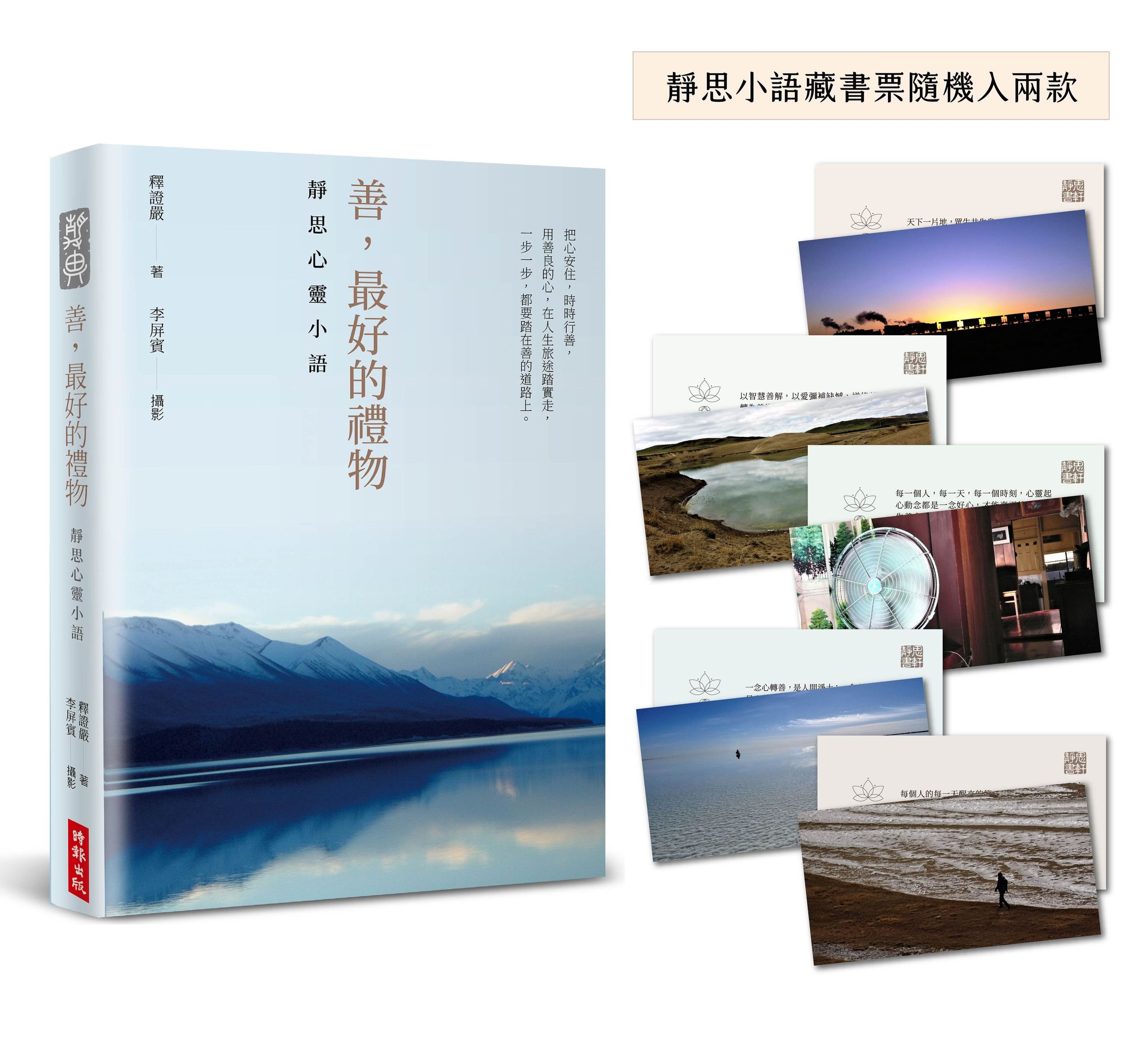

附限量靜思語隨機藏書票|善, 最好的禮物: 靜思心靈小語 (靜思語三十五周年精裝紀念版/附限量靜思小語隨機藏書票二入)

把心安住,時時行善,

用善良的心,在人生旅途踏實走,

一步一步,都要踏在善的道路上。

「最微小的善舉,勝過最偉大的意圖。」

──王爾德(Oscar Wilde)

「再微小的善念和善行,都比巨額現金有價值。」

──約翰.拉斯金(John Ruskin)

不要低估善意,善良也不是弱點;堅強的人才有餘力行善,行善的人必須學會愛與原諒,看見自己與他人的好。

本書精選自證嚴法師《靜思語》、《菩提心要》、《衲履足跡》等上百則與「善」有關的智慧語錄,以及「光影詩人」李屏賓多年來隨手拍攝的精采作品。透過這些在工作、生活、旅行等生命不同時刻裡的吉光片羽,以及精簡、智慧的文字,讓視覺的盛宴與文字的智慧之美長存於心中,描繪出屬於自己的心靈風景。

人生實難,時時以「善」的智慧小語提醒自己,把心安住、日日行善,踏實行走於生命旅途,做個願意選擇善良、相信世界會因為善行而改變的人,匯聚更強大的善的力量,形成善的循環,減少苦難。

好康優惠

新書報到 | 馬上選購

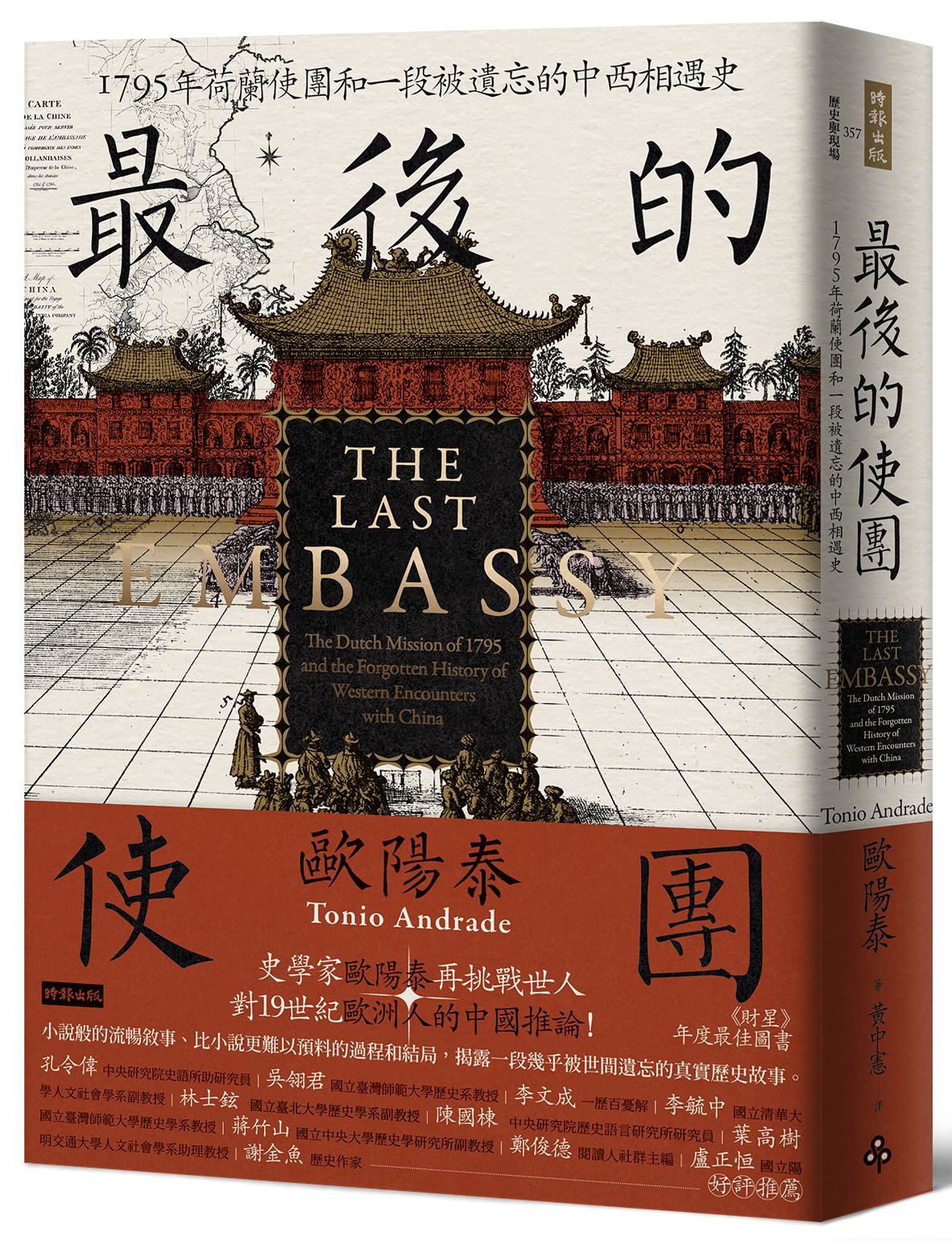

比小說難預料的史實|最後的使團: 1795年荷蘭使團和一段被遺忘的中西相遇史

繼《火藥時代》、《決戰熱蘭遮》,

史學家歐陽泰(Tonio Andrade)再挑戰世人對19世紀歐洲人的中國推論!

小說般的流暢敘事、比小說更難以預料的過程和結局,

揭露一段幾乎被世間遺忘的真實歷史故事。

「1793年英國的馬戛爾尼勛爵帶來形形色色的禮物、大批藝術家、科學家和樂師、一組大膽的提議。他覺得這些提議若能實現,將有助於中英關係走上互蒙其利之路……」馬戛爾尼使華拒絕下跪磕頭、大清帝國面對歐洲外交使團迂腐僵化的形象幾乎眾所皆知,但是,真的是這樣嗎?

歐洲人與中國的相遇並非都不歡而散,歐陽泰利用豐富的檔案資料,全面且多角度的呈現一個以詭計和戰爭為特點的時代。《最後的使團》講述1795年荷蘭使團經歷苦不堪言的跋涉來到北京,成為最後一個受到中國朝廷熱烈款待的歐洲外交代表團的故事。如此成功的使團,何以如今卻鮮為人知?甚至大清帝國與荷蘭使團的接洽過程,更揭露了一樁充滿戲劇性、並且徹底改變我們對中西關係史中,文化衝突觀念的大謬誤。

《最後的使團》書中穿插了出自中國人、歐洲人之手的素描和繪畫,讓讀者認識到常被誤解為傲慢、心胸狹隘的清廷,其實願意接受新思想、願意變通、帶有好奇心、具有世界主義的精神。另一方面,歐洲人挫折於無法以平起平坐的身分和中國打交道,如何形塑、深植「文化衝突說」,斷言必須把中國帶進西方國際體系,如有必要不惜用武力達成觀念的成形過程。

在這部恍如小說般的歷史之中,除了冒險、驚喜和寫實的動人故事外,更有一連串角色的相遇。如熟悉東亞文化、正直謹慎的完美主義者正使得勝;生性浮誇,自認天賦異稟的副使范罷覽;見解犀利、尖刻、幽默風趣的譯員小德經。另一邊,有十全老人、千古一帝乾隆大帝;患有痛風卻非常精明又有獨特魅力的權臣和珅;喋喋不休的兩廣總督愛新覺羅‧長麟等主要角色建構了這段史話。

《最後的使團》還談到其他許多人:搬運要送給皇帝之重禮的挑夫;拿火把幫忙的農民,及從竹林裡的藏身處或從水牛背上觀看的農民;搭車出行且一臉好奇盯著看的優雅女子;每天大清早用大喊叫醒使團團員的北京某公務員;以這些團員為題寫詩且拿藥給他們的朝鮮使者;爬上屋頂撿球且往下看某些仕女看得太久的年輕法國人阿吉。歐陽泰挖掘無數檔案史料裡充斥的種種相遇──令人惱火、生氣、困惑、暖心、想笑的相遇──每個相遇都讓人一窺生卒於許久以前、但其情感和經歷一如今日我們真實的人。

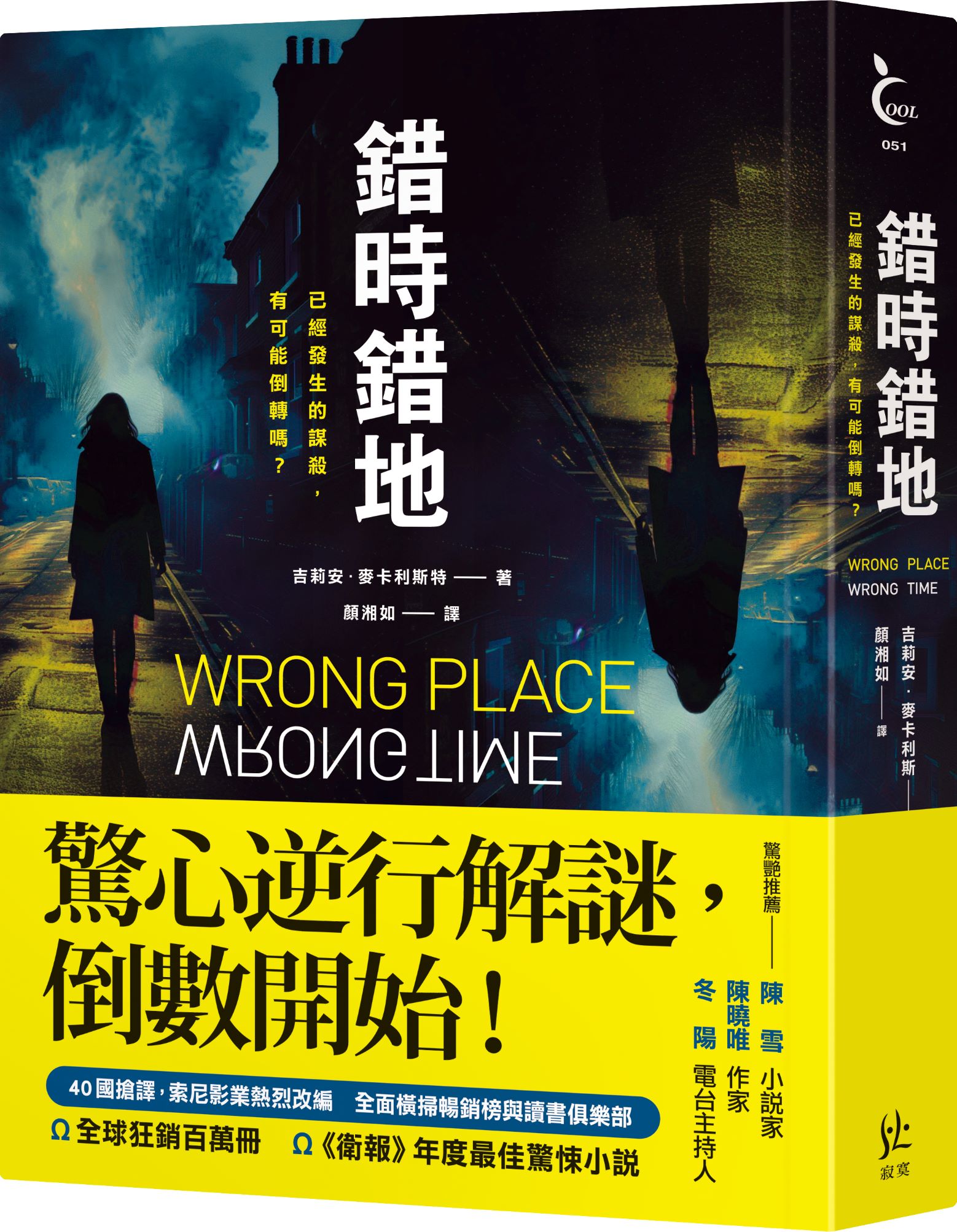

全球狂銷百萬冊|錯時錯地: 已經發生的謀殺, 有可能倒轉嗎?

只有對的時間,才能在對的地點,拯救對的人。

而對的時間,竟然是──昨天!

驚心逆行解謎,倒數開始!

第 0 天 兒子殺了人,關警局,必須幫幫他。

負 1 天 案件還沒發生,家裡一團和樂,但是只有她知道危機逼近。

負 3 天 兒子什麼話也問不出來,包裡藏刀她已拿走,一切能回歸日常了?

負12天

負60天

負7230天……

珍很忙,當律師忙,教養青少年更忙。

誰能想得到,那晚她竟成了兒子持刀殺人的目擊者!

更想不到的是,一夜憂心之後,起床要面對的是──昨天。

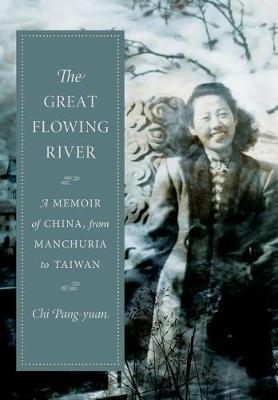

齊邦媛《巨流河》英譯|The Great Flowing River: A Memoir of China, from Manchuria to Taiwan

齊邦媛《巨流河》。寫作歷時四年 跨越百年時空,感動海內外百萬讀者。讀了巨流河,你終於明白,我們為什麼需要知識份子。苦難時代的信史 文學救贖的詩歌:一部反映中國近代苦難的家族記憶史,一部過渡新舊時代衝突的女性奮鬥史,一部台灣文學走入西方世界的大事紀,一部用生命書寫壯闊幽微的天籟詩篇。「當我記下了今生忘不了的人與事,好似看到滿山金黃素的大樹,在陽光中,葉落歸根。」-齊邦媛。書的記述,從長城外的「巨流河」開始,到台灣南端恆春的「啞口海」結束.........巨流河,位於中國東北地區,是中國七大江河之一,被稱為遼寧百姓的「母親河」。南濱渤海與黃海,西南與內蒙內陸河、河北海灤河流域相鄰,北與松花江流域相連。這條河古代稱句驪河,現在稱遼河,清代稱巨流河。影響中國命運的「巨流河之役」,發生在民國十四年,當地淳樸百姓們仍沿用著清代巨流河之名。作者齊邦媛的父親齊世英──民國初年的留德熱血青年,九一八事變前的東北維新派,畢生憾恨圍繞著巨流河功敗垂成的一戰,渡不過的巨流像現實中的嚴寒,外交和革新思想皆困凍於此,從此開始了東北終至波及整個中國的近代苦難。作者的一生,正是整個二十世紀顛沛流離的縮影。本書嘔心瀝血四年完成,作者以邃密通透、深情至性、字字珠璣的筆力,記述縱貫百年、橫跨兩岸的大時代故事。獻給──所有為國家獻身的人。

Heralded as a literary masterpiece and a best-seller in the Chinese-speaking world, The Great Flowing River is a personal account of the history of modern China and Taiwan unlike any other. In this el...

給受傷地球的動人情書|也許你可以

一首對綠色世界仍懷抱希望的詩篇,

一封寫給受傷地球的動人情書!

即使未來看似黯淡,微小力量也能帶來巨大改變!

大家都說小女孩不可能改變世界,但她選擇傾聽心底的聲音,

默默在貧瘠荒蕪的土地,埋下一顆種子。

沒人預料到,在她悉心照顧下,

種子不只發芽,還長成大樹、開枝散葉、結出纍纍果實。

於是,小女孩取出每顆果實中的種子,埋入土裡,

給予充足水分,給予適當照護。

樹愈長愈高,提供人們遮蔭與好吃的水果。

地底下的水順著樹根往上走,變成蒸氣、累積成雲;

雲滿載著水,那些水變成了雨,終於,

這個地球上最炎熱、最乾旱的地方,再次出現一條河!

就在一切都如此美好之際,

可怕的暴風雨來襲,第一棵樹應聲倒下⋯⋯

小女孩的心也跟著碎了,一切都完了嗎?

得來不易的蓬勃生機,是否能豐美如常?

風格強烈的插畫,意境十足,與真摯感人的文字共舞出一首詩。

即使未來看似黯淡,我們每個人都可以做出改變!

一個小小的舉動,一個忠於內心聲音的選擇,

促使貧瘠荒蕪的自然生態重新萌發……

▍閱讀推手&繪本專家 真摯推薦(依姓名筆畫排序)

吳文君|文字創作者

林怡辰|國小教師.閱讀推廣人

海狗房東|繪本工作者

黃筱茵|資深兒童文學工作者

劉昭儀|水牛書店X我愛你學田負責人

盧方方|後青春繪本館主編

葉嘉青|臺師大講師暨天鈺環境永續基金會顧問總監

▍本書特色

★全書以深刻動人的文字與圖像,共同譜出面對了無生氣大地仍懷抱一絲希望的幽微心情,是部溫柔與溫暖直入人心的繪本佳作。

★兼具語文與藝術的跨領域學習:全書以優美動人的詩句,搭配風格獨具的插畫,讓孩子在繪本中增進語文與藝術能力。

★符合108課綱與SDGs精神:讓孩子從故事中得到啟發,理解生態環境的保育,從每個人隨手可做的小事中就能實踐。

★繪本名家導讀:附上專業導讀,讓父母、師長能與孩子自在共讀。

學習領域:語文-國語、生活課程、藝術

議 題:生命教育、閱讀素養

SDGs :氣候行動、保育陸域生態

關 鍵 字 :大自然、環境保育、生命循環、閱讀素養

領券買書 | 閱讀推薦

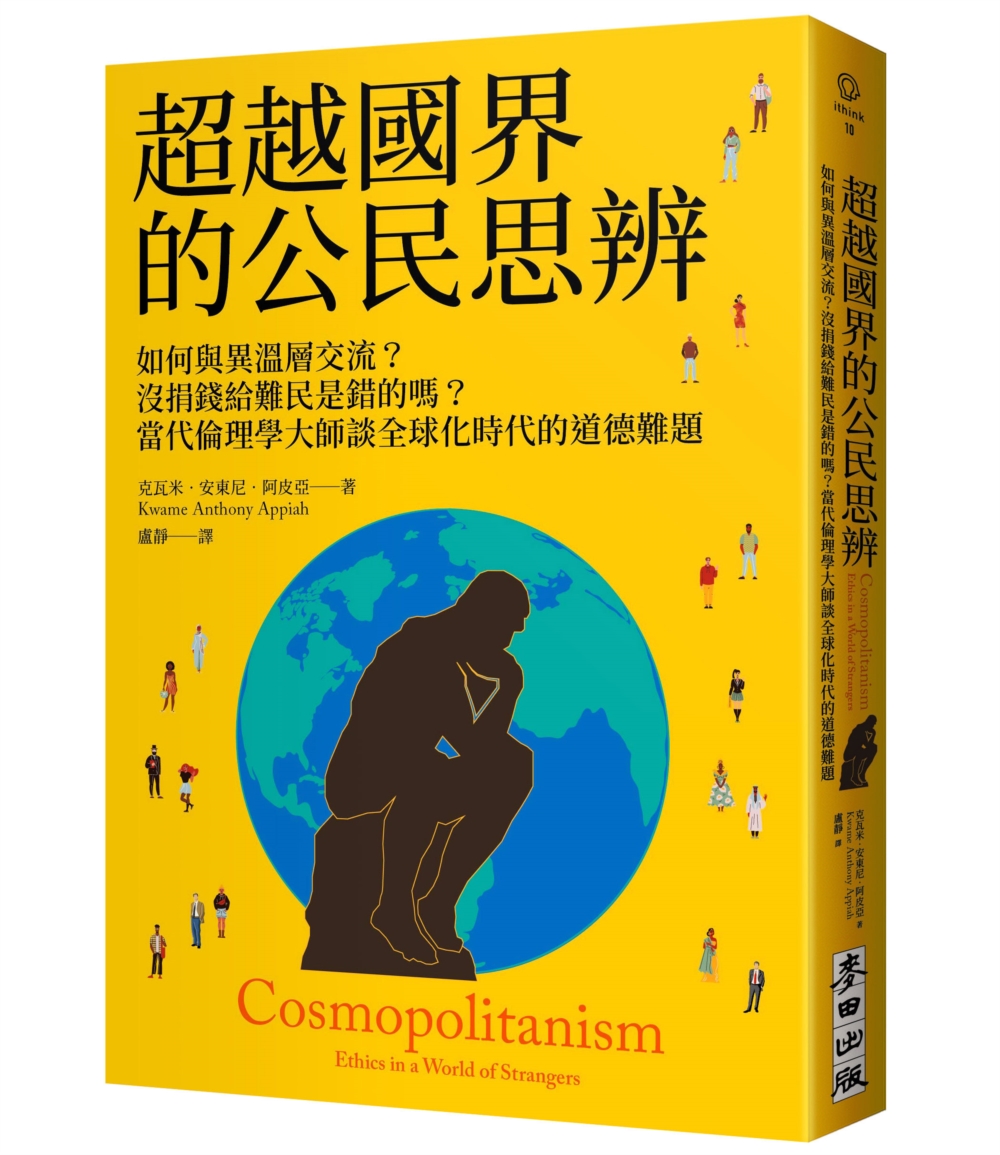

全球化時代的道德難題|超越國界的公民思辨: 如何與異溫層交流? 沒捐錢給難民是錯的嗎? 當代倫理學大師談全球化時代的道德難題

與漢娜.鄂蘭齊名的世界百大思想家

獻給紛亂時局最迫切的一堂思辨課

★美國人文獎章、斯賓諾莎獎得主 結合個人生命經歷與時代省思的代表作★

★亞瑟.羅斯圖書獎得獎作品★

★亞馬遜網路書店4.4分高分評價★

▍本書特色

1. 本書廣泛舉例和援引軼事說明超越民族與國界的世界主義論點。從維多利亞時期冒險家的世界主義思想談起,到二十世紀無國界醫生普世主義的理想追求,反思我們對陌生人的道德責任。

2. 本書主題包含倫理決策、多元文化多樣及全球化等,切合全球各國關係密不可分的社會現況之下,人們面臨的迫切道德議題。

3. 當代倫理學討論的熱絡在於眾聲喧嘩,而阿皮亞則提出嶄新的觀點:反對透過理性論據形成共識,因為強辯往往不能使人心服,反而使我們失去對話的可能性。

4. 本書作者不僅在思想界耕耘多年,同時也是影響世界的十位哲學家之一。除了以其世界主義的思想廣受學界與文化工作者的盛讚,以及《紐約時報》、《衛報》等國際媒體一致好評,也曾榮獲美國對外關係委員會亞瑟·羅斯圖書獎、美國國家人文獎、美國布蘭迪斯大學Glittler獎等多項殊榮。

5. 老牌出版社諾頓重磅推出的「我們時代的議題」系列書籍之一。問世近二十年的二十一世紀暢銷倫理學經典論著、譯成十三國語熱賣言全球。

▍專文推薦摘句(按姓氏筆畫排序)

● 《超越國界的公民思辨》是一本在紛亂時刻帶給人衝擊、啟發與安慰的書。──李可心(美國台灣觀測站共同編輯)

● 在全球哲學界裡,阿皮亞無疑是第一流的說書人。──吳豐維(文化大學哲學系副教授)

● 如果你正在思考「如何讓自己成為更好的人」,本書將以「實現善的最大化」為你展現一個恢弘深刻的視野。──黃春木(臺北市立建國高中歷史科教師)

▍各界齊聲推薦(按姓氏筆畫排序)

● 吳叡人(中研院臺灣史研究所副研究員)

● 李雪莉(《報導者》營運長、總主筆)

● 林靜君(南港高中哲學課教師)

● 鄭凱元(哲學新媒體共同創辦人、執行長)

▍內容簡介

全球化時代的交流不再受國界與文化隔閡,

為什麼世界的紛擾仍未因此削減,人們也依然無法和平共處?

多元文化背景的當代思想家阿皮亞剖析,當人人都是「世界公民」,

如果你的傳統不符合我的正確,該如何討論對與錯?

「讀完這本書後,我感覺自己變成了一個更好的人。」──諾貝爾文學獎得主帕慕克

東非女性割禮是壓迫女性的陋習,還是應受維護的傳統?一定要捐助無淨水可喝的孟加拉村民,才能算是「好人」?當我們光憑網路就能與地球彼端的人建立連結,也就不僅止於隸屬一座城市、一個國家,該如何在與陌生人共享世界的今日,面對不同文化、立場相左的人,真正理解多元而迴異觀點並與之共存?做一個世界公民,除了對他人負有道德義務,也必須尊重異文化的生活方式,這既是一種理想,也是一項挑戰。

作者阿皮亞以其豐厚的家族及成長背景出發──出身於迦納阿散蒂政治世家的父親、活躍於庫馬西社會的英國作家母親──從歷史、文學、哲學等多重角度切入,並以他在迦納、英國、美國三地生活的經驗為基礎,譜寫一本給近八十億人在地球村裡共同生活的道德宣言──即便不同文化形塑出天差地遠的價值觀,而分歧各方都認為自己才有道理,展開交流、找出共通點,終將達成理解。

在面臨全球秩序崩解與重組的時代下,透過尋找彼此的共同點,人與人之間將不再針鋒相對,也得以在相互影響的同時,同樣重視地域差異與文化保存,並在這紛亂、多元而充滿活力的世界中,成為更好的公民、創建共榮的社會。

▍精采摘錄

1. 直到過去幾百年,人類的每一個小社會,才逐漸被納入同一個貿易網絡和全球資訊網;現在每個人都完全可以想像,自己如何和六十億同類中的任何一個人搭上線,然後送給對方一些有價值的好東西,比如收音機、抗生素,或是好點子。不幸的是,如果我們一時疏忽或是懷抱惡意,同樣也能輕易送出會造成惡果的事物,像是病毒、空氣污染或是壞主意。而一旦換作政府以我們的名義實施政策,結果又可能放大無數倍──或許是難以斗量的好,但也可能是細數不盡的惡。

2. 世界主義思想是由兩個基本觀念交纏而成的。第一種觀念是我們對他人負有義務,而且這份義務不只及於血緣和情誼,甚至遠超越公民同胞的紐帶。另一個觀念則是,我們不只應當重視所有人類的生命,還應當看重具體的生命經驗,這代表我們要渴望了解賦予他人生命意義的習俗與信仰。世界主義者知道人與人之間有所差異,但從這些差異裡,我們可以學到很多。而既然人類有這麼多的可能性值得探索,我們便不會期待,也不會想讓每個人或每個社會都走向同一種生活方式。無論我們對他人(或他人對我們)有什麼義務,每個人通常都有權利走自己的路。但正如之後我們會看到的,「普世關懷」和「尊重正當差異」這兩種理想,有時也會彼此牴觸。某種程度上,「世界主義」指的不是一種方案,而是一項挑戰。

▍媒體與專家好評

基於非常人性化的現實觀和對藝術的熱愛,試圖重新定義我們對他人的道德義務……讀完這本書後,我感覺自己變成了一個更好的人,我向其他人推薦同樣的體驗。──二〇〇六年諾貝爾文學獎得主奧罕.帕慕克

我的朋友和同鄉克瓦米.安東尼.阿皮亞在這本大作中,從全球人民間合理的互相尊重與了解出發,提出了一份關於我們該如何嘗試共生的遠大計劃。他相信跨界對話,並指出我們每個人對其他人的義務,為這依舊受到狂熱與褊狹荼毒的世界,開出了一帖令人振奮的處方。本書的見解和聯合國的任務有著深遠的關係,我希望它能廣為流傳。──聯合國秘書長科菲.安南

《超越國界的公民思辨》中的努力讓人喜聞樂見,它試圖重振一種典雅的道德和政治思想,並呈現了這種思想與當前世態的關聯。──約翰.格雷,《國家》雜誌

《超越國界的公民思辨》值得一讀──寫作風格引人入勝,書中的個人經歷更增添了鮮活的色彩……阿皮亞不僅對當代纏結的問題有非常敏銳的見解,省思判斷也同樣冷靜清晰。──湯瑪斯.內格爾,《新共和國》雜誌

在這本關於全球倫理的通透沉思錄中,政治哲學家阿皮亞思索了許多因為全球化而變得迫切的古老問題:世界公民是什麼?我們共通的人性又讓我們對陌生人有什麼責任?透過本書引人入勝的自傳、歷史、文學性和哲學思索交織之下,阿皮亞說出了他的答案。作者自己的成長背景──父親來自非洲,母親來自英國,在迦納長大,在英國受教育──完美契合本書跨越邊界的主題。本書的主旨是重新思考世界主義的道德原則,這種古老的思想宣揚拋棄部落意識和民族主義,接納廣大的人類社群。作者協調了世界主義思想的兩大流派,既強調全球責任,也重視地域差異,在保存地方和社群價值的同時,也追求不是的價值。阿皮亞透過各種趣聞軼事和堅守原則的論證,試圖找出一種新的倫理想像,既允許個人擁有多元認同與忠誠,又能藉著對話與探索,建立開明進步的全球社群。──G.約翰.伊肯伯尼,《外交政策》雜誌

安東尼.阿皮亞的這本書極為珍貴罕見,雖然是一部哲學作品,但一般人同樣能讀得開心,同時深有所獲。阿皮亞的魅力四射的文字風格,以及他對本書主題迷人又豐富的闡釋,照亮了他寫作初心:糾正當今流行的相對主義,指出人與人、文化與文化之間的共通性,遠遠超越了我們之間的差異。這本閃耀的哲學與全球史著作,挑戰了一直籠罩在二十一世紀西方世界上空的那片憂愁與苦厄。即將承擔責任、起身領導的世代應當能從本書得到靈感和勇氣。──布萊恩.厄克特

阿皮亞活出了他所呼籲的世界主義;他讚揚差異,卻不將之神化。他敦促人們採取道德行動,卻不假裝這很容易的。最重要的是,他將美麗的故事和高尚的原則交織為一,說服我們儘管普世價值與個體需求的平衡非常微妙,但我們絕對能夠做得更好,好得遠遠超出我們預期。──薩曼莎‧鮑爾,《地獄的難題》作者

《超越國界的公民思辨》成功使用多彩的語言風格,結合作者對往日的旁徵博引,以多媒體時代的本質傳達出細緻的思想。閱讀本書就像觀賞一場充滿顛覆性幽默的光藝,同時又深深體會到人性一切價值觀在時代演進中的綿延相續。──一九九一年諾貝爾文學獎得主娜丁.歌蒂瑪

阿皮亞認為,文化交會不見得一定會成為衝突……這不只是學術思索,更是他的個人經歷……他的論述不僅字字成理,讀來更是暢快淋漓。──《波士頓周日環球報》

阿皮亞認為,持續的全球文化交流是不同國族理解彼此最佳方式,在這恐怖肆虐的時代更是如此。──《Time Out New York》週刊

克瓦米.安東尼.阿皮亞擁有妙趣橫生的文筆,讀他的書更像是在談天,而非聽老師說教。他提出了許多論點,但從未讓讀者感到困惑,更不會打擊他們的自信。書中的舉例、軼事和格言更是教人難忘。──理察.羅蒂,《The New Leader》雜誌

藉著鼓勵我們成為世界公民,《超越國界的公民思辨》引導我們找出方法,思考高度複雜的概念。……阿皮亞將有關全球化的公共討論提升到哲學專業的水準,為國際主義的思考方式,提供了有趣的基礎。──拉什沃斯.基德,《基督科學箴言報》

阿皮亞的《超越國界的公民思辨》看似溫和,實則基進。──史丹利.克勞奇,《紐約每日新聞》

本書雖然不厚短小,思想卻非常卓越……在九一一過後的世界,國家之間烽煙再起,因此就像阿皮亞所說,討論全球倫理不僅必要,也是不可避免的。──亞倫.布萊恩特,《Black Issues Book Review》

重新挽回跨越差異界線交流創意與想像的傳統……這是一本滋味辛辣的讀物,調以欣快流暢的文筆,以實用、實際的世界觀挑戰一些時髦的、壁壘分明的衝突論,並高歌頌揚人類的差異與相似。對諾頓出版社的新書系《我們時代的議題》來說,這是非常傑出的起手式。──《出版者》週刊

《超越國界的公民思辨》清晰解釋了道德理論中的關鍵問題,強烈推薦。──大衛.高登,鮑林格林州立大學,《Library Journal Review》

▍書系簡介 ithink, I think──

思想決定行動,行動是對生命本身的肯定,

如同沙特說:「在行動中存在著希望。」

了解一種思考方式,如同掌握一件處世工具;

了解不同的哲學概念,提供我們重新審視所處社會的不同角度與準則;

了解一位哲學家的思想與生平,讓我們的生命經驗得到參照;

了解哲學的歷史,即是見證在經歷無數次翻轉與重建之後,人類何以為人類。

世界時時刻刻在變化,思想應是動態的。從隨時能閱讀的輕鬆漫談,到精采的思想展演,我們期許這個書系的書籍,能夠回應此時此地的不同處境。哲學發展始於對世界的好奇,最終也必然回歸到人類對自身及其所處世界的關心。我們將以上述幾個類型為框架,希望大家能找到最適合自己親近哲學的路徑,也找到思想與行動結合的方式。

◆不馴的異端

以一本憤怒之書引發歐洲大地震,斯賓諾莎與人類思想自由的起源

史蒂芬.納德勒──著 楊理然──譯

◆口袋裡的哲學課

道德可以計算嗎?快樂一定比痛苦好嗎?如果能夠隱形,你還會奉公守法嗎?

牛津大學的10分鐘哲學課,跟著亞里斯多德、尼采、艾西莫夫、薩諾斯等93位思想家,破解135則人生思辨題

喬尼‧湯姆森──著 吳煒聲──譯

◆水變成冰是哲學問題?

12位大哲學家╳11次劃時代重要翻轉,一部寫給所有人的自然科學哲學史

哲學新媒體──策畫 孫有蓉──主筆 邱獻儀──文字協力

◆給焦慮世代的哲學處方

跟著塞內卡、西塞羅、叔本華等10位斯多葛思想家,學習面對不確定年代的生命智慧

沃德‧法恩斯沃斯──著 李斯毅──譯

◆跟蘇格拉底學思辨

從《對話錄》學習如何質疑、怎樣探究?矯正僵化思維、屏除固有偏見,寫給每個人的理性思考與對話指南

沃德‧法恩斯沃斯──著 陳信宏──譯

◆給所有人的世界哲學史

哲學發源不只在希臘?佛陀與斯多葛都談「不期不待不受傷害」?跟著113位哲人掌握縱貫三千年的人類思潮脈動

羅伯特.索羅門、凱瑟琳.希金斯──著 黃煜文──譯

◆衣裳哲學

奠定英美現代人文精神的哲學經典

湯瑪斯‧卡萊爾──著 賴盈滿──譯

◆成為大人的第一堂哲學課

用哲學找出自己人生的答案

小川仁志──著 談智涵──譯

◆為什麼我們需要政治哲學?

如何對政府公權力設限?意見分歧的人們能否共存?當代自由主義名家談和諧社會的關鍵思考

查爾斯‧拉莫爾──著 陳禹仲──譯

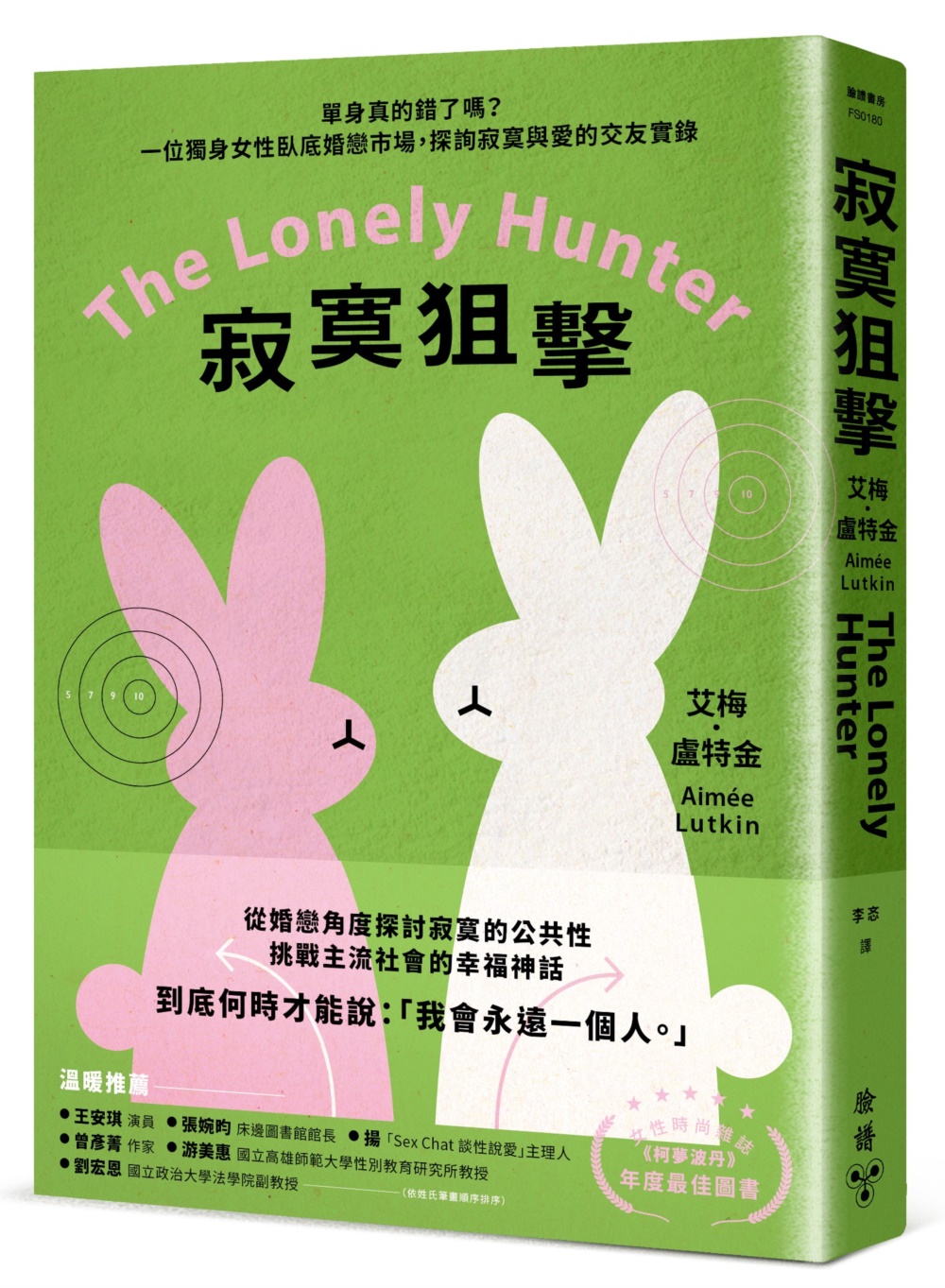

單身女性臥底婚戀市場|寂寞狙擊: 單身真的錯了嗎? 一位獨身女性臥底婚戀市場, 探詢寂寞與愛的交友實錄

從婚戀角度探討寂寞的公共性,挑戰主流社會的幸福神話

到底何時才能說:「我會永遠一個人。」

──女性時尚雜誌《柯夢波丹》年度最佳圖書──

「我曾經告訴自己,只要認真努力、變成值得被愛的人,就會贏得快樂結局,結果卻和說好的不一樣。」

究竟從何時開始,「單身」成為人人避之唯恐不及的詛咒?難道人真的天生不完滿,所以婚禮上,才以「你完整了我的生命」作為愛語?種種貶抑,讓人不禁想高呼:「單身就真的那麼糟嗎?」

單身被貼上負面標籤,或許因為它總跟「寂寞」有所牽扯。然而綜觀歷史,儘管寂寞確實會引發痛苦,但過去當人們感到寂寞時,他們決定進入人群,而不是設法與他人建立婚戀關係。寂寞和愛情的連結,其實是相當近代的產物。

本書作者艾梅・盧特金是作家、導演,作品散見於《美麗佳人》、《Jezebel》、《Glamour》等雜誌。她在2016年因為撰寫〈何時才能說「我會永遠一個人」?〉爆紅。因為朋友無心的質疑,展開她的「改變大作戰」,開始健身、使用交友App,在一個又一個約會中,企圖顛覆「單身必定空虛、寂寞、覺得冷」的謬論,結果卻不如她所想。她在書中以幽默譬喻描述單身生活引人發噱的時刻,坦率記錄遇到的各種挑戰,令人捧腹大笑,卻又處處扎心。

盧特金犀利質問:當長輩陸續過世、朋友專注經營自己的家庭、支持網絡愈來愈窄,這是人際關係的自然代謝,還是單身者注定通往的下坡?如果這個世界沒辦法照顧好每一種生活選擇,那孤獨到底是個人情緒,還是社會問題?盧特金認為,孤寂之所以成為文明病,真正的原因在於社會規則充滿缺陷,帶有歧視意味的法規或政策讓眾多族群因此受到排擠、成為「少數」、被人另眼相待,進而影響身心健康。

終結寂寞的方法不是鼓勵婚育,而是培養愛的能力,唯有練習去愛、去理解更多的人、事、物,並將這份包容推展至公共層面,才能建立更公平、健全的社會,讓所有人都能安適、茁壯。

各界好評頽鳢

「結合了回憶錄和報導文學,《寂寞狙擊》會讓你相信,無論你是否單身,我們『尋找愛情的過程都已失敗』。」

——《Vogue》

「細膩而精闢地剖析了一介女子的孤寂,以及現代社會如何使每個人都更寂寞疏離……這麼一個好似令人沮喪的主題,卻讀得我開懷大笑,且深有所獲。」

——布萊絲.羅伯森(Blythe Roberson)/《討厭男人的女人如何找男人》(How to Date Men When You Hate Men)作者

「真有人能讀完這部作品,還不愛上艾梅.盧特金嗎?這部回憶錄不僅是篇溫柔、活潑的現代戀愛考察,也是極其犀利的美國孤寂文化研究。了不起的暖心傑作。」

——瑞秋.柯特(Rachel Vorona Cote)/《太多》(Too Much)作者

「諷刺、機智,充滿苦甜摻半的細節和活靈活現的場景。《寂寞狙擊》是本引人入勝、不屈就於簡單答案的書,敢於拋出大哉問——怎樣才能活出美好的人生?我們又究竟想從彼此身上獲得什麼?」

——羅莎莉.內赫特(Rosalie Knecht)/《薇拉.凱莉》(Vera Kelly)系列作者

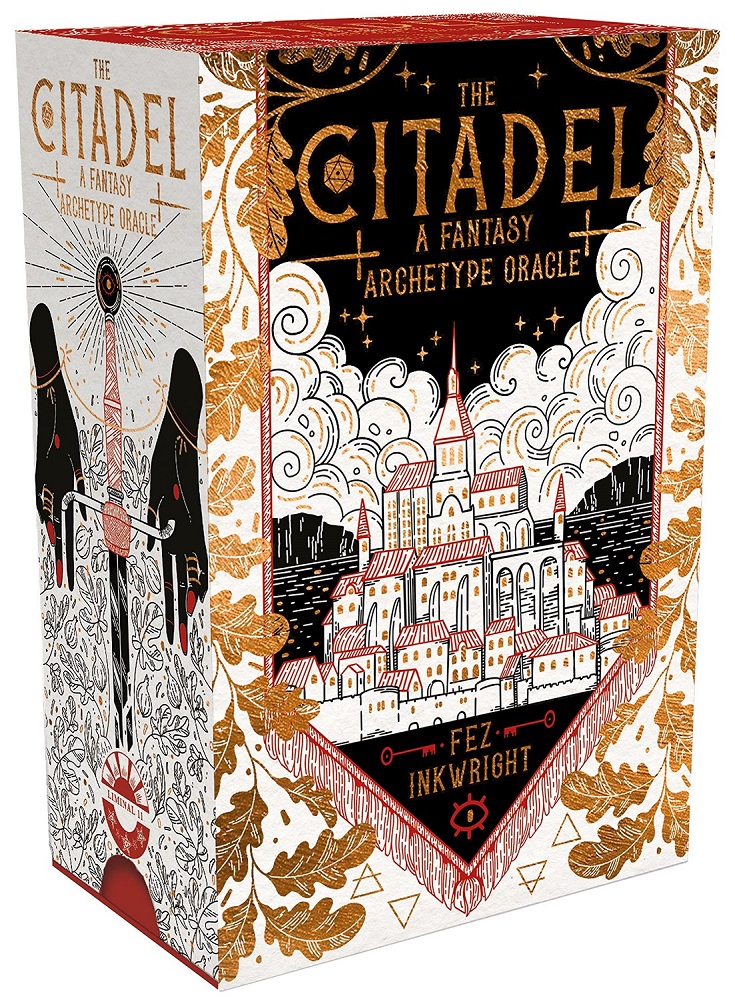

融合故事閱讀與神諭卡|The Citadel: A Fantasy Oracle

命運與機會的白城要塞:融合故事閱讀與神諭卡解讀

歡迎來到這座要塞,高聳入雲的塔尖與白色城牆反射著陽光,城堡下方為洶湧的海浪與岩石環抱,附近則充滿村莊、農舍與果園。

在這裡,你會遇見很多不同的人,在命運與機會的轉折下,故事又將會如何進行?

熱銷神諭卡“Seed and Sickle”知名塔羅牌插畫師Fez Inkwright繪製,這款神諭卡的特色在於結合說故事與神諭卡,可以選擇情境與抽到的角色牌卡,進行解讀;也可以把這套牌卡當作是激發故事創作的遊戲,內附詳細說明簡介手冊。

每一張牌卡都是一個角色,角色代表的象徵也各自不同,透過Guide Book中詳細的牌卡與場景解說,讀者將在不同場景中遇見各種的角色,相遇也暗示著寓意,端看讀者想尋找的答案或建議來解釋。

讀者可融入自身經驗和目前遇到的狀況,察覺是否有相似的情境出現?沒有正確答案,就像故事走向為何,也取決於你的決定。

卡盒為磁吸扣設計,方便收納不容易損壞,卡片大小:12*7cm

At the top of a cliff stands a city. White stone walls gleam in the sun, and banners snap lazily in the breeze. This is the Citadel, home of fates and possibilities, host to remarkable people whose own stories provide an insight into the nature of humanity itself...

From best-selling author and illustrator Fez Inkwright comes The Citadel, a fresh take on oracle decks that is seeped in the magic of fantasy literature, Tolkien's Middle Earth, and tabletop gaming - a truly unique combination of storytelling and cartomancy!

Each of the 60 cards in this deck represents a person living within the Citadel. The guidebook describes different scenes that the reader will encounter while travelling through the city, including the stories of each character and the interpretation of each card.

Beyond cartomancy, The Citadel can supplement tabletop role-play games, generating new worlds, characters, and encounters for fantasy gameplay.

生活好物 | 編輯精選

無糖好喝營養零負擔|炆久之芯滴紅豆/ 10入禮盒

滴紅豆是升級版的紅豆水,保留紅豆皮的營養而不破壞表皮結構,只萃取其中的精華,零負擔且口感濃郁香醇。

嚴選日本北海道紅豆,優質產區及食材,並獨家採用日本遠藤專利技術,原粒紅豆萃取,不壓碎、不破壞、不流失、濃縮活性營養,瞬間保鮮。無咖啡因、無添加防腐劑、糖、香料與色素。

時尚選物 | 超值登場

在自然微香中溫和清潔|綠藤生機auscentic微香沐浴禮盒/ 山山/ 350ml

2023 台灣設計週指定合作

以經 1,000 多小時低溫發酵熟成再生製成的日本熟成酒粕萃取,搭配嶄新漸進式溫和潔淨模式,以分 層漸進的方式,將其輕輕帶離體表,降低對肌膚的傷害,為肌膚留下自然潤澤

自然:草本⨉木質調|佛手柑|松針|苦橙葉

原貌:為香氛而生的潔淨泡沫,100% 純精油傳遞自然香氣,漸進式潔淨留下自然潤澤

0 合成香精 | 0 石化來源定香劑 | 0 石化來源擴香基底 | 0 石化來源香氣調整成分

巴黎時裝品牌香水|Maison Margiela 迷你香氛禮盒[爵士+溫暖壁爐+慵懶週末+梧葉秋聲](7mlX4)-平行輸入

-平行輸入 Maison Margiela 迷你香氛禮盒[爵士+溫暖壁爐+慵懶週末+梧葉秋聲](7mlX4)-平行輸入](https://s.eslite.com/b2b/newItem/2024/03/11/878_154204318_438_mainCoverImage1.jpg)

◆觸動每個人的珍藏時刻

◆將情感與回憶封存在香氛中

◆再現不同地點和時期的氣味和美好時刻

⊙爵士酒廊香調⊙

前味:粉紅胡椒、橙花、檸檬

中味:朗姆酒、鼠尾草、爪哇香根草

後味:菸葉、香草、苯乙烯樹

⊙溫暖壁爐香調⊙

前味:丁香、粉紅胡椒、橙花

中味:栗子、瓜亞木、杜松

後味:香草、秘魯香脂、克十米爾木

⊙慵懶周末香調⊙

前 味:前味:醛、梨、鈴蘭

中味:鳶尾、玫瑰、橙花

後味:白麝香、廣藿香、麝香錦葵

⊙梧葉秋聲香調⊙

前 味: 香菜、粉紅胡椒

中 味: 肉荳蔻、乳香、胡蘿蔔籽

後 味: 雪松、苔蘚、香脂

寵愛獻禮超值入手|【CHANEL 香奈兒】金色CC Logo 牛皮雙層翻蓋卡片夾/零錢包(淡粉色) / 平行輸入

品牌:CHANEL

材質:粒紋牛皮

尺寸:11 x 8.5 x 2.5cm

配件:盒子 防塵套 **晶片款**

來源:實際產地依每次進貨的產地為主

貼心提醒:圖片顏色會因個人螢幕設定差異,造成部份色差現象,請以實際商品顏色為準

「本公司收到您下單(要約)後,仍需確認交易條件正確、供貨商品有庫存或服務可提供。

如有無法接受訂單之異常情形,或您下單後未能完成正常付款,

應視為訂單(買賣契約)全部自始不成立或失效,本公司得於合理期間內通知說明拒絕接受訂單。

請您重新依需求下單訂購。」

-平行輸入 Maison Margiela 迷你香氛禮盒[爵士+溫暖壁爐+慵懶週末+梧葉秋聲](7mlX4)-平行輸入](https://s.eslite.com/b2b/newItem/2024/03/11/878_154204318_438_mainCoverImage1.jpg)