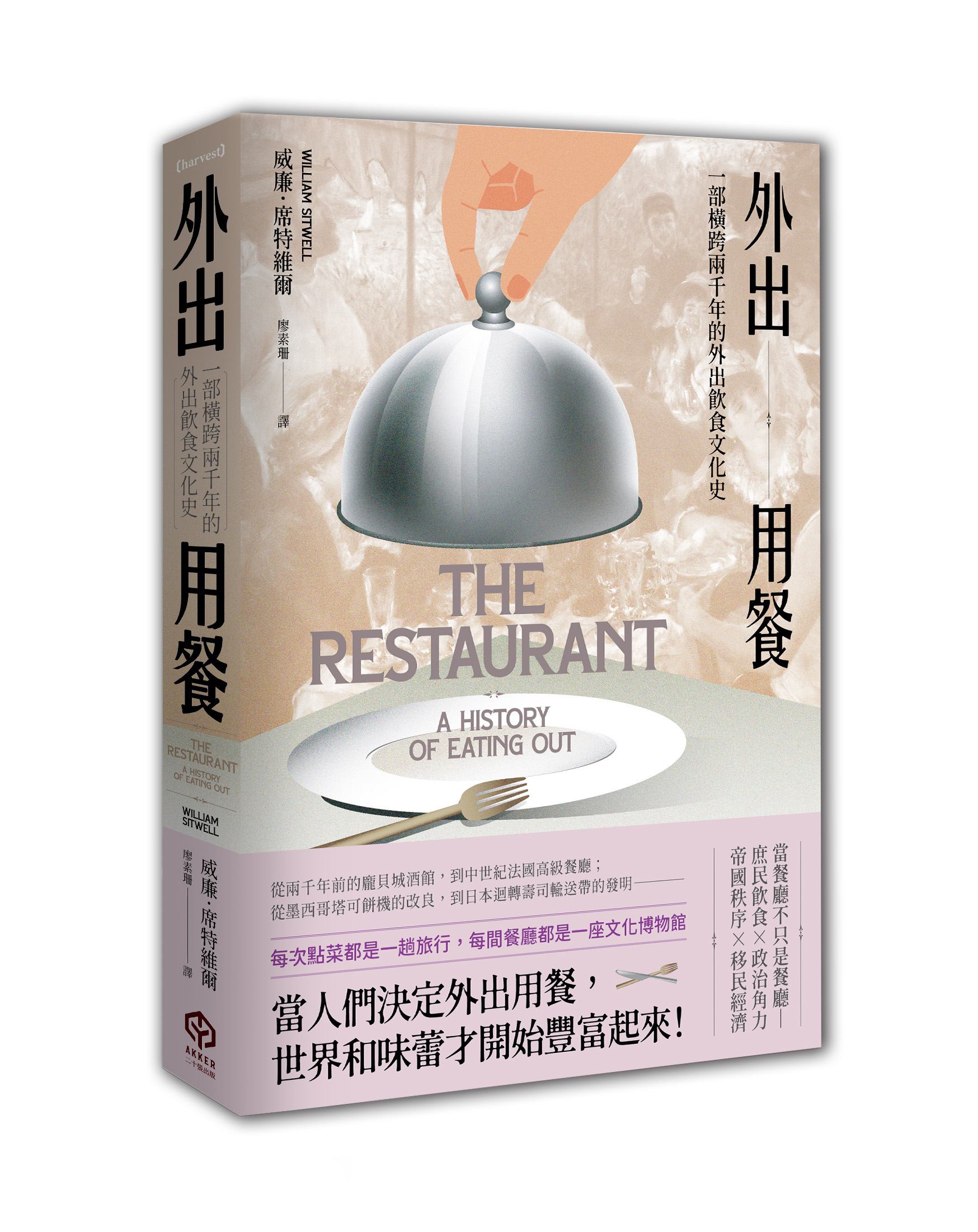

發燒必買

母親節下殺↘燕珍長生官燕窩6入

【純粹燕珍】

燕珍長生只給您最純粹的燕窩,不僅能滋補養生、調整體質,更是養顏美容的天然瑰寶。

【精湛的工藝】

由專業師傅手工挑毛,不使用化學藥劑漂白、染色,確保每一盞燕窩保留完整營養價值與天然風味。

【嚴選孵育環境】

自有燕場,嚴選周遭自然環境,燕子不會吃到污染的食物,以確保燕窩純淨零污染。

【真空滅菌新鮮美味】

真空殺菌充填,完整保留燕窩精華。瓶內燕窩固形物清晰飽滿,成分單純,堅持只有水、冰糖及燕窩三元素。

自有燕場,來源安心:

印尼是官燕最大聚集地,為了確保貨源及品質使『燕珍長生』的燕窩都是來自產地的第一手上等燕盞,團隊在印尼設有自己的燕場。

組合價↘$999➤檜山坊檜木精油+香氛檜木球

【品名】 台灣原生檜木精油

【產地】 100%台灣製造

【主要原料】 二次蒸餾法 台灣檜木

【成份特性】 萃取天然檜木成份-檜木醇,在家就能享受大自然森林芬多精

【使用方法】

◎薰香:可搭配各種薰香用具,適量滴入清水中即可。

◎泡澡:滴入泡澡水中,使用量可以個人喜好。

◎芳香調理:建議由專業芳療師指導使用。

◎居家清潔:滴入清潔用的水中,可拖地、擦拭家具、環境清潔。

◎衣物芳香:在最後一次清水洗淨程序,滴入洗衣機水中,讓衣物充滿檜木香氣(勿與柔軟精同時使用)。

◎美化嗅覺:滴在口罩內緣或衣角,可隨身散發幽靜清香。

【保固範圍】 新品瑕疵

【退換貨】

七天鑑賞期內退換貨請保持商品完整性,商品必須為『全新未經使用』,商品包裝需完整回收,

包含購買商品、外盒、附件、內外包裝、隨機文件、贈品、商品外膜等請一併退回,若有缺件、

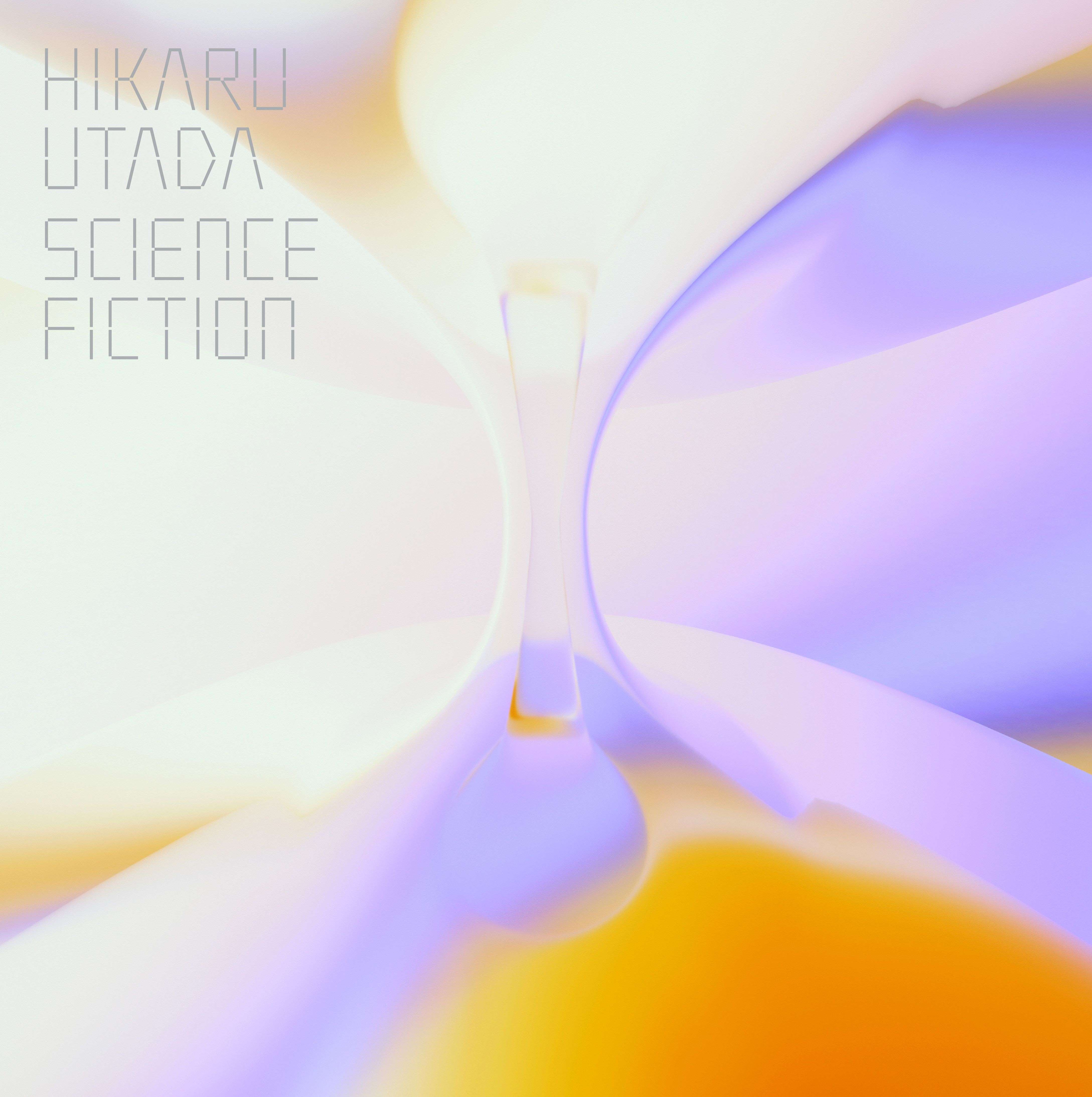

宇多田光經典➤首張精選輯黑膠

跨世代經典傳奇,宇多田光生涯首張精選輯《SCIENCE FICTION》黑膠盤發行! 自1998年12月9日以單曲《Automatic time will tell》出道以來,宇多田光不停創作著創新又兼具大眾性的流行歌曲。從這25年來的作品中,宇多田光親自挑選的首張精選輯黑膠盤發行!26首收錄曲中,包含了三首重新錄製的歌曲、全新混音歌曲十曲、以及2024年發行的〈何色でもない花〉和〈Electricity〉兩首新曲等等。本作顯露了宇多田光對粉絲們這25年來支持的感激之情,與不斷提升自身創造力的藝術性,正是經歷了整整25年才能創作出的精選專輯。《SCIENCE FICTION》類比黑膠盤,由國際級頂級錄音室Abbey Road Studios艾比路錄音室的Miles Showell傾力製作,採半速刻片,極致重現出類比黑膠盤,與數位CD版絕然不同的聆聽體驗。■ 黑膠規格【限定盤】180g 3LP 方形16頁全彩Booklet

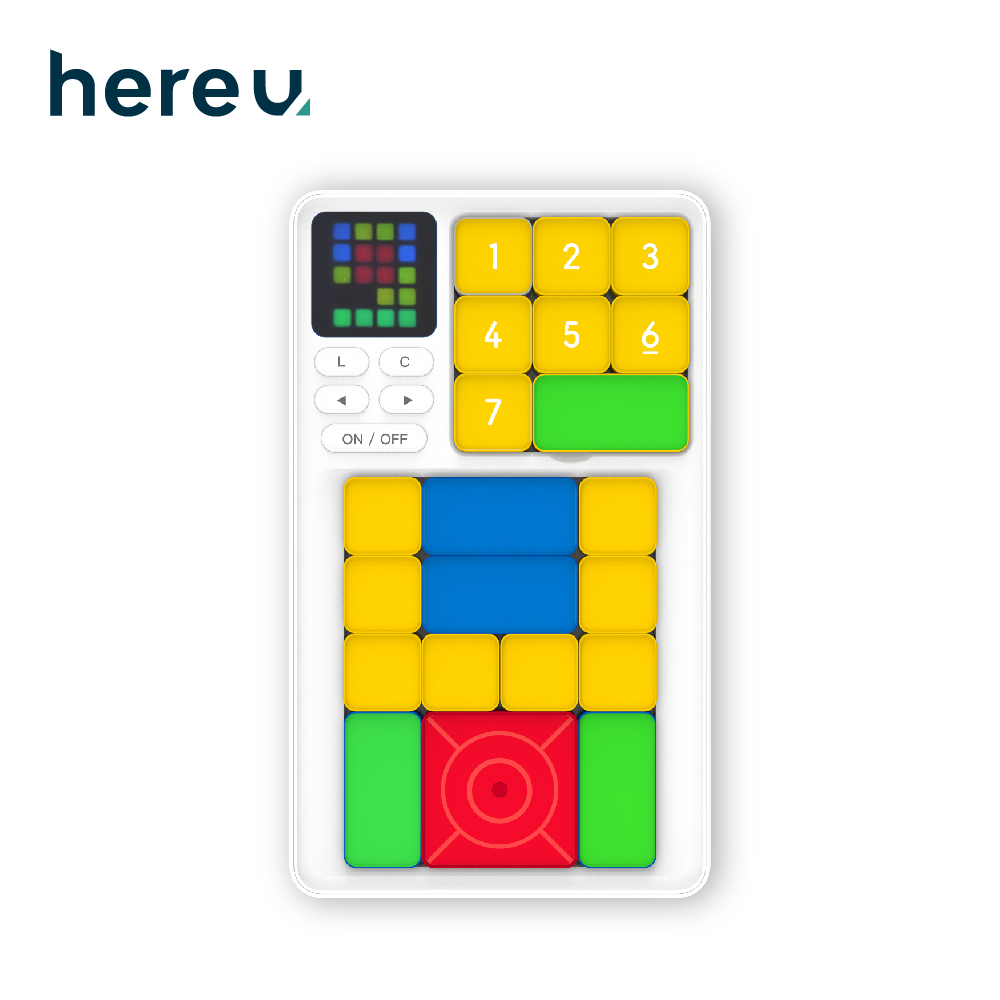

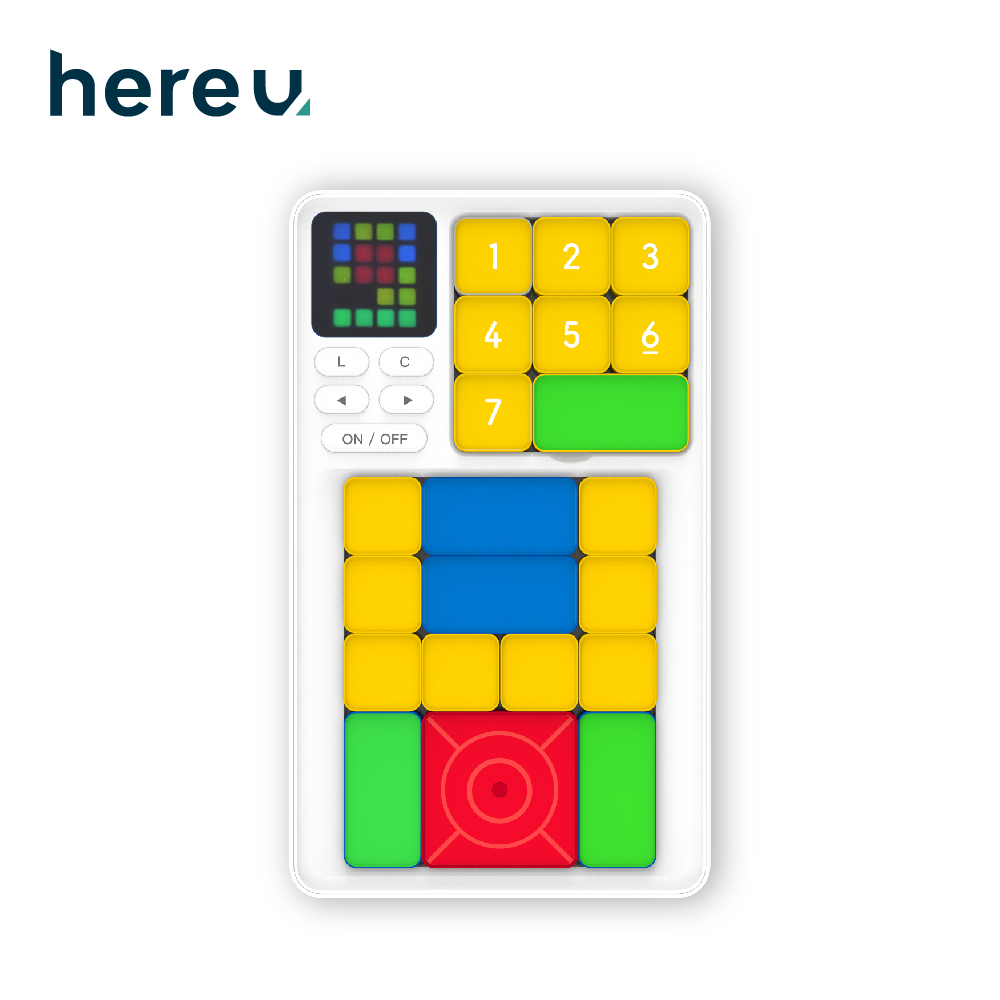

金頭腦等你來挑戰★hereu益智解謎滑塊

「 hereu益智解謎滑塊 」一款手腦眼鍛鍊的遊戲

親子遊戲大人小孩一起討論一起玩!!!!!!

手眼大腦,完美配合,觀察力,反應能力,思考力

關卡520關,關卡種類多從簡單到困難

卡關了有解題步驟還有限時挑戰

從小開始做益智力思維訓練 !!!!!

*保固半年,不包含人為損壞,拆封時須即時確認是否缺件,並在鑑賞期內提出換貨。

今日最推

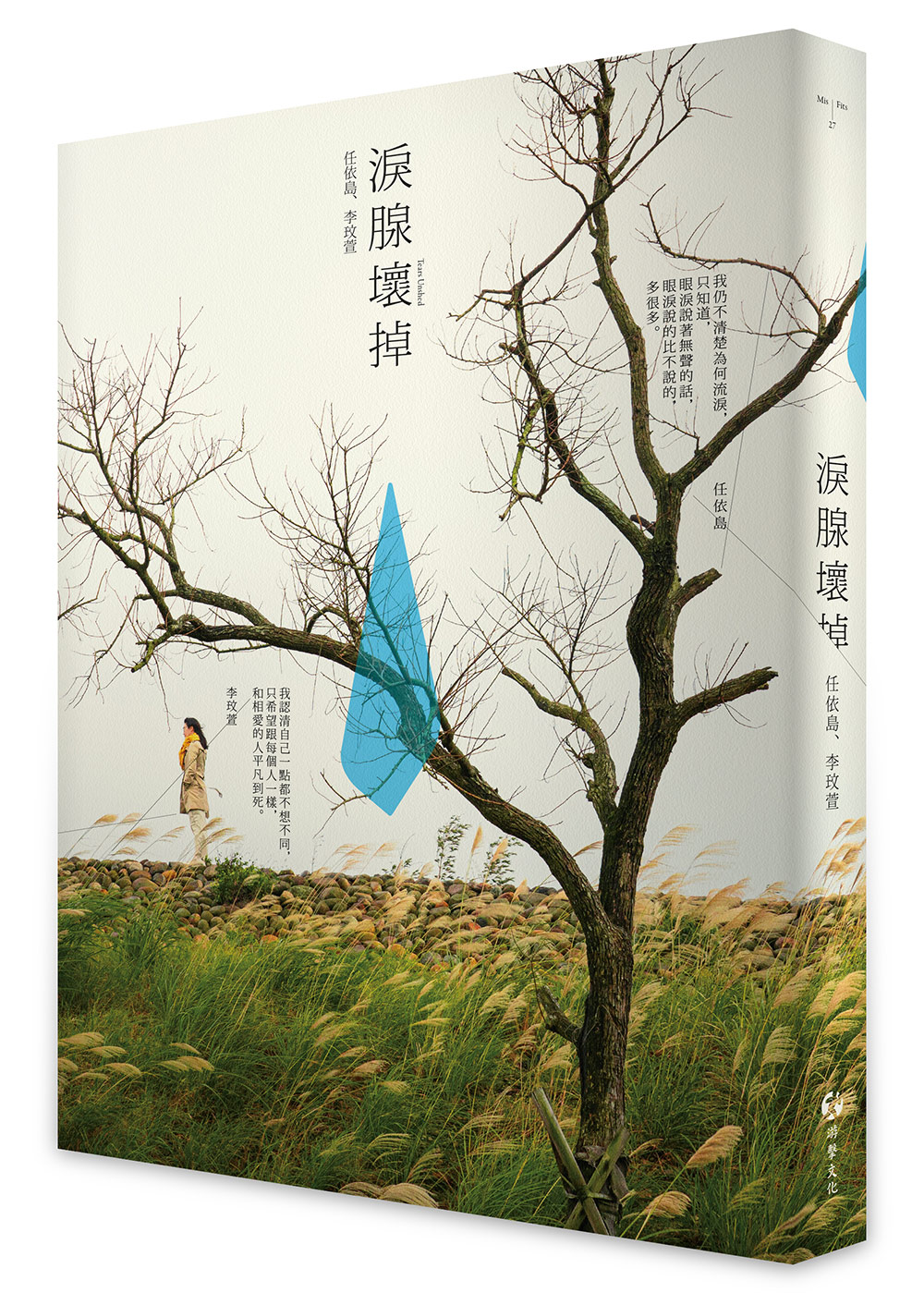

眼淚說著無聲的話|淚腺壞掉

不能哭了、不想哭了

保護機制一旦失守,潰堤的情緒會兵敗如山倒

台北國際書展大獎得主

任依島 × 李玟萱

因為山而相遇的兩人

寫給對方與自己的十二封信

★楊佳嫻、郭熊、丁名慶、鄭清鴻、熊一蘋 真誠推薦

「我看電影已經很久沒大哭了,不像以往,在感動處就會哭。可能是潛意識裡要壓抑自己的情感避免波動,否則保護機制一旦失守,潰堤的情緒會兵敗如山倒。」——李玟萱

「我仍不清楚為何流淚,只知道,眼淚說著無聲的話,眼淚說的比不說的,多很多。」——任依島

▍活著的每一天,都是「向死而生」……

本書作者是背景迥異的兩人,男/女、心理師/文字工作者、北部人/南部人、未婚/已婚、帶病/陪病、本土囝仔/外省第三代。

那幾年,他們雙雙墜入人生幽谷。

一個罹患癌症,歷經化療、休養、再度復發、再治療的循環。

另一個因伴侶嚴重中風,擔起陪病者的她,面臨身心重大考驗,很多年都不再外出。

直到任依島身體復原後,開啟每月一山團,李玟萱也試著出去走走,兩位作家因此認識。

同獲台北國際書展大獎首獎肯定的兩位作家,因為山而相識,繼而透過書信,在疫情期間交換彼此生活的痕跡。

▍李玟萱的十二封信,訴說的是《失去你的三月四日》後,生命的轉折。

在交往十年的男友J離世後,她像是走進一個很長很黑的山洞,看不見光,也看不到路,不再期待對誰說話。

直到多年後,她的先生出現,她再度擁抱愛與幸福。

然而結婚沒幾年,先生中風倒下,至今無法言語、也無法吞嚥。

人生再次墜落的她,失去感受世界的能力、也寫不出任何文字……

▍任依島的十二封信,回顧的是成長的印記。

自認平庸的他,如何在升學體制下匍匐前進。

在失戀與退學雙重打擊下,他如何在挫敗中慢慢爬起。

終於走上喜歡的心理工作時,癌症卻來襲……

原以為可以前進的人生,腳步慢到像停了下來……

兩位作家歷經生命的傷痛,但他們沒有讓自己往下墜落,而是透過各種方式自我療癒,也勇於接受旁人的關懷與支持,從而能一步一步繼續往前走。

這份書寫是以他們的生命體會所展開的復健之旅,既是身心的復健,更是文字的復健,他們共同盼望「當世界下起滂沱大雨時,能用文字為某個人搭起一刻的廊簷。」

在每個消沉、頹喪、抑鬱、寂寞、無助的時刻,但願他們的文字可以陪伴你。

【本書精句】

任依島

「變化本是如此的日常,瘟疫只是將其規模放大至全世界。疫情給出困難且無可迴避的功課,要我們不時地回望自身及所處的社會與環境,那不可預料、無從抗力的變動,更值得人類學習與之共處。」

「孤獨的起始與終點,就是學習自己跟自己在一起,因為當生命步入盡頭,即使有家人、朋友陪伴在側,但只有陪著的自己才能一起迎向並完成死亡。」

「旅行的起點是為了自己,縱使行旅異地,遇見他者,終點仍會回到自己。只是這個自己裡面,有了他人。」

李玟萱

「我認清自己一點都不想不同,只希望跟每個人一樣,和相愛的人平凡到死。」

「感情到了極致,竟會以無情的方式展現」

「有時候疼痛太立體了,語言的限制會將它壓縮得扁平,唯有在願意跋涉到你心裡的人面前,才甘心讓文字在樹洞裡重新編織成繩索,攀出深淵。」

「我們永遠無法從表面得知他人過的是什麼樣的生活,眼前的黑不是黑,看似平靜的白,也許是蒼白。」

【一致推薦】

李玟萱和任依島借寫信來相互推促,回顧那些使自己長大的人事物,曾動搖我,刺穿我,孤立我,曾淹沒過我,席捲使我目眩心迷而又留下我的──使我成為我,使我知道我被歸類在哪裡,而我又想前往哪裡。——楊佳嫻(學者、作家)

閱讀旁人的日記有種蒙太奇的組裝感,每一篇帶領我走進一個事件、一個視角、一個靈光乍現的瞬間,從而再次整合成一個空間與時間,我宛如一位獵人閱讀書中的文字化成生動無比的畫面。——郭熊(《走進布農的山》作者)

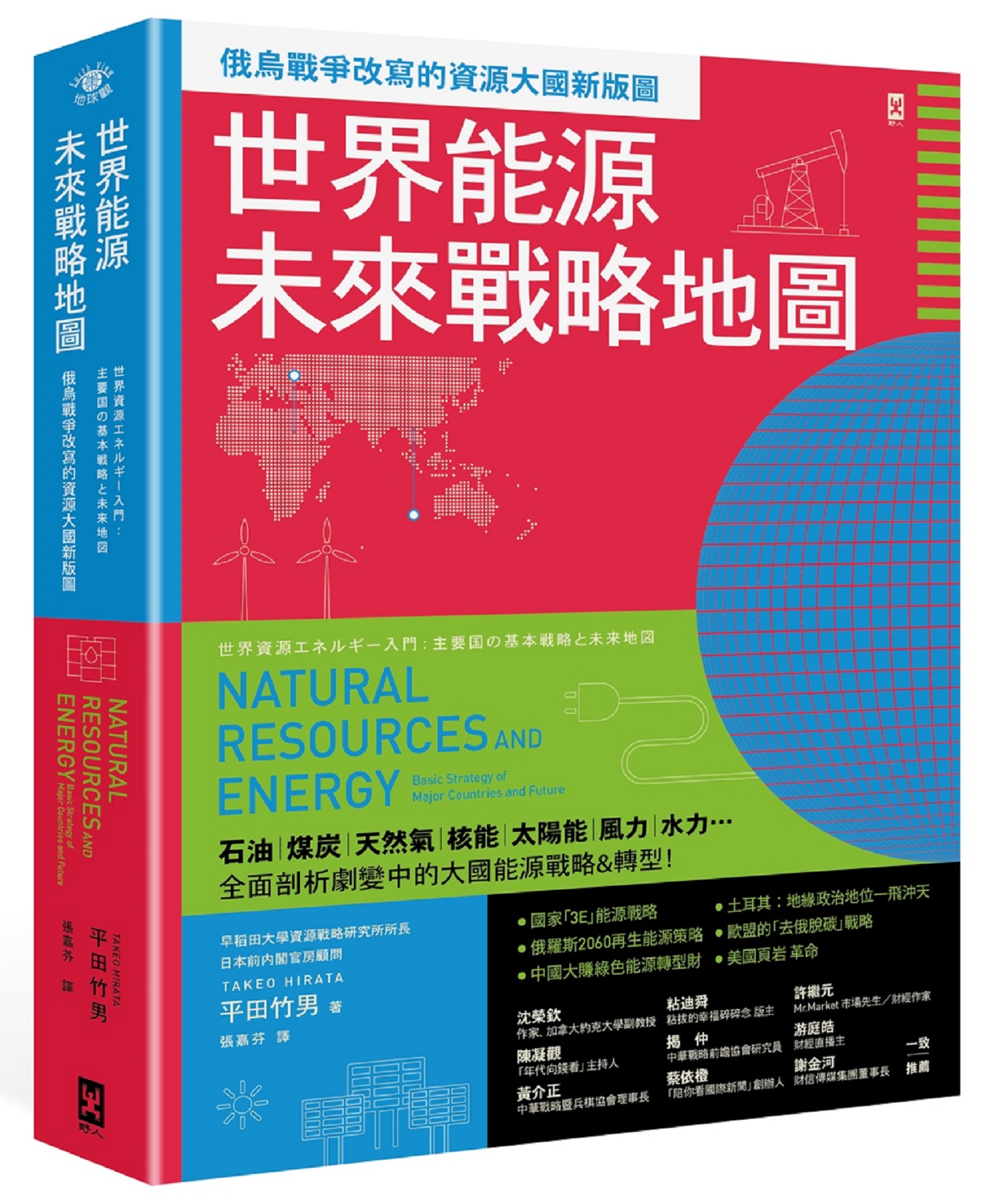

把握現況、洞悉未來|12個經濟指標讓你投資無往不利

JC財經觀點 Jenny 專業推薦

目前,我們正處於關鍵的時代轉折點。美中貿易戰、地緣政治、極端政權的騷動、就職困難卻又處處缺人才、供應鏈混亂、升息、通膨,以及各種金融市場的動盪,未來愈來愈不可預測。

在社會、經濟都處於極大變動的情況下,資產很容易不知不覺縮水,甚至因為投資失當而產生虧損。因此,經濟學家、全球策略專家艾敏‧尤爾馬茲指出,為了把握現況、洞悉未來,我們必須讀懂經濟指標。

他清晰解讀12項重要的美國經濟指標,也進一步說明輔助判斷用的9項關鍵綜合指標,甚至指明具備經濟指標特性的企業,幫助讀者:

● 了解利率、匯率、股價與物價的連動關係。

● 判斷趨勢轉折點,提前進場、加碼或避險。

● 當經濟指標出現矛盾時,快速精確判斷現況。

● 分析產業時,找到有代表性的關鍵企業。

● 做決策時,不被雜亂的資訊干擾。

本書不只能讓投資人在股市、匯市、債市都更有優勢,對於需要判讀景氣的企業主管、業務人員也能派上用場,甚至可以幫助想要抗通膨的家庭做好穩健的理財規劃。

經濟指標應該這樣讀!

● 要得知科技產業的前景,第一個得看臺灣半導體的訂單動向。

● 要了解全球的經濟趨勢,應該先觀察美國的經濟指標。

● 美國經濟指標中,最重要的是就業統計,特別是「非農就業數據」、「失業率」與「勞動參與率」。

● 觀察製造業的變化,要看中國的數字;觀察服務業的變化,要看美國的數字。

● 想要判斷是否有高通膨或通縮,不只要看消費者物價指數,還要看躉售物價指數。

● GDP是落後指標,對即時的投資判斷用處不大。

要預測未來的景氣,看債券利率動態比看股價波動更有效。

商場贏家的全新面貌|極客之道: 科技天才的商業制勝邏輯

2013年才推出自創影集的Netflix,8年內打敗HBO,成為好萊塢王者。

市值一度腰斬的微軟,卻因為執行長一個轉念,完成企業史上最偉大的逆襲。

新創企業HubSpot,僅花五年就上榜全美最受歡迎工作場所。

這些企業的共同之處不在於產業類別、地理位置,

而在於它們的靈魂當中全都擁有一個特質:極客之道!

以前,極客指的是特立獨行的人,尤其是那些被認為聰明過頭、土裡土氣或不善社交的人,

但如今這群人卻主宰商業界,不論貝佐斯、馬斯克、海斯汀、納德拉,

都掌管著世界上市值最高的企業,創造出顛覆傳統經營的極客企業。

商業趨勢大師麥克費告訴我們,極客企業正掀起一場進行中的企業革命,

破壞所有遊戲規則,他們擁有四個值得大家學習的重要概念:

.科學:拋棄資歷、魅力、道德、美學,改用證據說話。

.所有權意識:停止大量的協調、溝通,為組織解開官僚主義束縛。

.速度:快速迭代,加速學習與進展,以打敗90%症候群。

.開放:共享資訊,歡迎組織成員挑戰現狀而不是自我防衛。

當傳統工業時代的企業陷入掙扎之際,擁抱極客之道的企業已在引領世界,

唯有為自己、為企業換上新腦袋,才能在這個快速變動的世界發光發熱。

舒適圈並非危險的地方|別再跳脫舒適圈: 以更少的壓力和更持久的心流狀態, 創造真正熱愛的人生

內附線上別冊【留在舒適圈更成功的27個簡單練習】,一步步讓你邁向真正熱愛的人生

● 打開本書前,請準備好忘掉大家告訴你關於「舒適圈」的一切!

1. 舒適圈是你懶得採取行動而自滿待著的地方。(x)

2. 舒適圈會阻礙你實現夢想生活。(x)

3. 你處於舒適的狀態,就不會成長。(x)

4. 「跳脫舒適圈」,得用奮力、痛苦、堅忍去生活,才能成功。(x)

5. 沒有痛苦就沒有收穫,沒有踏出舒適圈的成功是可恥的。(x)

6. 你待在舒適圈裡就不可能做到高生產力。(x)

7. 你要先跨出舒適圈,才會意識到自己的潛力。(x)

8. 如果你感到舒適,表示你是在欺騙自己。(x)

9. 待在舒適圈裡,你的夢想就會死去。(x)

10. 如果你想擁有美好人生,就一定要跨出舒適圈。(x)

● 上述的說法若是錯的,那舒適圈的真面目是什麼呢?

作者克莉絲汀認為,舒適圈是成長、可能性與喜悅的真正源頭,而且待在舒適圈的心態,是健康、自信、快樂、信念、放鬆、成功……。

→只要透過3個步驟、27個練習,我們就可以運用舒適圈所獲得的能量,取得巨大的成功。

● 大家都說,待在舒適圈就是不知長進,為何要待在舒適圈裡?

作者要告訴你,「沒有什麼地方會比在舒適圈時更快、更省力的取得成功。」她寫道:「我在舒適圈內生活,因此取得比想像中更多的成功,而且我沒有因此感到過於勞累或因此妥協,你也可以。」

→待在舒適圈,你會充滿安全感、信心、愉悅,且自然地展現自己,這時的你力量最大,嘗試新事物成功的動力最滿,能順利取得更多的成功。

● 用「舒適圈流程」3步驟,更快成功!

步驟1:定義你所在的地方

我們的人生狀態有三種圈子,依序是舒適圈、生存圈和自滿圈。作者認為,我們待在舒適圈,才能將自己的力量發揮到最大。首先,要找出自己現居在哪一個圈子,再找到自己的舒適圈,逐漸往舒適圈移動。

在這步驟,一旦進入舒適圈,你會感受到「安全感」「展現力(充分展現自己)」「愉快感」「勇氣」。

步驟2:擬定你前往的地方

居處「舒適圈」,你將會獲得上述四種感受。那你要怎麼前往「自己想去的地方 夢想」(擴展舒適圈)。作者認為,先想像「擴展的自我」,然後製作「舒適圈願景板」去一步步實現。

在這步驟,要善用「言詞」與引導「內心的情緒」,才能幫助自己實現夢想或擴展舒適圈。

步驟3:指引抵達的方式

就空間看來,步驟3其實不在最後,它是連結步驟1和2的橋梁,因為指引抵達的地方,需要先知道出發點和終點。當你清楚自己的所在地與前往地,步驟3就會出現有成效的行動,把你帶到內心真正渴望的目的地。

在這步驟,要特別關注自己的「心理習慣」!它會影響你的念頭與現實。

特別注意:依循這三大步驟,做練習的時候,請千萬注意,不要指責自己!

● 知道留在舒適圈更快成功的步驟後,你需要更多練習

作者用自身的經驗出發,在每章節後附上練習,共27個,從信念、目標、畫下界線、對焦習慣、養成良好思維等,無一缺漏。跟著這27個練習,你將會迎來自己真正熱愛的美好人生。

● 隨時檢驗你的狀態:總有痛苦、恐懼的時候,這時我離開了舒適圈嗎?

有五種情緒可以用來判斷我們是否離開舒適圈,如果你感受到其中一種情緒,就該知道你的鏡頭要向內轉,審視內在狀態,好讓自己返回舒適圈。

這五種情緒分別是:困惑、嫉妒、身體的疼痛或損傷、不堪負荷和焦慮。

你若想成為「過著快樂又圓滿生活的成功人士」,這本書將會是你的人生指南。

【各界美言】

本書會一舉改變你對成長與舒適的想法!

──路易斯.豪斯(Lewis Howes),《紐約時報》暢銷書《卓越學校》(The School of Greatness)作者

「跨出舒適圈,才會有所成長。」這句老生常談大家都聽過,但克莉絲汀.巴特勒在此要修正這個錯誤觀念,並向各位證明,只要回到舒適圈,就能創造你喜愛的人生。這本指南的內容出色又富有關懷精神 ,提供多種方法,幫助你擴展舒適圈,在你所在之地茁壯成長。這正是克莉絲汀一直以來做的事情,如今她正在啟發全球各地數百萬人活出富足又喜悅的人生。

──維克斯.金(Vex King),《星期日泰晤士報》暢銷書作者

克莉絲汀.巴特勒在心態領域堪稱思想領袖。在這個領域,我們亟需致力改善搖搖欲墜的身心健康和身心倦怠。本書提出的前提看似違反常識,有些人一看到也許會心想:「等一下,你說什麼?」其實,舒適圈不會阻礙你達成夢想,一旦理解其中的智慧,你的人生反而會有所轉變,而世人現在正需要這套方法。

──艾米.沙阿(Amy Shah)博士,雙認證醫生和營養專家,《我累死了》(I’m So Effing Tired)作者

本書挑戰我們對舒適圈的看法,還提出證明,只要我們跟舒適圈的關係變得更健全,就能邁向美好人生。

──賽門.亞歷山大.王(Simon Alexander Ong),《活力滿分:充分運用每一刻》(Energize: Make the Most of Every Moment)作者

大家都以為「舒適圈」是停滯不前的地方,但克莉絲汀.巴特勒這本內容超凡的新書,改寫這份迷思。不只如此,她還向諸位證明舒適圈是怎麼樣的,及為何不是停滯不前的地方。當我們處於不適的狀態,身體就無法達到運作的巔峰,在學習、創造、成長方面,也無法達到最佳表現。凡是想獲得真正的茁壯成長,《別再跳脫舒適圈》正是必讀之

作。

──烏瑪.納多(Uma Naidoo)醫師,哈佛營養精神醫學家、主廚、營養師、國際暢銷書《大腦需要的幸福食物》(This Is Your Brain on Food)作者

好希望我在三十年前就讀了這本書。我在電影界賺了數百萬美元,假如當初待在舒適圈,賺到的錢會是十倍以上。

──大衛.薩克(David Zucker),編劇兼導演,作品有《空前絕後滿天飛》(Airplane! )、《站在子彈上的男人》(The Naked Gun)、《驚聲尖笑3》(Scary Movie 3)、《驚聲尖笑4》(Scary Movie 4)

本書會徹底顛覆你對成功、成長、舒適所抱持的想法。克莉絲汀在方法、習慣、心態的轉變上,提出詳盡的說明,不僅務實可行又深具洞見,幫助你擴展舒適圈,不用跨出舒

適圈。想要擁有更美好的人生,又不用付出身心倦怠的代價,請閱讀本書吧!

──戴夫.霍利斯(Dave Hollis),《紐約時報》暢銷書作者,《共好》(Rise Together)Podcast 節目主持人

克莉絲汀藉由真誠、關懷、親身經歷的描繪來擁抱讀者,同時讓讀者鼓起勇氣,輕鬆採取行動。在本書的幫助下,讀者就能離開「自滿圈和生存圈」的現況,跨進令人雀躍、力量強大的舒適圈。她的敘事風格充滿關愛,有典範轉移的作用,讓讀者重獲新生。本書蘊含的智慧俯拾皆是,請閱讀、練習並實踐吧。

──尼勒許.薩古魯博士(Dr. Nilesh Satguru),醫生、作家、高績效教練

克莉絲汀.巴特勒把正能量的層次往上提升,教導大家把自己覺得舒適的狀態往外擴展,藉此達到高水準的成功。對於想達成夢想又不願身心倦怠的人來說,本書堪稱必讀之作。

──艾登.梅庫斯(Ayden Mekus),演員與內容創作者

《別再跳脫舒適圈》是強大的重新組構,也是必要的提醒,促使我們遠離有害的忙碌文化,邁向健康、快樂又和諧的人生,這才是我們理應擁有的人生。

──米歇爾.C.克拉克(Michell C. Clark),講者與作者

《別再跳脫舒適圈》的每一頁都散發著克莉絲汀的喜悅能量!她精心設計的路線圖清晰、簡潔又可行,讀者可以依循這張路線圖,達成目標和夢想,同時彰顯你在當下此刻的真實樣貌。她的言詞和方法會平靜地引導你、支持你,讓你徹底重塑舒適圈、擴展舒適圈,創造幸福人生。她聰慧過人!大力推薦!

──艾莉莎.柯維(Elisha Covey),八位數企業家、Podcast 節目主持人、企業顧問

這是革命性的著作,世人的思想和心靈都會因此有所轉變。舊有的意識型態認為做的事愈多就愈成功,但克莉絲汀打破舊有的意識型態,真正破解這道難題。她喚醒讀者,讓讀者站在嶄新的視角去看待人生、存在、創造,還提供簡單又可逐步實踐的一套方法,讓讀者能夠立刻付諸行動,在人生中達到終極的快樂和內心的平靜。這份智慧是世人一直以來所渴求的,如今終於面世!在我過去十年來讀過的書籍中,這本是名列前茅之作,人人都需要一本。

──蘿倫.馬格斯(Lauren Magers),快樂人生系統(The Happy Life System)創辦人

克莉絲汀.巴特勒的《3 分鐘正能量日誌》(3 Minute Positivity Journal),讓我個人和我指導的學生運動員都獲益良多,所以我早已敬重並追隨她的作品與洞見。不過,《別再跳脫舒適圈》可說是真正讓人眼界大開。她闡述人們只要去接納並擁抱舒適圈,就能擴展舒適圈,而她的寫法別具啟發性又能引起共鳴,擄獲我的心。這份指南寫得十分精采,我們可以據此調整我們看待自己的目光,真正活出最美好的人生。

──多明尼克.莫恰努(Dominique Moceanu),奧林匹克金牌體操選手、《紐約時報》暢銷書作者、多明尼克.莫恰努體操中心(Dominique Moceanu Gymnastics Center)創辦人

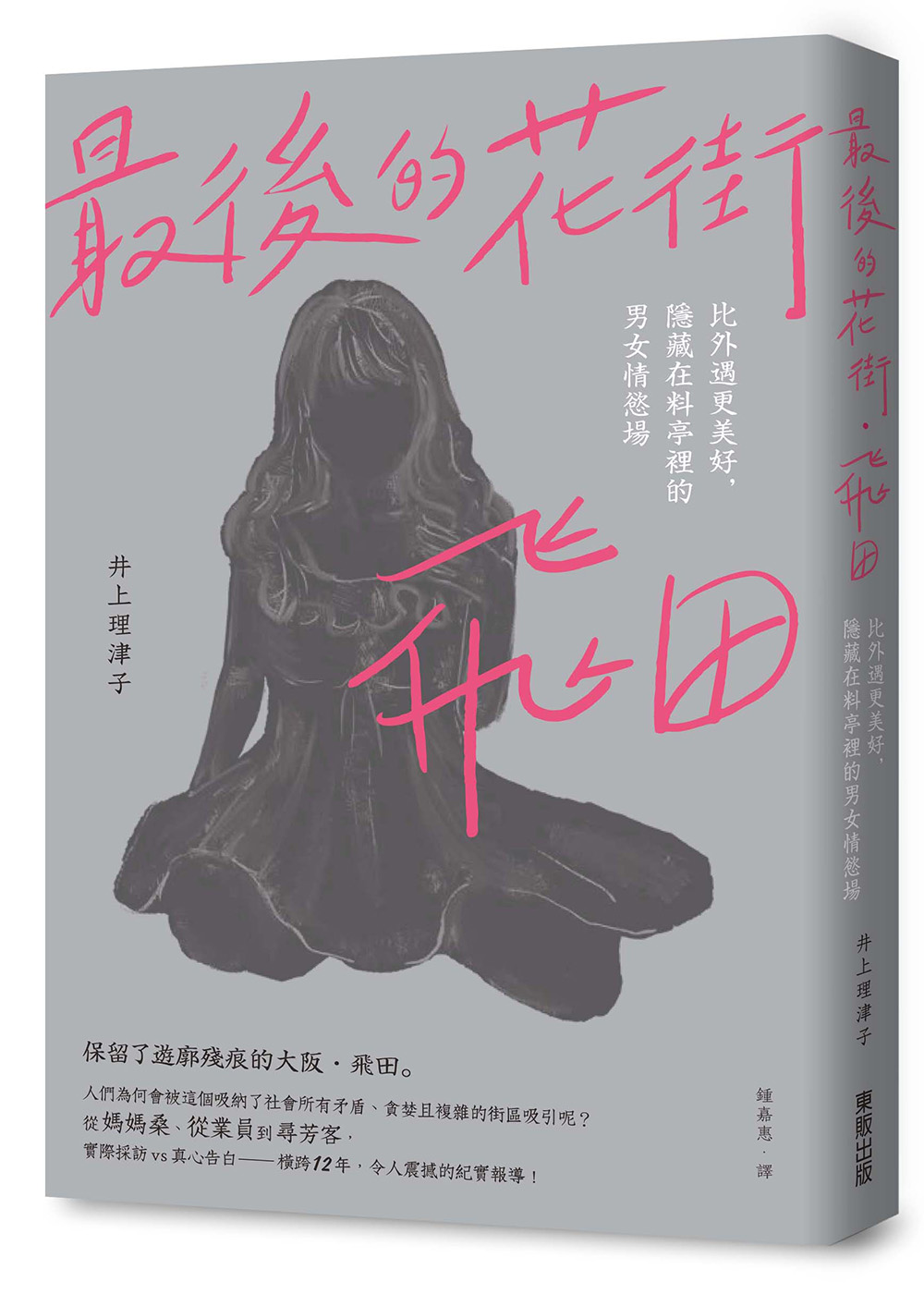

大阪的林森北路|最後的花街.飛田: 比外遇更美好, 隱藏在料亭裡的男女情慾場

保留了遊廓殘痕的大阪・飛田。

人們為何會被這個吸納了社會所有矛盾、

貪婪且複雜的街區吸引呢?

從媽媽桑、從業員到尋芳客,

實際採訪x真心告白,

橫跨12年,令人震撼的紀實報導!

――「就像一般肉舖都會在肉上面打兩、三道光,

這樣一來賣相會更好,看起來也更加鮮美可口對吧?

我們店裡替小姐打光也是同理。」

――「我專攻社會學,也清楚用人權的角度來看,性交易既不合理也不合法。

但我還是來買春,畢竟人有時就是會想做一些不該做的事。」

――「養老院的接駁車停在飛田附近,從車裡下來了好幾個阿公。

他們身穿運動服、拄著枴杖,慢吞吞地走進料亭。」

飛田新地接待過無數來這裡排解慾望的男人。

不分年齡大小、職業貴賤,只要付錢就能談一場模擬戀愛。

遊廓有自己的規矩跟玩法,

也有自百年前延續下來的氛圍與情調。

那裡有血有淚也有歡笑,

是有別於日常生活的另一個世界。

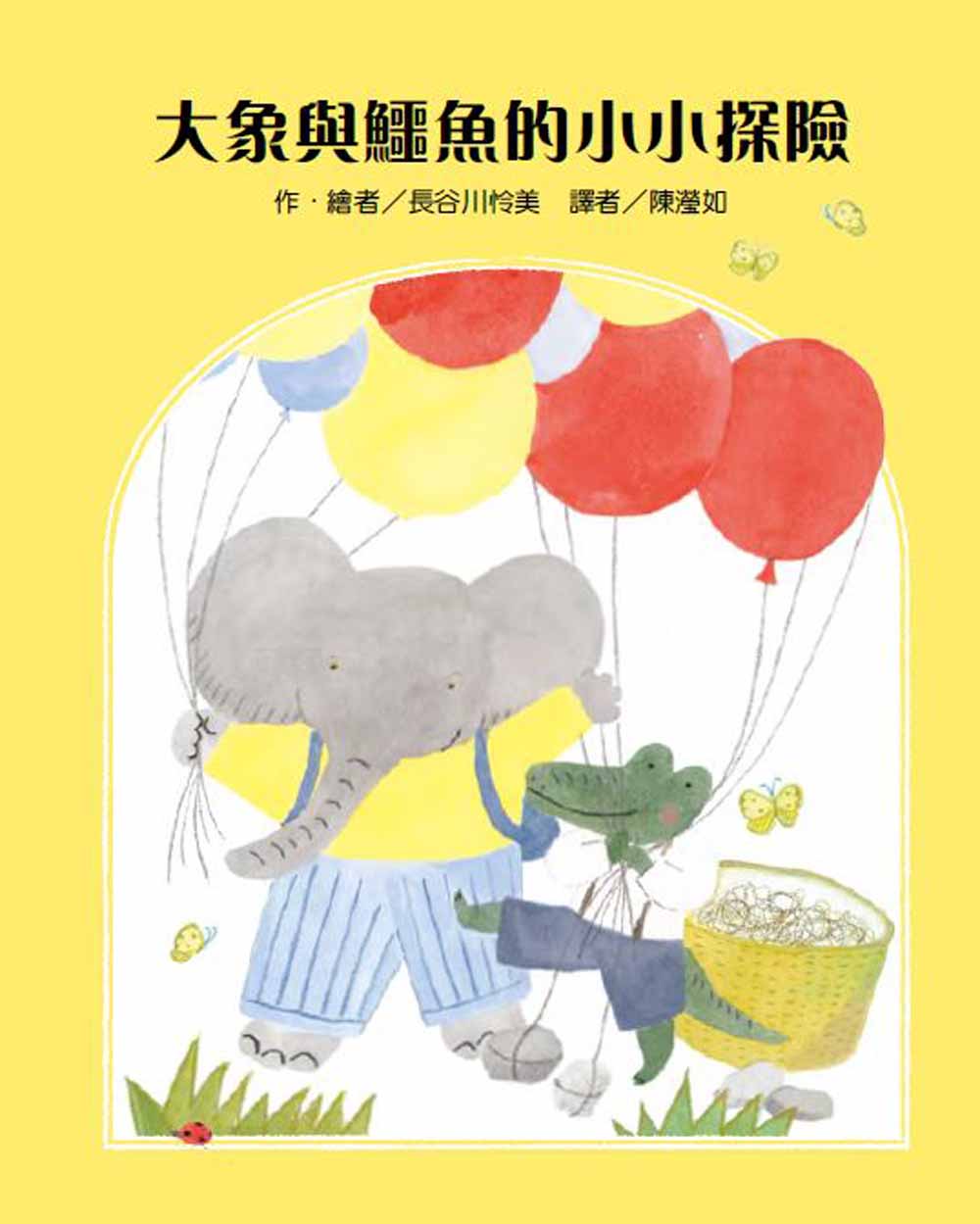

溫暖人心療癒小故事|大象與鱷魚的小小探險

直率又淘氣的大象福尼夫和開朗又可靠的鱷魚瓦姆,是最要好的朋友。他們一起做了好多事!

某天,福尼夫突發奇想:「風從哪裡來啊……要想知道風去了哪兒,最好的辦法就是我們試著被風吹走!」於是兩人一起去尋找風的祕密基地,卻被風吹得暈頭轉向!

他們還曾一起在下雨天時,回憶起瓦姆誕生的故事,曾是一顆蛋的鱷魚瓦姆,竟也經歷了一場大冒險呢!

還有,相約在原野玩耍的兩人,又發生了什麼有趣的事呢?

---------------

SDGs永續發展目標

#良好健康與福祉

#優質教育

#陸域生命

#夥伴關係

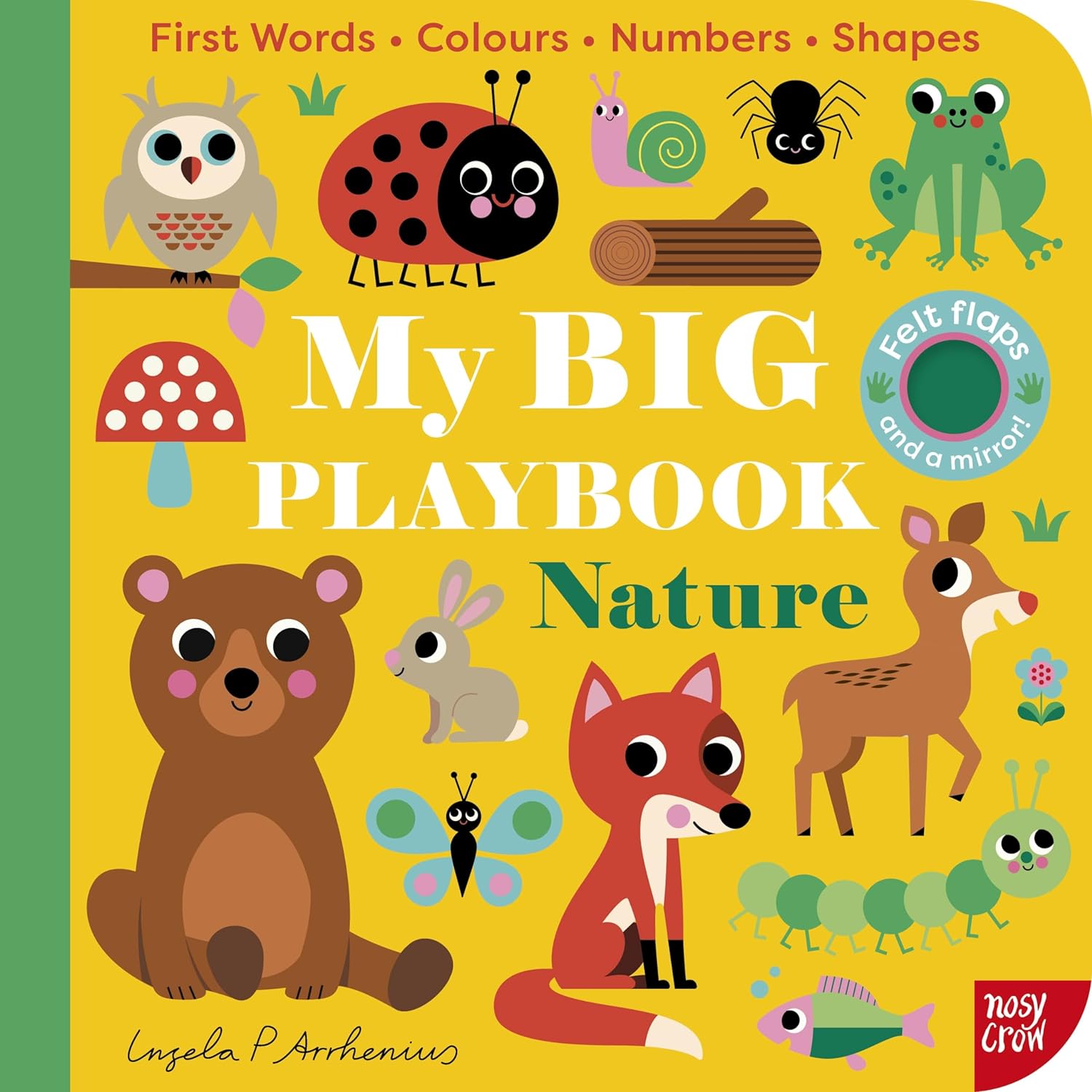

寶貝的大自然主題遊戲書|My BIG Playbook: Nature

A BIG nature book for sharing with a little person, introducing first words, colours, numbers, shapes, opposites - with felt flaps and a mirror!

好康優惠

新書報到 | 馬上選購

韓國國民作家金英夏|告別 (作者首度來台限量親簽紀念版)

《告別》原本是金英夏2019年受韓國會員制電子書訂閱平台(www.millie.co.kr)之邀所寫的故事。

2020年初,新冠肺炎疫情爆發,金英夏大幅度更改了故事的結構和內容。面對疫情初期全球防疫失控、導致無數人在這場近代最大規模瘟疫中無意義死去的局面,他寫下這個故事,討論我們生命的意義何在、人類這個物種的存在價值。相對地,人工智慧也正如火如荼深入人類社會各個層面,而我們一邊懷抱著對AI的恐懼,卻仍一邊持續開發其可能性——究竟,人類正往哪裡去?人性會否有終結的一日?

安海瑟薇主演影集原著|The Idea of You

安海瑟薇主演:《關於你的想法》(暫譯)Amazon影集原著小說

TREAT YOURSELF WITH THIS SCORCHING HOT LOVE AFFAIR ABOUT THE MAN THAT EVERYONE IS TALKING ABOUT . . .

'THIS SLAYED ME' Taylor Jenkins Reid

'IF YOU ONLY READ ONE BOOK THIS YEAR, MAKE IT THIS' 5***** Reader Review

'SUMMER'S SAUCIEST, SEXIEST READ' Red

'THE ENDING . . . I'M NOT OVER IT' 5***** Reader Review'

'I'M MADLY IN LOVE WITH THIS NOVEL' Curtis Sittenfeld

THE RICHARD & JUDY BOOK CLUB PICK

_______

EVERYONE IN THE WORLD KNOWS HIS NAME. BUT IT'S YOU HE WANTS.

To the media, Hayes Campbell is the star of a record-breaking British boyband.

To his fans, he's the naughty-but-nice front man - whose dimples and outlandish dress sense drive them crazy.

To Solène Marchand, he's just the pretty face that's plastered over every girl's bedroom wall.

Until a chance meeting throws them together . . .

The attraction is instant. The chemistry is electric. The affair is Solène's secret.

But how long can it stay that way?

_______

'This is an addictive, glamourous, escapist page-turner - and pure wish fulfilment for Harry Styles fans' DAILY RECORD

領券買書 | 閱讀推薦

全球讀者捧腹激賞|天真的人類學家: 小泥屋筆記 & 重返多瓦悠蘭 (跨世代共讀經典合訂本)

★★★★★八○年代英美青年人手一本的暢銷經典★★★★★

◢◤◢◤◢◤一部無人能出其右的田野調查筆記◢◤◢◤◢◤

一九八○年代的奈吉爾.巴利還是個初出茅蘆的年輕學者,一位尚未下過田野的「天真的」人類學家,帶著(事後證實不僅不足還提領不出的)研究經費、打了(讓他把所有症狀得了個遍的)諸多疫苗,當然還有尚未被消磨的職業熱情,前往非洲喀麥隆的原始部落進行田野調查。在克服一連串荒謬的官僚程序之後,找到一位老是抱怨巴利不擺架子害他地位跟著低落的嚮導,結識了哪裡有酒就有他的酋長、扇椰子果肉會「好心嚼軟」才請他吃的多瓦悠婦人、騎重機四處風流(跟別人老婆)的無政府主義者、可以修好(或乍看修好)任何破銅爛鐵的新教牧師,並過著只要開車就得讓沿途任何人(連同家眷、作物、牲口)搭便車,並在車上盡情嘔吐的日子。「秩序在這裡是根本不存在的東西,他還必須從多瓦悠人的幽默戲謔中挖掘他們的文化真諦。」

巴利以令人捧腹的英式幽默記錄了那段趣事不斷的經歷,將人類學家如何克服乏味、災難、生病、敵意真實呈現在讀者面前。出版後深受全球讀者喜愛,暢銷多年經典不墜,而當時所激起對田調本質的思索和辯證,隨著時代更迭,此刻回看更顯珍貴。「不同於那些嚴肅而充滿了讓外行百思不得其解的術語的人類學書,這也是一本關於人類學家自己的書。」

◢◤人類學界 天真不改傳承之作◢◤

黃道琳/前中研院民族所助理研究員、《菊花與劍》譯者 ▍導讀 ▍

趙恩潔/中山大學社會學系教授、《辶反田野》共同主編 ▍專文推薦 ▍

強納森‧史托克(Jonathan Stock)/前英國雪菲爾大學民族音樂學教授 ▍專文推薦 ▍

林浩立/清華大學人類學研究所副教授、《芭樂人類學2》共同主編

--共感推薦

◢◤文化界 書架典藏不換回憶◢◤

董成瑜/鏡文學總經理暨總編輯

簡莉穎/大慕影藝內容總監

朱嘉漢/作家

李拓梓/專欄作家

--共讀推薦

簡莉穎:「因為天真的人類學家,考上人類學系是我高中的第一志願,輾轉來到戲劇的領域仍然持續的對人類感到好奇。這本書太好笑太自嘲了,那是真的好好平視他人與自己的文化才能長出的幽默視角。」

李拓梓:「多瓦悠蘭和當代的文化衝擊,多年後重讀依然妙趣橫生,所有有志於田野調查的朋友都該一讀。」

◢◤全球讀者捧腹激賞◢◤

「適合那些喜歡窩在現代公寓裡看研究人員在泥屋生活的讀者。」

「如果您想要進行嚴肅的人類學研究,或者客觀記錄傳教士尚未玷污的喀麥隆偏遠地區的生活,那麼這本不適合你。作者有一種非常英式的自嘲幽默,他總是出問題,要嘛是不知情的受害者,要嘛是他自己造成的。他從來不是英雄。」

「娛樂性十足,典型的英式幽默層次不窮。巴利很有文采,我覺得他如果不做人類學家,去做個小說家應該也會出色。讀這本書真有種身臨其境的感覺:跟他一起去非洲喀麥隆偏僻的窮山惡水爬高上低,和土著打成一片,受衝擊、遭磨難,然後慢慢與環境相熟,與人相親,幾乎有了『在家』的感覺——據說對於人類學者來說,一旦有這種感覺就該離開了……」

「書裡寫得精采不僅是多瓦悠人,還有形形色色的外來人:旅人、傳教士、學者、冒險家。不管誰,但凡出現在喀麥隆這個神奇的非洲國度,就天然地帶上了一種莫名的殖民主義色彩、一種文化衝突的荒誕。」

時尚選物 | 超值登場

滿萬加贈後背包|【LOJEL】CUBO FIT 29.5吋前開擴充 防盜拉鍊拉桿箱/ 酒紅

全球保固號碼牌, 為每個箱子設立ID, 方便您可以在全球維修

前開式設計, 在任何環境只須極小空間便能整理行李

雙齒防盜防爆拉鍊, 用尖銳物戳不開, 防潑水性更加

擴充設計, 容量瞬間加大

360度耐磨靜音飛機輪

100% 德國拜耳PC耐碰撞材質

箱蓋上備有收納袋, 輕鬆分類取物

CUBO系列採用前開式設計, 中間為擴充圍, 不同於一般對開式行李箱, 開闔時只需要極小空間, 讓您不管在任何環境都能輕鬆整理行李.

生活好物 | 編輯精選

送禮收藏皆宜|氺の尼 泥研製所胖胖招福貓/ 6cm/ 單入/ 戀愛粉

【居家小物】胖胖招福貓 -戀愛粉

圓滾滾的招福貓造型討喜, 無論是祝賀送禮或收藏自用皆為首選 !

採用環保水泥製成,特殊的氣孔與紋路可搭配香水或精油作為擴香石。

小巧可愛的招財招福貓適合擺放在辦公桌或者書桌上

胖胖的讓您財源滾滾來,肚子飽飽 ~

一共有六色可供選擇

民間顏色祈願代表可參考以下

黑色代表避邪避小人 消災解厄 身在職場上絕不能錯過

白色代表自在安定 純白色的水泥質感高級 美麗兼備

灰色代表平靜穩定 水泥原始色 大器而不失雅趣

粉紅色代表戀愛姻緣運 促進感情浪漫 單身招甜蜜好對象

綠色代表健康平安 清新又放鬆 充滿生命力

黃色代表財富與成功 讓財富運更加倍