今日最推

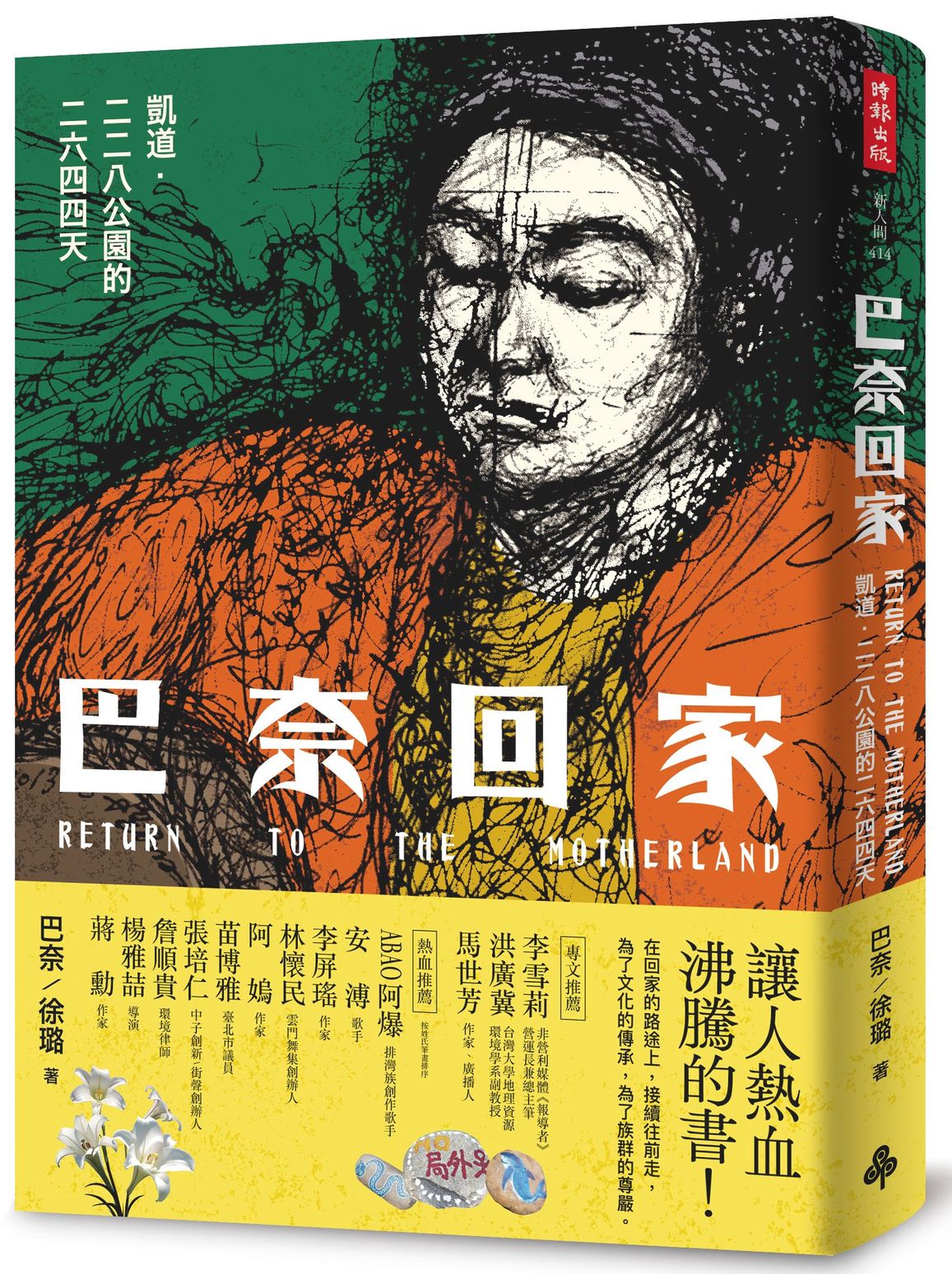

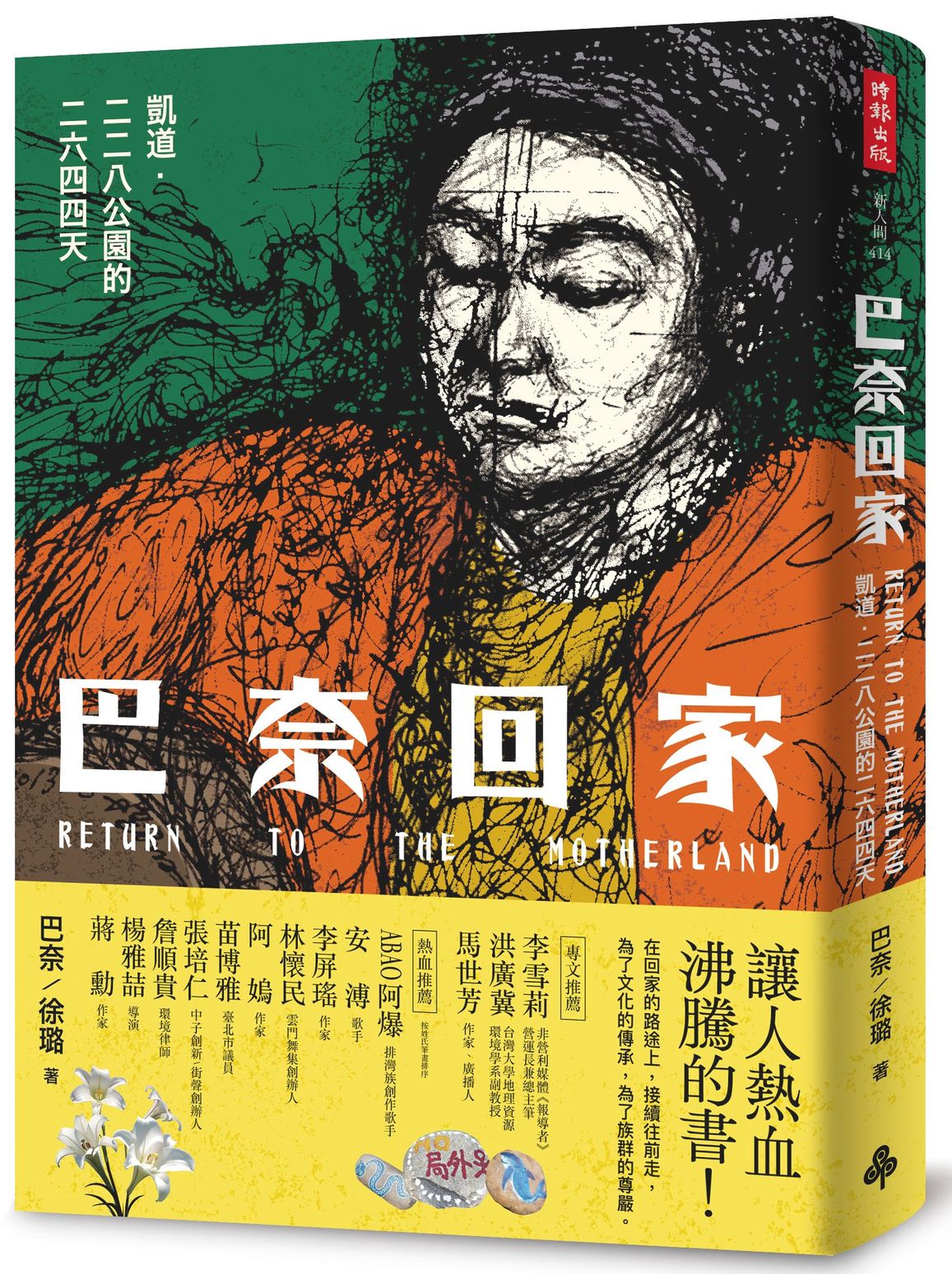

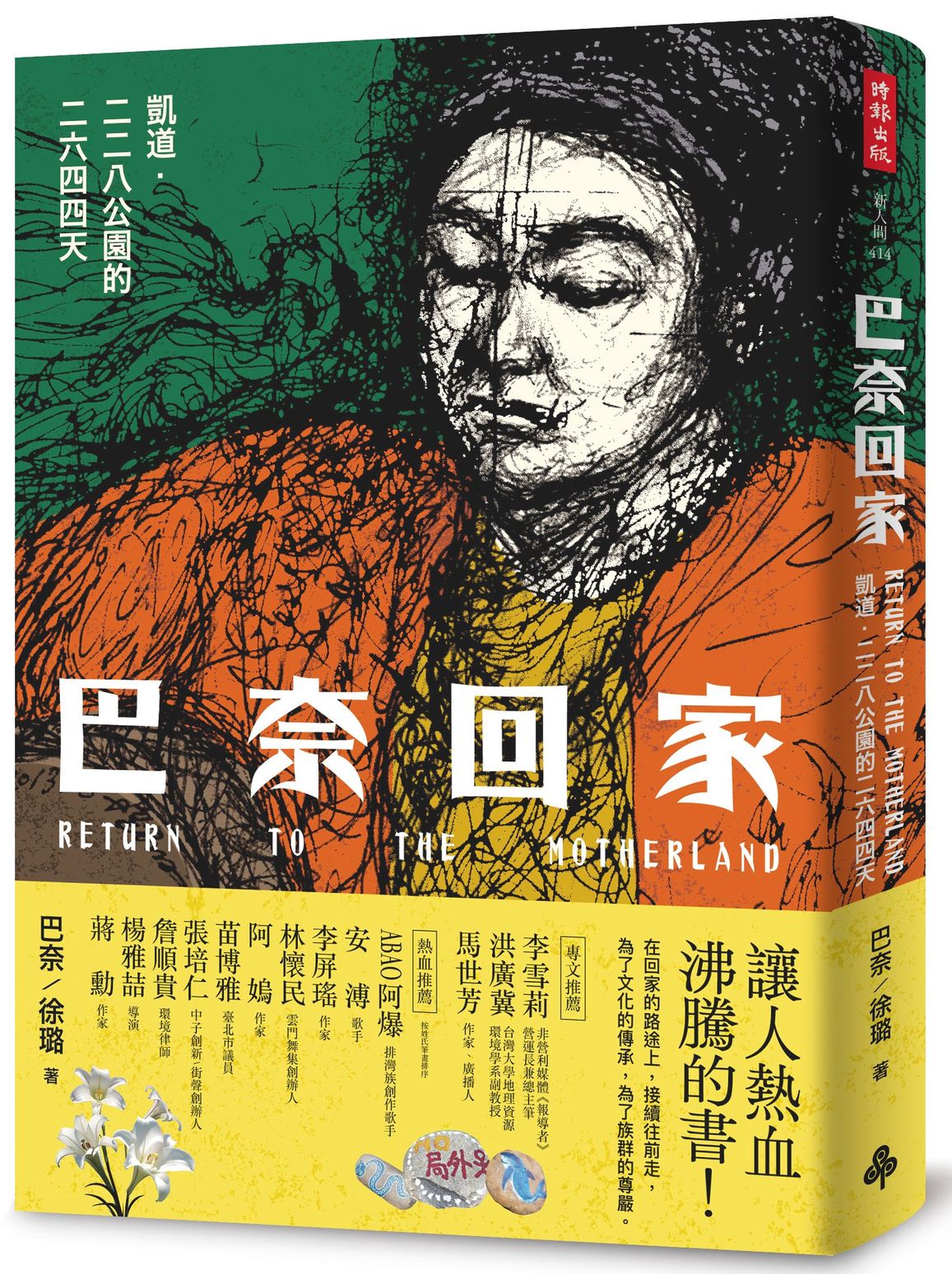

為了文化傳承與族群尊嚴|巴奈回家: 凱道.二二八公園的二六四四天

讓人熱血沸騰的書!

這是巴奈的生命故事

也是許多原住民族生活和歷史的縮影

希望這本書可以讓我們的聲音,

陪伴一代又一代的年輕人,

在回家的路途上,接續往前走,

為了文化的傳承,為了族群的尊嚴。

「妳叫什麼名字?」

柯美黛。

「不是,不是,我是問妳的族名?」

我從小知道自己是原住民,但「族名」是什麼?

以〈流浪記〉聞名歌壇的巴奈,從自我認同的迷惘裡走上族群命運的反思與奮起。為了原住民族的「尊嚴」、為了「轉型正義」、為了要求政府「完整劃設原住民族傳統領域」……

二○一七年起,巴奈與那布走上凱道,經過警方多次驅離,最後轉進二二八公園的角落,抗爭運動逐漸從焦點轉向邊陲。

她和那布在帳篷裡歷經四季寒暑,甚至曾經「睡在沒有屋頂的地方」,他們堅持了七年、超過二千六百個日子。

很多人問:「你們還在?」

是的,依然在。

漫長歷史上,原住民族從原來的聚落被強制遷徙,「被迫」放棄名字、語言、祖先的承繼,在從屬於他者的生活方式裡,逐漸喪失了自己的歷史記憶、傳統和山林文化……抗爭七年間彷彿過去處境重演,他們的身影在不斷地驅趕中遠離大眾的視野,但這次,已經踏上「回家」的腳步將不會停。

這本書首度寫出巴奈的成長故事,更寫出原住民族群被迫離開家園、失去土地的歷史。這是一本讓人熱血沸騰的書,也是原住民族生命和歷史的縮影。

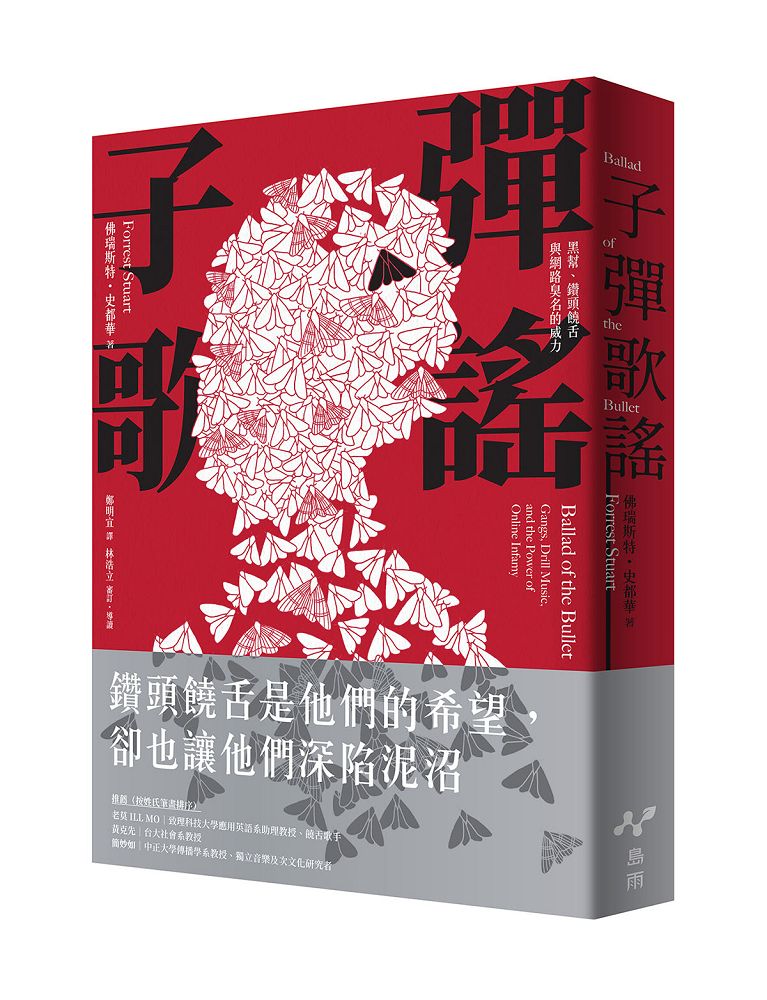

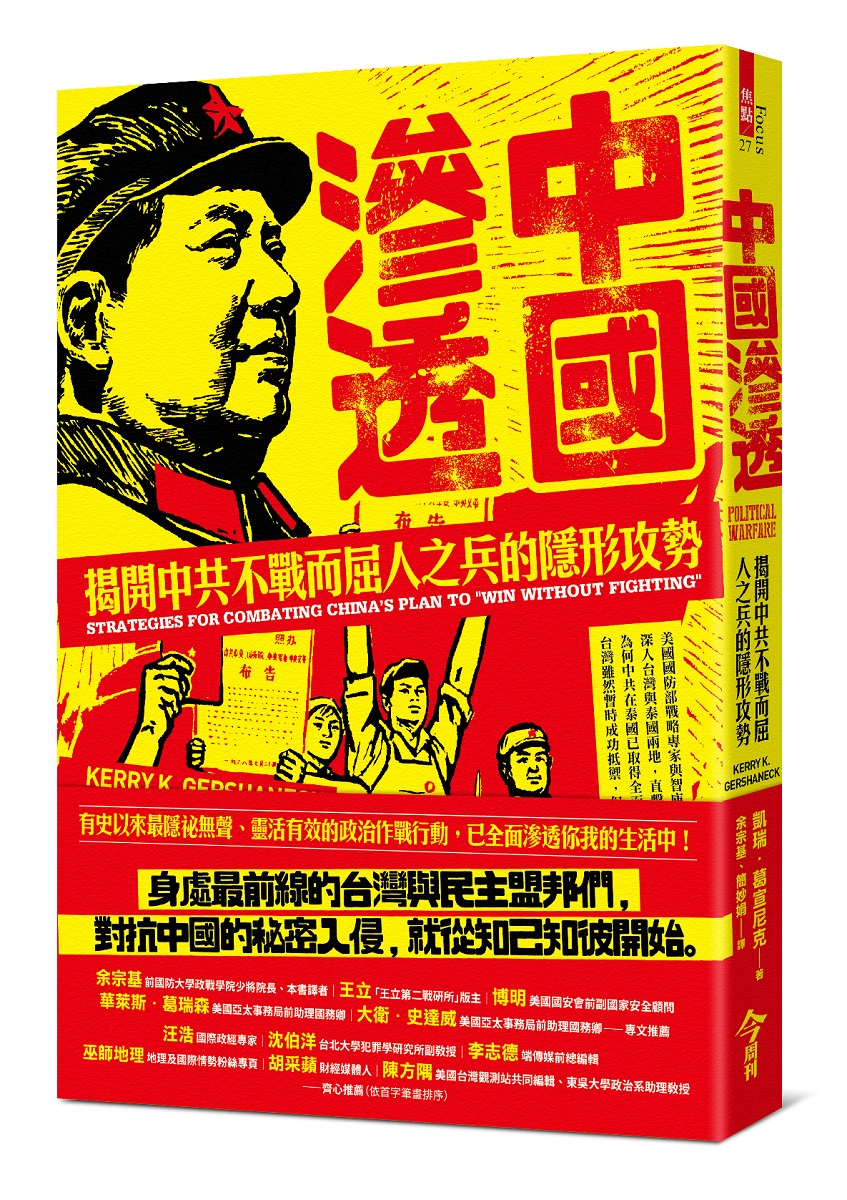

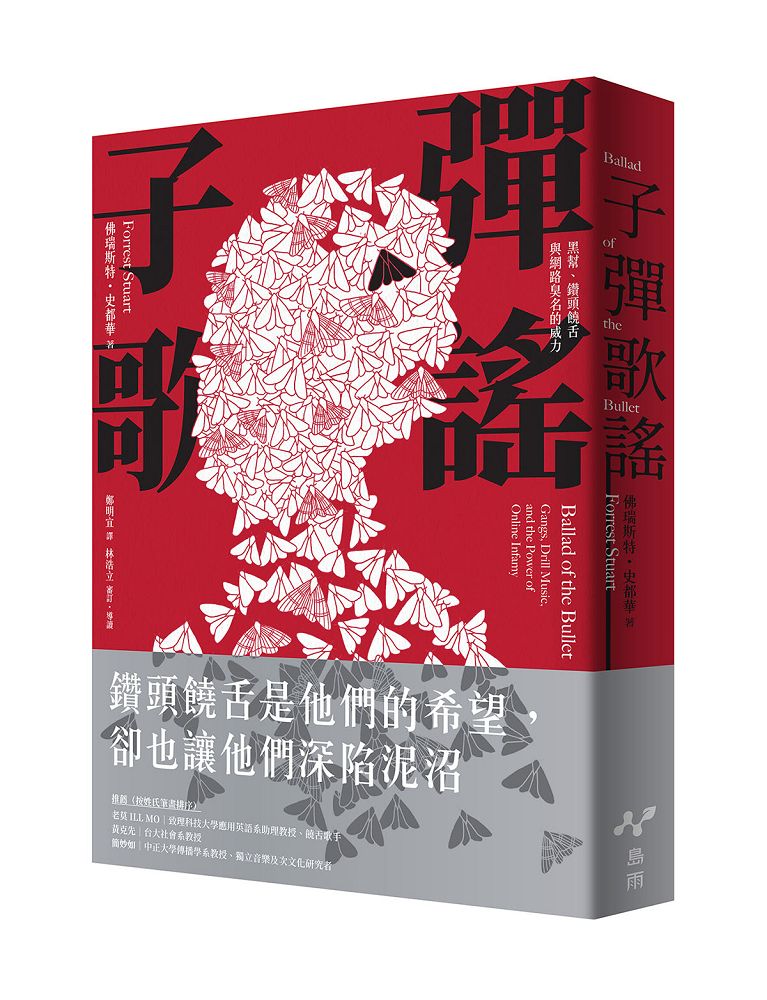

在流量至上的時代求生存|子彈歌謠: 黑幫、鑽頭饒舌與網路臭名的威力

鑽頭饒舌是他們的希望,卻也讓他們深陷泥沼

★★清大人類所副教授、饒舌團體「參劈」成員林浩立專文導讀★★

這是一個鑽頭饒舌、幫派暴力與微網紅交織在一起的複雜故事。作者花了數年的時間在芝加哥南區與一群自稱為「街角兄弟」(化名)的幫派少年日夜相處,研究他們如何在這個流量至上的時代求生存。

由於治安政策的改變,美國當代的幫派少年已經無法像前輩一樣進入大型幫派組織,受到庇護且靠販毒謀生。低薪服務業看起來是唯一的選項,但難以維持且前途黯淡。因此,當他們看到「酋長基夫」這種跟他們出身背景類似的饒舌歌手藉由描繪幫派暴力成為眾人追捧的網紅、甚至拿到高達六百萬美元的唱片合約時,他們開始有樣學樣,積極創作鑽頭饒舌,內容全都是關於飛車槍擊、炫耀武器與毒品等極度暴力的東西。除了音樂之外,YouTube、臉書與推特等社群媒體才是真正的戰場,因為「有圖/影片有真相」且可以即時打卡,讓他們的日常生活在粉絲眼中看起來超級刺激。雖然,根據作者的觀察,他們的線上內容有很大的成分是在「表演」,網紅世界真真假假,而流量是這個時代唯一的真理。

腥羶色的內容永遠不缺觀眾,因此他們成為微網紅之後確實取得了一些資源,像是粉絲給的金錢與物品、跨刀所拿到的報酬、受到同學的追捧、妹子投懷送抱,聽起來比前輩們在九〇年代所從事的毒品生意好多了——合法、「看起來」風險較低?但真實情況並非如此,因為饒舌講求「做自己」,而微網紅之所以吸引觀眾,也是因為觀眾認為他們「比較真實」,因此這些年輕的鑽頭歌手為了維持自己在網路上的暴力形象,在日常生活中也不得不戒備森嚴,畢竟,倘若在手無寸鐵的情況下被仇敵堵到、被拍下恥辱的影片然後上傳的話,輕則暴力人設崩塌,重則小命不保。此外,他們的數位足跡也引發了強大的後座力,因為網路無遠弗屆,上傳內容永遠不會消失,所以就算想要金盆洗手而搬到別的社區也沒什麼用,仇敵照樣認得他們。此外,執法人員同樣也拿社群媒體上的內容當作呈堂證供,將他們定罪。

這群少年掉進了自己拼命建立起來的「暴力人設」陷阱之中,難以脫身。

本書也剖析了他們的同學鄰居怎麼看待與消費鑽頭音樂。一方面,社區居民與警方指責鑽頭音樂是幫派暴力加劇的罪魁禍首;另一方面,即便是最品學兼優的青少年也很熱愛鑽頭音樂,並且用它來應付生活中面臨的各種狀況。貧民窟以外的聽眾則是出於各種五花八門的理由愛上鑽頭饒舌:有人拿鑽頭音樂來克服日常生活的無聊感、有人與鑽頭歌手一夜情好體驗越界的快感、也有教會領袖利用鑽頭歌手的名氣來拉攏年輕會眾。

暴力很真實,槍擊事件確實層出不窮且常常殃及無辜。鑽頭饒舌與相關的網路內容絕對涉及高度暴力,但它所反映的究竟是赤貧的黑人青少年所身處的絕境、是年輕人在注意力經濟中想要出人頭地、從此脫貧的一線生機,抑或是如政府治安單位所言,真的是暴力事件的源頭,應該徹底掃蕩?

◎好評推薦

「忠實呈現經濟弱勢的黑人青少年在網路世代所面臨的困境。」——老莫ILL MO(致理科技大學應用英語系助理教授、饒舌歌手)

「貧民嘻哈的微網紅之路,是一躍高飛還是粉身碎骨?揭露美國芝加哥底層青年黑人社群的鑽頭音樂嘻哈創作,以及他們在注意力經濟時代下的微網紅經營之路,交錯的內容,相同的生存困境!一無所有中,以最少的成本,縱身一搏,終究危機四伏、永無寧日。文化人類學、社會學、傳播學,都需要一看的深度田野調查,檢視貧困、希望勞動、公共窺視 獵奇等當代議題,是危殆階級的數位警鐘,也是一則充滿反思的黑色寓言。」——簡妙如(中正大學傳播學系教授、獨立音樂及次文化研究者)

「這本書讓我對於微網紅與年輕世代的文化徹底改觀⋯⋯史都華揭露了社群媒體如何為最弱勢的年輕人同時帶來希望與危險。」——艾許莉・米爾斯(Ashley Mears,《泰晤士高等教育》)

「教育工作者、社區工作者與音樂粉絲必讀之作。」——西朗・塔帕爾(Ciaran Thapar,記者)

「(史都華)與新興鑽頭饒舌團體中的青少年相處的故事,讀起來扣人心弦。」——亞當・羅伯斯(Adam Roberts,《經濟學人》)

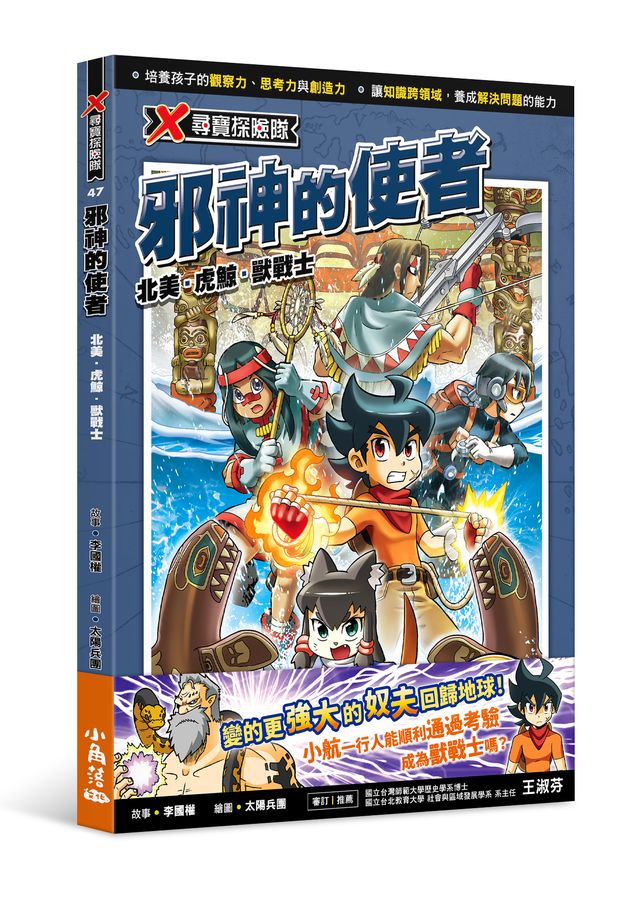

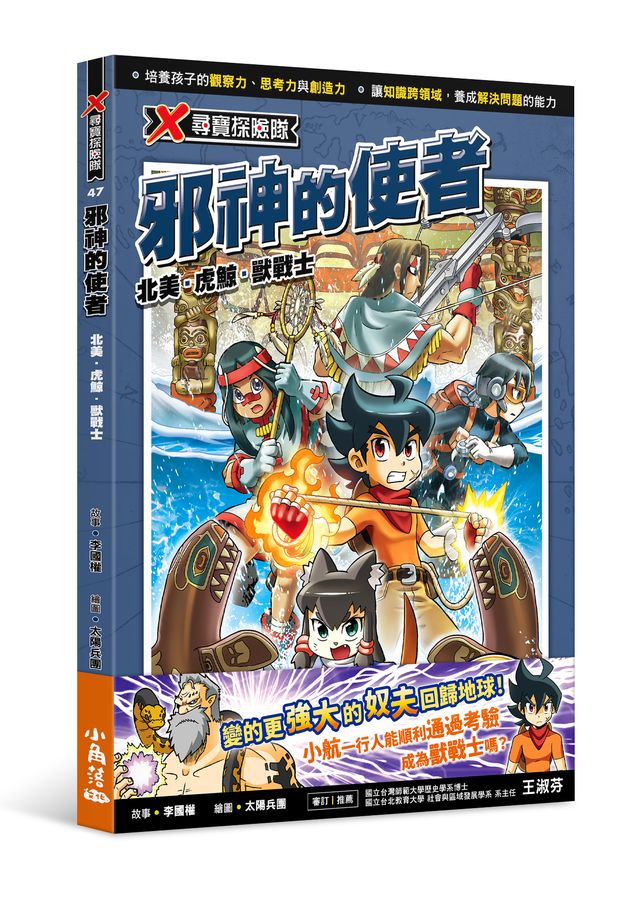

滿額贈送X尋寶書盒|X尋寶探險隊 47: 邪神的使者

朝著No.1的目標前進!這次,小航決不犧牲任何夥伴!

肥王奴夫以大蛇使者的身分再度回歸,威脅到整個地球!

世界聯軍集合全體人員,誓死保護地球的安全。

小航一行人想盡辦法打倒奴夫,但是凡人的武器卻傷害不了奴夫!

在這種緊急的情況下,小航他們該怎麼辦呢?

【審訂推薦】

王淑芬 國立台北教育大學社會與區域發展學系系主任

【三大特色】

◎觀察力★★★★★

全彩印刷畫風細緻、故事題材生動有趣,淺顯易懂的歷史及地理知識。

◎創造力★★★★★

腦力激盪的智力教育漫畫,訓練孩子的觀察、思考及創造力,幫助孩子全腦開發。

◎思考力★★★★★

書中彙整了讀者必讀的小航尋寶筆記,集結趣味的科學益智遊戲,讓孩子從閱讀中動腦解開謎題。

【知識學習重點】

#中國上海 #轟炸機 #原子彈 #夸夸嘉夸族 #蛇的眼睛 #虎鯨 #美國紐約 #蛇的消化系統

© 2023 KADOKAWA GEMPAK STARZ

好康優惠

新書報到 | 馬上選購

讓人熱血沸騰的書!|巴奈回家: 凱道.二二八公園的二六四四天

讓人熱血沸騰的書!

這是巴奈的生命故事

也是許多原住民族生活和歷史的縮影

希望這本書可以讓我們的聲音,

陪伴一代又一代的年輕人,

在回家的路途上,接續往前走,

為了文化的傳承,為了族群的尊嚴。

「妳叫什麼名字?」

柯美黛。

「不是,不是,我是問妳的族名?」

我從小知道自己是原住民,但「族名」是什麼?

以〈流浪記〉聞名歌壇的巴奈,從自我認同的迷惘裡走上族群命運的反思與奮起。為了原住民族的「尊嚴」、為了「轉型正義」、為了要求政府「完整劃設原住民族傳統領域」……

二○一七年起,巴奈與那布走上凱道,經過警方多次驅離,最後轉進二二八公園的角落,抗爭運動逐漸從焦點轉向邊陲。

她和那布在帳篷裡歷經四季寒暑,甚至曾經「睡在沒有屋頂的地方」,他們堅持了七年、超過二千六百個日子。

很多人問:「你們還在?」

是的,依然在。

漫長歷史上,原住民族從原來的聚落被強制遷徙,「被迫」放棄名字、語言、祖先的承繼,在從屬於他者的生活方式裡,逐漸喪失了自己的歷史記憶、傳統和山林文化……抗爭七年間彷彿過去處境重演,他們的身影在不斷地驅趕中遠離大眾的視野,但這次,已經踏上「回家」的腳步將不會停。

這本書首度寫出巴奈的成長故事,更寫出原住民族群被迫離開家園、失去土地的歷史。這是一本讓人熱血沸騰的書,也是原住民族生命和歷史的縮影。

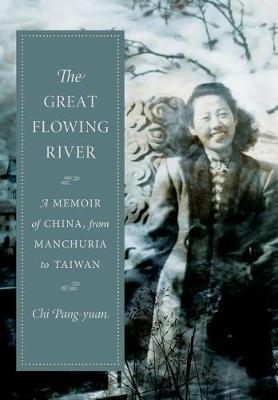

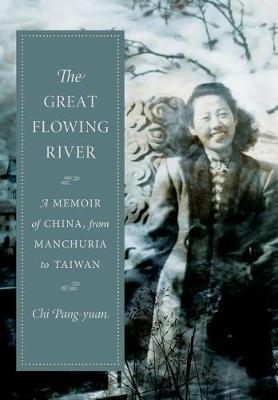

齊邦媛《巨流河》英譯|The Great Flowing River: A Memoir of China, from Manchuria to Taiwan

齊邦媛《巨流河》。寫作歷時四年 跨越百年時空,感動海內外百萬讀者。讀了巨流河,你終於明白,我們為什麼需要知識份子。苦難時代的信史 文學救贖的詩歌:一部反映中國近代苦難的家族記憶史,一部過渡新舊時代衝突的女性奮鬥史,一部台灣文學走入西方世界的大事紀,一部用生命書寫壯闊幽微的天籟詩篇。「當我記下了今生忘不了的人與事,好似看到滿山金黃素的大樹,在陽光中,葉落歸根。」-齊邦媛。書的記述,從長城外的「巨流河」開始,到台灣南端恆春的「啞口海」結束.........巨流河,位於中國東北地區,是中國七大江河之一,被稱為遼寧百姓的「母親河」。南濱渤海與黃海,西南與內蒙內陸河、河北海灤河流域相鄰,北與松花江流域相連。這條河古代稱句驪河,現在稱遼河,清代稱巨流河。影響中國命運的「巨流河之役」,發生在民國十四年,當地淳樸百姓們仍沿用著清代巨流河之名。作者齊邦媛的父親齊世英──民國初年的留德熱血青年,九一八事變前的東北維新派,畢生憾恨圍繞著巨流河功敗垂成的一戰,渡不過的巨流像現實中的嚴寒,外交和革新思想皆困凍於此,從此開始了東北終至波及整個中國的近代苦難。作者的一生,正是整個二十世紀顛沛流離的縮影。本書嘔心瀝血四年完成,作者以邃密通透、深情至性、字字珠璣的筆力,記述縱貫百年、橫跨兩岸的大時代故事。獻給──所有為國家獻身的人。

Heralded as a literary masterpiece and a best-seller in the Chinese-speaking world, The Great Flowing River is a personal account of the history of modern China and Taiwan unlike any other. In this el...

多重感官饗宴|法布爾昆蟲記立體書

含括自然、人文、知識、文學與科學領域的互動遊戲書

一場觸覺、視覺、聽覺與嗅覺的多重感官饗宴

翻一翻|找一找昆蟲在哪裡

拉一拉|聽一聽蟋蟀在唱歌

擦一擦|聞一聞特殊的薄荷味

關一關|看一看螢火蟲在發光

很久很久以前,法國昆蟲學家法布爾買下鄉村一塊荒地,種上百里香和薰衣草,邀請心愛的蟲子們來作客,他用一生時間記錄著奇妙的昆蟲世界。

翻開《法布爾昆蟲記立體書》,你會看到糞金龜的工具包,就像一座神奇的科技博物館。螢火蟲真的會發光,草叢裡還有突然蹦出的蟋蟀和打來打去的螳螂,樹枝觸感逼真,薄荷葉散發出香味,記得用放大鏡觀察一下榛子裡的象鼻蟲,沉浸式探究昆蟲的奧祕。

超豪華4大特色

★內容豐富:改編自法布爾《昆蟲記》,十大跨頁,五十多種動植物,上百個知識點。

★超高顏值:科學繪畫師出離純手工精繪插畫,封面的金鳳蝶工筆點了七千多針,用科學與藝術雙重視角觀察昆蟲。

★嚴謹審定:全書內容均由專業昆蟲研究者三蝶紀審讀校訂。

★互動升級:三大重工結構,五處驚喜工藝,三十八個立體互動場景。

領券買書 | 閱讀推薦

釜山國際影展話題之作|那一天, 我追的歐巴成為了罪犯

我曾是成功的粉絲,後來卻成為失敗的粉絲……

現在,我想成為一個,有所成長的粉絲。

獻給所有曾經愛、正在愛的你,讓我們找回愛的勇氣!

※作者訪台與電影特別放映活動,詳情請鎖定Facebook「時報悅讀俱樂部」※

★第26屆釜山國際影展話題之作

★劉在錫「You Quiz On The Block」節目專訪

★售出日文版權,電影日本熱映中!

★榮獲第23屆釜山獨立電影節評委特別獎

★入圍第58屆大鐘獎電影節、遠東國際影展、倫敦亞洲電影節、光州女性影展、釜山獨立影展、首爾獨立影展、仁川人權影展

偶像與粉絲,我和你

美好的回憶就這樣變成了黑歷史。

明明犯罪的是你,為何我如此悲傷、憤怒與自責?

【成粉,成功的粉絲】

作者吳洗娟就是一個「成粉」。為了讓歐巴記住,她穿韓服去參加簽售會,還以鐵粉身分上節目;歐巴一句「妳用功唸書,我努力唱歌」,更讓她穩拿全校榜首,考上理想大學。

【她喜愛的偶像,就是鄭俊英】

2019年,鄭俊英與BIGBANG勝利等人的聊天群組曝光,被發現散布多名女性的非法拍攝影片,之後鄭俊英被判5年有期徒刑。

【歐巴犯罪入獄,她成為失敗的粉絲】

回憶被剝奪,更彷彿自我被否定,她憤怒、難過又羞愧,也很好奇──其他粉絲也有相同感受嗎?偶像犯下厭女罪行,為什麼還是有女性粉絲願意相信他?

【敗粉成長之旅,是為了再次去愛】

她找到許多有相同境遇的粉絲,一起回看各自失敗追星的經驗,以及界線逐漸模糊的偶像與粉絲文化,希望讓這些撼動社會的偶像犯罪,不僅止於個人情感的損耗,也能獲得療癒與勇氣,找回自我,再次盡情去愛!

─【成粉內心話】─

❤沒有人是想追星才追的,而是像突如其來的命運般,打開了新世界的大門。沒在追星應該很難理解吧,這不是人生中能經常體會到的情感。

❤追星是熱烈的單戀。只看到他展現的樣貌就足以支持、喜歡他,想為他做很多很多。

❤以前覺得能被喜歡的偶像認出來才是成粉,但我現在認為,透過這份愛使自己的人生更加成長,才是真正成功的粉絲。

❤追星就是走入一個人的人生,再轉化為自己的人生。但必須牢記,偶像跟我一樣是平凡人,應該更客觀的看待,才能健康追星。

❤其實我能理解那些希望他徹底贖罪後,未來能好好生活的粉絲,我覺得那份心意非常美好。

❤現在我明白了,世上哪有完美的人啊。他究竟是怎麼樣的人,對我已不再重要,因為更重要的是喜歡他的過程。

❤即使一切的開端是他,我的主角仍是自己。沒有了他,我的世界也不會崩塌。若未來再喜歡上誰,我也會從他身上汲取些什麼,讓我的世界不斷擴大。

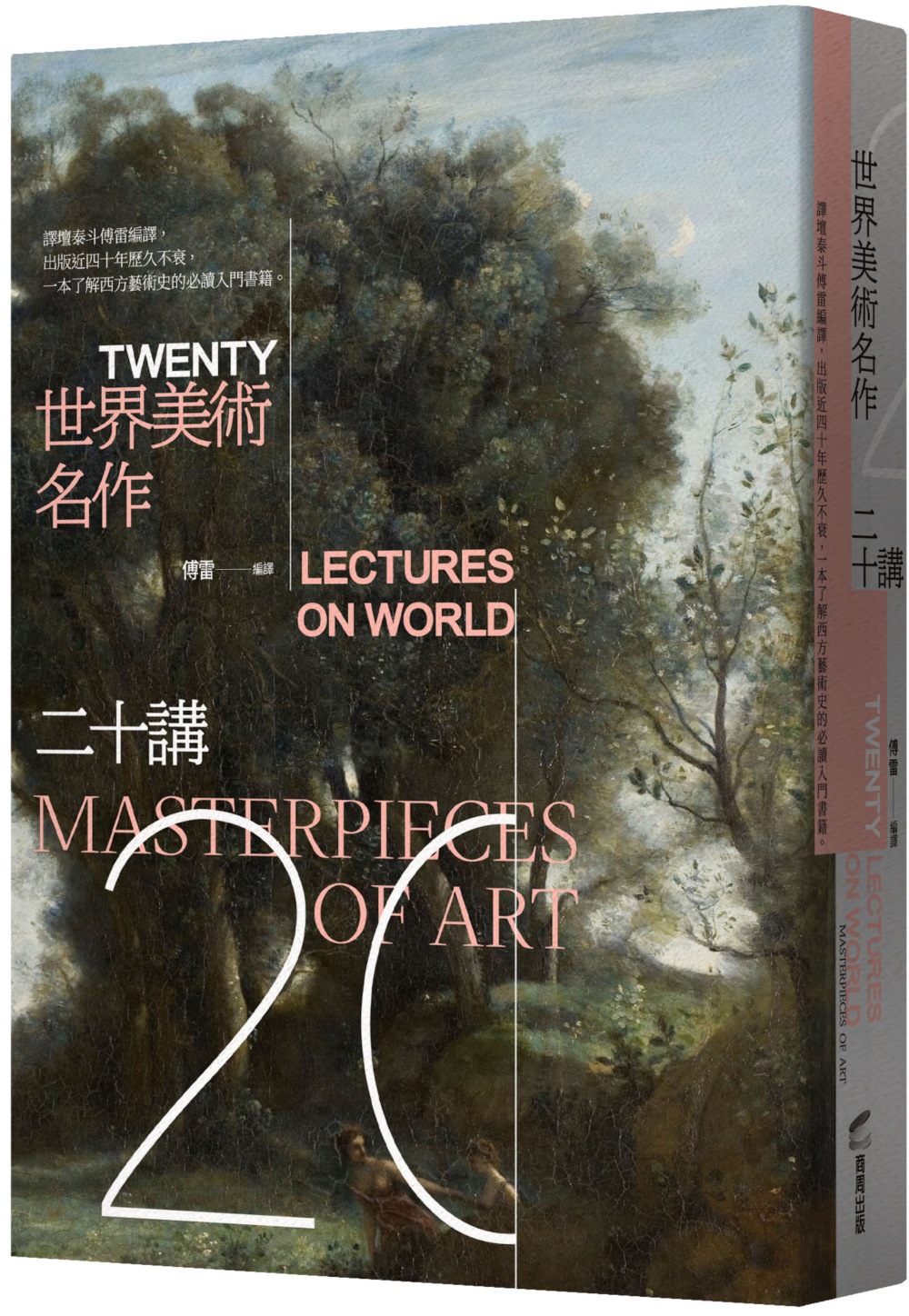

譯壇泰斗傅雷經典|世界美術名作二十講

譯壇泰斗傅雷編譯,出版近四十年歷久不衰,一本了解西方藝術史的必讀入門書籍。

一九三〇年代,中國著名翻譯家傅雷先生受聘於上海美術專科學校,將其美術史課程講稿整理補充,而成就本書。內容介紹西方近二十位美術大師及其名作,時序跨越七個世紀,包括繪畫、雕塑與建築。

為什麼達文西不給《蒙娜麗莎》加上一抹眼神的光彩?

為什麼米開朗基羅的壁畫人物都有如雕塑般健壯?

藝術作品並不只是技巧或造型,筆觸之間更乘載著作者的思想與意志。作品的色調、輪廓、構圖,往往與藝術家的性格、生平及時代背景緊緊相依;視覺的藝術更與音樂、文學與哲學有著微妙之緣。數百年來,繪畫的主體歷經了由人物到風景的轉變,藝術的目的從表達神聖轉變為反映真實;例如荷蘭畫家林布蘭在《以馬忤斯的晚餐》,將日常融入,改變了藝術對宗教題材的想像,或是西班牙畫家委拉斯開茲的《宮女群》,徹底翻轉了藝術的觀看邏輯。

傅雷透過傳神流暢的譯文,輔以深刻熱情、深入淺出的評述,表達了他對美學的看法以及對東方藝術的期待,並帶領讀者走入藝術的聖堂,看見技巧、審美與精神的百年流變,感受藝術之美。

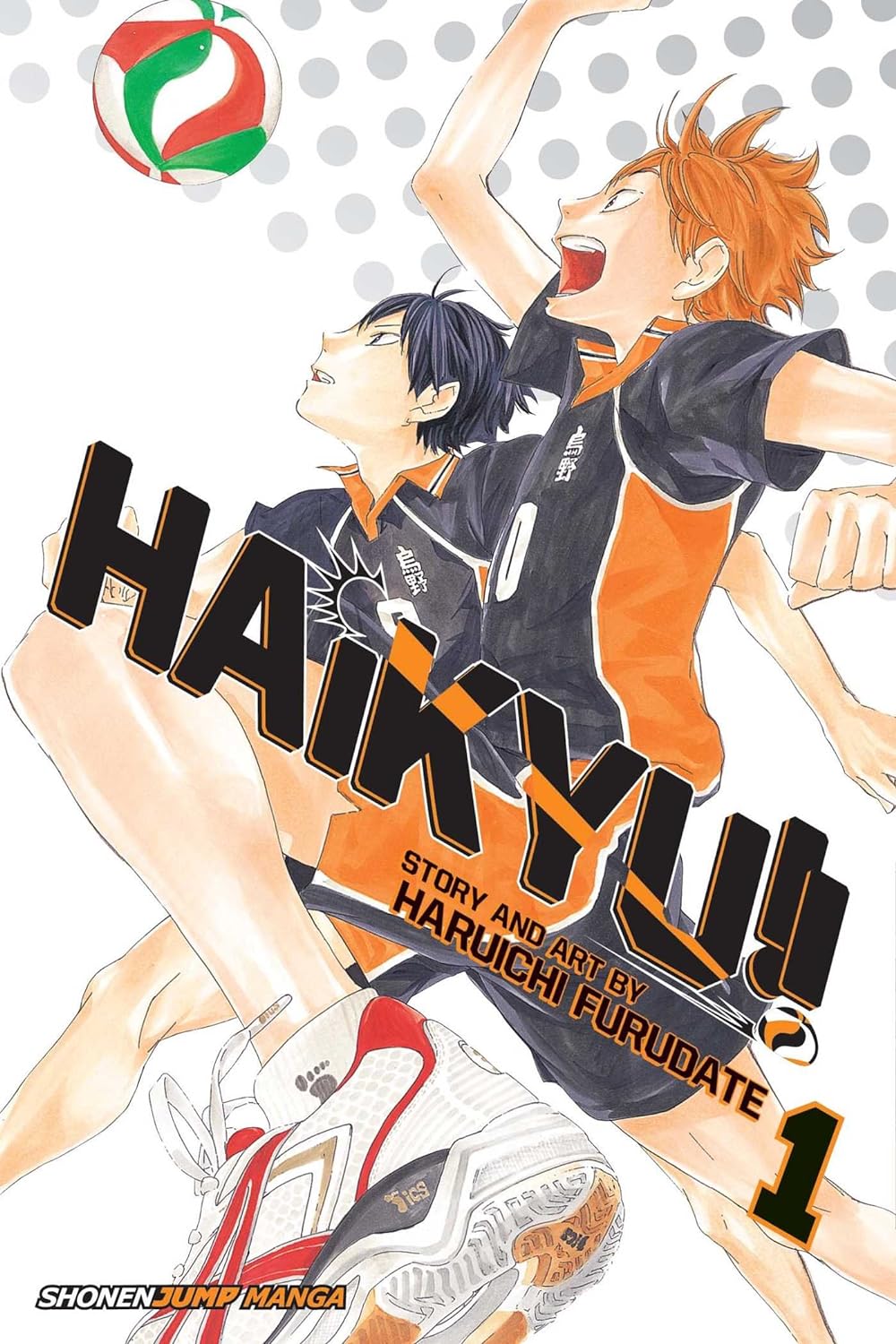

《排球少年》英文版|Haikyu!! Vol. 1

【看漫畫‧學英文】人氣漫畫《排球少年》英文版!Shoyo Hinata is out to prove that in volleyball you don't need to be tall to fly!

Ever since he saw the legendary player known as “the Little Giant” compete at the national volleyball finals, Shoyo Hinata has been aiming to be the best volleyball player ever! Who says you need to be tall to play volleyball when you can jump higher than anyone else?

After losing his first and last volleyball match against Tobio Kageyama, “the King of the Court,” Shoyo Hinata swears to become his rival after graduating middle school. But what happens when the guy he wants to defeat ends up being his teammate?!

時尚選物 | 超值登場

做工精緻穿搭亮點|法國 Mapoésie 圍巾/ B-NAMIBIE/ 粉彩

2010年成立於法國,由設計師Elsa Poux創辦,憑藉著在法國各大品牌的工作經驗,創辦平面、飾品配件設計工作室,以鮮亮的色彩、大膽的幾何圖騰為主視覺風格,個人配件中又以圍巾織品最受歡迎,在多國選品店都可看到品牌商品,與印度工作坊合作,將品牌平面設計完整呈現、製成做工精緻的商品。

自2010年以來,Mapoésie以其獨特的彩色作品在限量系列中製作,並且這些圖案在每個季節中都不斷重塑。Mapoésie偏愛使用天然材料,例如棉花、絲綢和羊毛。

生活好物 | 編輯精選