The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

約翰柏格投資常識

出版日期:

2017/10/15

79

1,000790

內容簡介

The best-selling investing "bible" offers new information, new insights, and new perspectives

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

While the stock market has tumbled and then soared since the first edition of Little Book of Common Sense was published in April 2007, Bogle’s investment principles have endured and served investors well. This tenth anniversary edition includes updated data and new information but maintains the same long-term perspective as in its predecessor.

Bogle has also added two new chapters designed to provide further guidance to investors: one on asset allocation, the other on retirement investing.

A portfolio focused on index funds is the only investment that effectively guarantees your fair share of stock market returns. This strategy is favored by Warren Buffett, who said this about Bogle: “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. . . . Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

Bogle shows you how to make index investing work for you and help you achieve your financial goals, and finds support from some of the world's best financial minds: not only Warren Buffett, but Benjamin Graham, Paul Samuelson, Burton Malkiel, Yale’s David Swensen, Cliff Asness of AQR, and many others.

This new edition of The Little Book of Common Sense Investing offers you the same solid strategy as its predecessor for building your financial future.

●Build a broadly diversified, low-cost portfolio without the risks of individual stocks, manager selection, or sector rotation.

●Forget the fads and marketing hype, and focus on what works in the real world.

●Understand that stock returns are generated by three sources (dividend yield, earnings growth, and change in market valuation) in order to establish rational expectations for stock returns over the coming decade.

●Recognize that in the long run, business reality trumps market expectations.

●Learn how to harness the magic of compounding returns while avoiding the tyranny of compounding costs.

While index investing allows you to sit back and let the market do the work for you, too many investors trade frantically, turning a winner’s game into a loser’s game. The Little Book of Common Sense Investing is a solid guidebook to your financial future.

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

While the stock market has tumbled and then soared since the first edition of Little Book of Common Sense was published in April 2007, Bogle’s investment principles have endured and served investors well. This tenth anniversary edition includes updated data and new information but maintains the same long-term perspective as in its predecessor.

Bogle has also added two new chapters designed to provide further guidance to investors: one on asset allocation, the other on retirement investing.

A portfolio focused on index funds is the only investment that effectively guarantees your fair share of stock market returns. This strategy is favored by Warren Buffett, who said this about Bogle: “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. . . . Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

Bogle shows you how to make index investing work for you and help you achieve your financial goals, and finds support from some of the world's best financial minds: not only Warren Buffett, but Benjamin Graham, Paul Samuelson, Burton Malkiel, Yale’s David Swensen, Cliff Asness of AQR, and many others.

This new edition of The Little Book of Common Sense Investing offers you the same solid strategy as its predecessor for building your financial future.

●Build a broadly diversified, low-cost portfolio without the risks of individual stocks, manager selection, or sector rotation.

●Forget the fads and marketing hype, and focus on what works in the real world.

●Understand that stock returns are generated by three sources (dividend yield, earnings growth, and change in market valuation) in order to establish rational expectations for stock returns over the coming decade.

●Recognize that in the long run, business reality trumps market expectations.

●Learn how to harness the magic of compounding returns while avoiding the tyranny of compounding costs.

While index investing allows you to sit back and let the market do the work for you, too many investors trade frantically, turning a winner’s game into a loser’s game. The Little Book of Common Sense Investing is a solid guidebook to your financial future.

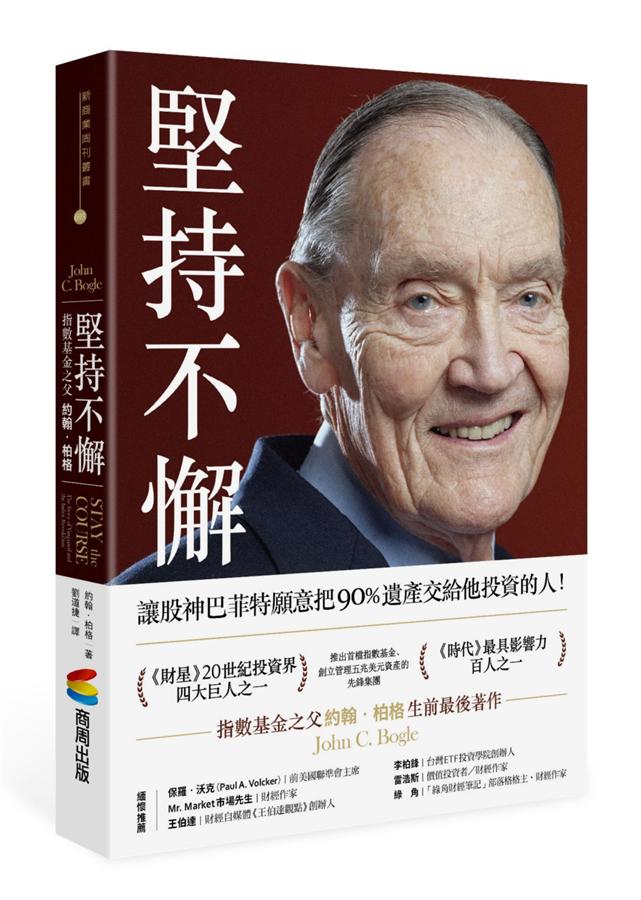

作者介紹

JOHN C. BOGLE is founder and former chairman of the Vanguard Group of mutual funds and President of its Bogle Financial Markets Research Center. After creating Vanguard in 1974, he served as chairman and chief executive officer until 1996 and senior chairman until 2000. Bogle is the author of ten books, including Enough: True Measures of Money, Business, and Life, The Little Book of Common Sense Investing, and Clash of the Cultures: Investment vs. Speculation, all published by Wiley.

規格

誠品貨碼 / 2681772639001

ISBN13 / 9781119404507

ISBN10 / 1119404509

EAN貨碼 / 9781119404507

頁數 / 304

注音版 / 否

裝訂 / H:精裝

語言 / 3:英文

尺寸 / 18.3X13.5X2.8CM

級別 / N:無

退貨說明

退貨須知:

- 依照消費者保護法的規定,您享有商品貨到次日起七天猶豫期(含例假日)的權益(請注意!猶豫期非試用期),辦理退貨之商品必須是全新狀態(不得有刮傷、破損、受潮)且需完整(包含全部商品、配件、原廠內外包裝、贈品及所有附隨文件或資料的完整性等)。

- 請您以送貨廠商使用之包裝紙箱將退貨商品包裝妥當,若原紙箱已遺失,請另使用其他紙箱包覆於商品原廠包裝之外,切勿直接於原廠包裝上黏貼紙張或書寫文字。若原廠包裝損毀將可能被認定為已逾越檢查商品之必要程度,本公司得依毀損程度扣除回復原狀必要費用(整新費)後退費;請您先確認商品正確、外觀可接受,再行拆封,以免影響您的權利;若為產品瑕疵,本公司接受退貨。

依「通訊交易解除權合理例外情事適用準則」,下列商品不適用七日猶豫期,除產品本身有瑕疵外,不接受退貨:

- 易於腐敗、保存期限較短或解約時即將逾期。(如:生鮮蔬果、乳製品、冷凍冷藏食材、蛋糕)

- 依消費者要求所為之客製化給付。(如:客製印章、鋼筆刻字)

- 報紙、期刊或雜誌。

- 經消費者拆封之影音商品或電腦軟體。

- 非以有形媒介提供之數位內容或一經提供即為完成之線上服務,經消費者事先同意始提供。(如:電子書)

- 已拆封之個人衛生用品。(如:內衣褲、襪類、褲襪、刮鬍刀、除毛刀等貼身用品)

- 國際航空客運服務。

若您退貨時有下列情形,可能被認定已逾越檢查商品之必要程度而須負擔為回復原狀必要費用(整新費),或影響您的退貨權利,請您在拆封前決定是否要退貨:

- 以數位或電磁紀錄形式儲存或著作權相關之商品(包含但不限於CD、VCD、DVD、電腦軟體等) 包裝已拆封者(除運送用之包裝以外)。

- 耗材(包含但不限於墨水匣、碳粉匣、紙張、筆類墨水、清潔劑補充包等)之商品包裝已拆封者(除運送用之包裝以外)。

- 衣飾鞋類/寢具/織品(包含但不限於衣褲、鞋子、襪子、泳裝、床單、被套、填充玩具)或之商品缺件(含購買商品、附件、內外包裝、贈品等)或經剪標或下水或商品有不可回復之髒污或磨損痕跡。

- 食品、美容/保養用品、內衣褲等消耗性或個人衛生用品、商品銷售頁面上特別載明之商品已拆封者(除運送用之包裝外一切包裝、包括但不限於瓶蓋、封口、封膜等接觸商品內容之包裝部分)或已非全新狀態(外觀有刮傷、破損、受潮等)與包裝不完整(缺少商品、附件、原廠外盒、保護袋、配件紙箱、保麗龍、隨貨文件、贈品等)。

- 家電、3C、畫作、電子閱讀器等商品,除商品本身有瑕疵外,退回之商品已拆封(除運送用之包裝外一切包裝、包括但不限於封膜等接觸商品內容之包裝部分、移除封條、拆除吊牌、拆除貼膠或標籤等情形)或已非全新狀態(外觀有刮傷、破損、受潮等)與包裝不完整(缺少商品、附件、原廠外盒、保護袋、配件紙箱、保麗龍、隨貨文件、贈品等)。

- 退貨程序請參閱【客服專區→常見問題→誠品線上退貨退款】之說明。

付款/配送