發燒必買

特價7折➤《哥吉拉與金剛》電影幕後製作特集

《哥吉拉與金剛:新帝國》電影美術設定集 幕後製作特輯✰怪獸迷的終極指南。地表最強對決!本書將解構電影《哥吉拉與金剛:新帝國》的幕後製作,揭開世界頂尖藝術家如何將令人驚豔的怪獸與史詩般的戰鬥場景,栩栩如生地呈現在大銀幕面前。獨家收錄——• 從未曝光的畫面:讓您一睹壯觀的場景、新亮相的怪獸,以及電影製作的驚人細節。• 拍攝團隊的訪談:通過導演 Adam Wingard(亞當·溫高德)、美術指導 Tom Hammock(湯姆·哈莫克)及其藝術團隊的獨家洞察,解構電影細緻的設計過程。• 場景的創作歷程:透過概念藝術與分鏡圖,追蹤《哥吉拉與金剛:新帝國》關鍵場景的發展。推薦給怪獸迷與哥吉拉的粉絲,適合與 Insight 出版社的其他怪獸電影系列書籍(Monsterverse),如《哥吉拉大戰金剛:電影美術設定集》(Godzilla vs. Kong: One Will Fall)和《哥斯拉:毀滅的藝術》(Godzilla: The Art of Destruction)共同收藏!

Discover the electrifying artwork behind the action-packed blockbuster, Godzilla x Kong: The New Empire.

Dive into the creation of Godzilla x Kong: The New Empire with this deluxe art book. Featuring commentary from the filmmakers, this volume explores how a team of world-class artists brought stunning creatures and epic battles to life for an all-new, big screen Monsterverse adventure. Illustrated with stunning visuals from the production, including never-before-seen concept art and storyboards, this book is the ultimate companion to one of the most highly anticipated films of 2024.

NEVER-BEFORE-SEEN IMAGERY: From all-new creatures, to stunning locations, this book offers an incredible gallery of art from Godzilla x Kong: The New Empire.

INTERVIEWS WITH CREATORS: Dive into the film’s intensive design process through exclusive insight from director Adam Wingard, production designer Tom Hammock, and their team of artists.

EXPERIENCE THE CREATIVE JOURNEY: Follow the development of key sequences from Godzilla x Kong: The New Empire, as told through concept art and storyboards.

COMPLETE YOUR COLLECTION: This book joins Insight’s other bestselling Monsterverse titles Godzilla vs. Kong: One Will Fall and Godzilla: The Art of Destruction.

今日最推

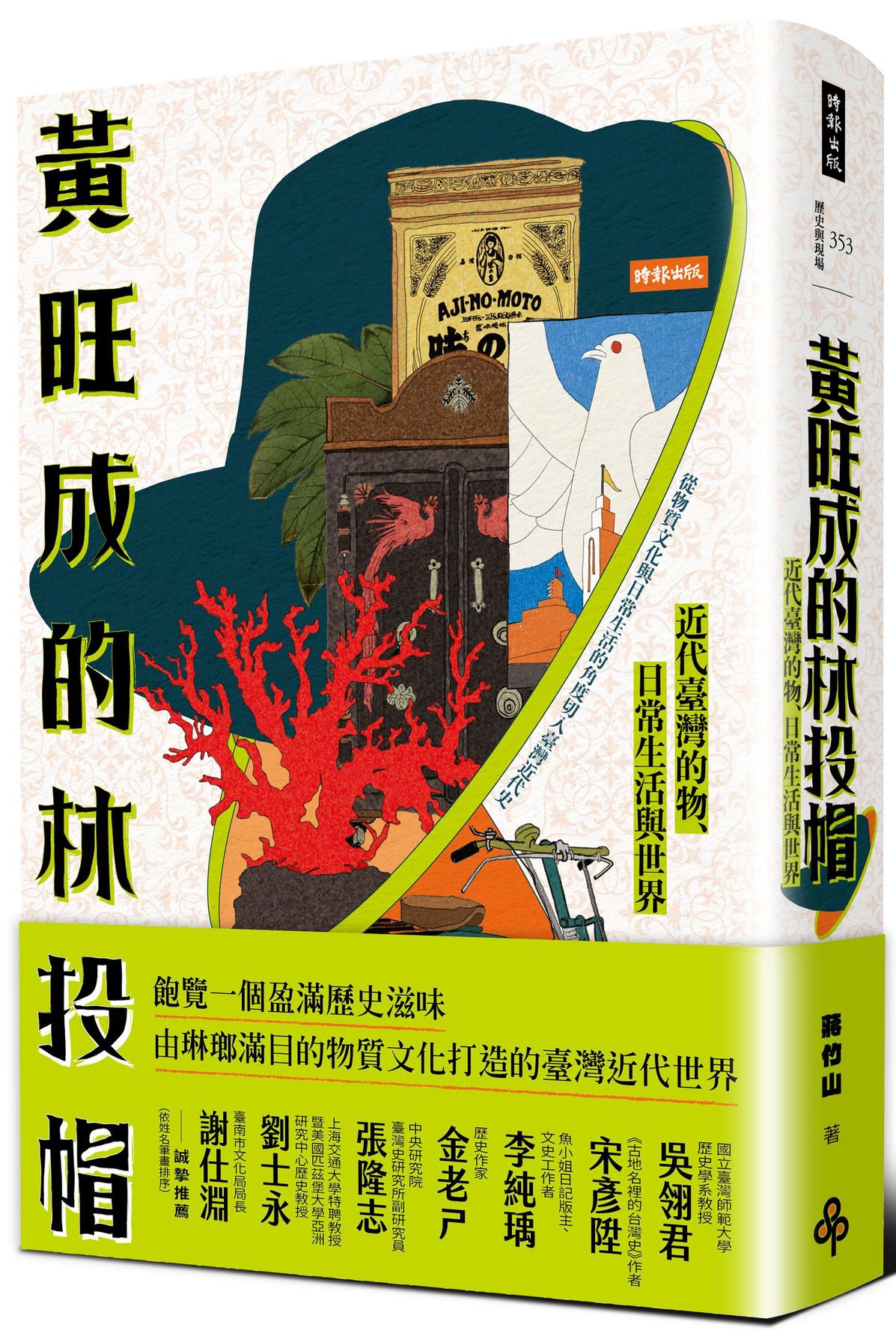

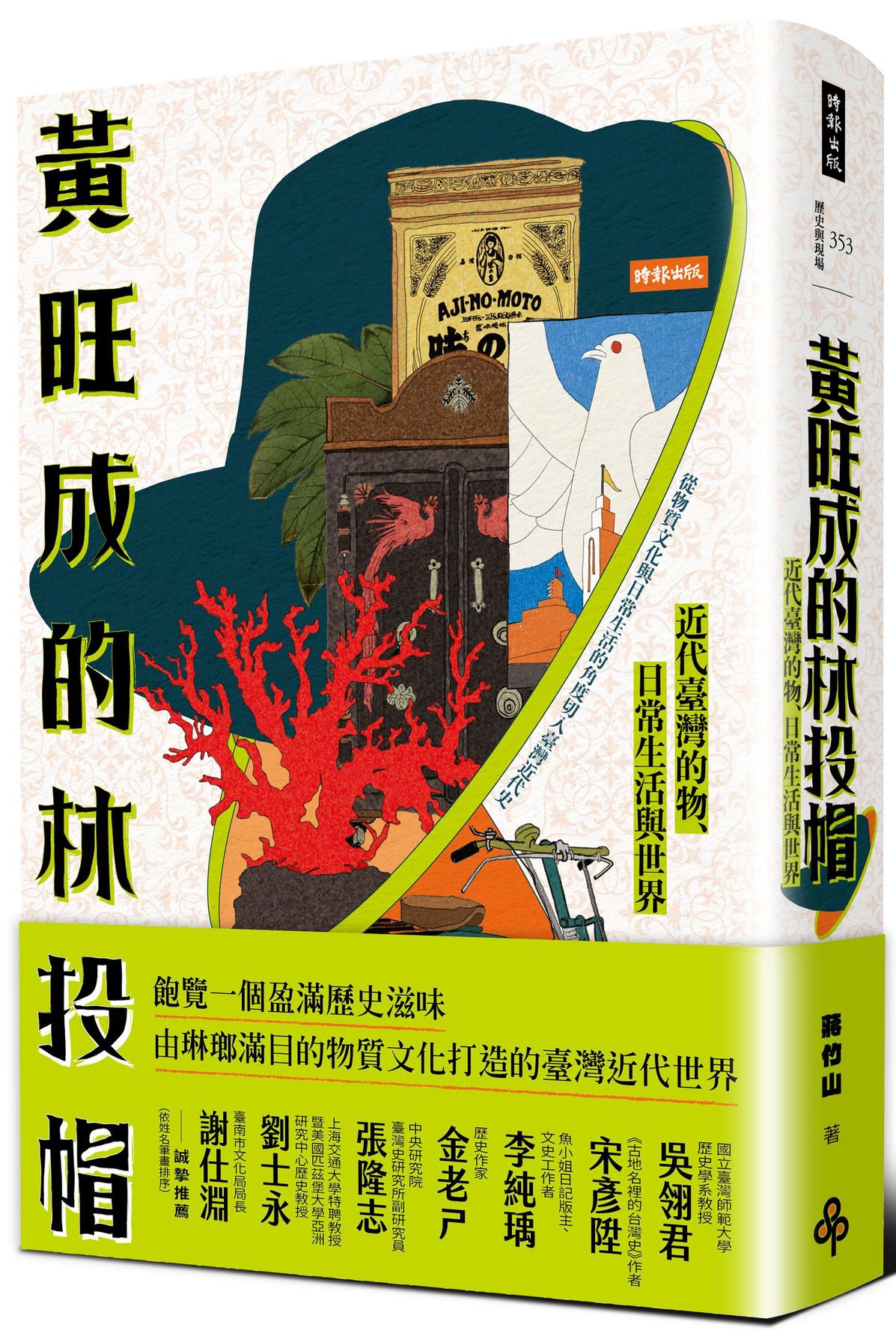

臺灣的物、日常與世界|黃旺成的林投帽: 近代臺灣的物、日常生活與世界

從日治時代到戰後的七○年代,

臺灣有哪些物產、人們如何過生活,國家在其中又扮演了什麼角色?

飽覽一個盈滿歷史滋味,

由琳瑯滿目的物質文化打造的臺灣近代世界!

《黃旺成的林投帽》聚焦在近代臺灣的物、物質文化與常民生活,透過「日常」再現城市脈動、以「觀看」來理解博覽會時代、從「製作」探討臺灣的物╱物產與世界的關聯、就「感官」來分析物對生活的影響,以及藉由「移動」來談戰時體制與戰後日常。

蔣竹山爬梳黃旺成、吳新榮、林獻堂等著名文化人的日記史料,與《臺灣日日新報》、《大阪朝日新聞臺灣版》、《聯合報》等報刊資料,穿越時空、抽絲剝繭,探索臺灣都市化與消費社會誕生的歷程,並以深入淺出的筆觸帶領讀者從微觀的方式看到宏觀的全球史發展脈絡,理解結合了物、感官與全球視野的當代史學研究新趨勢。

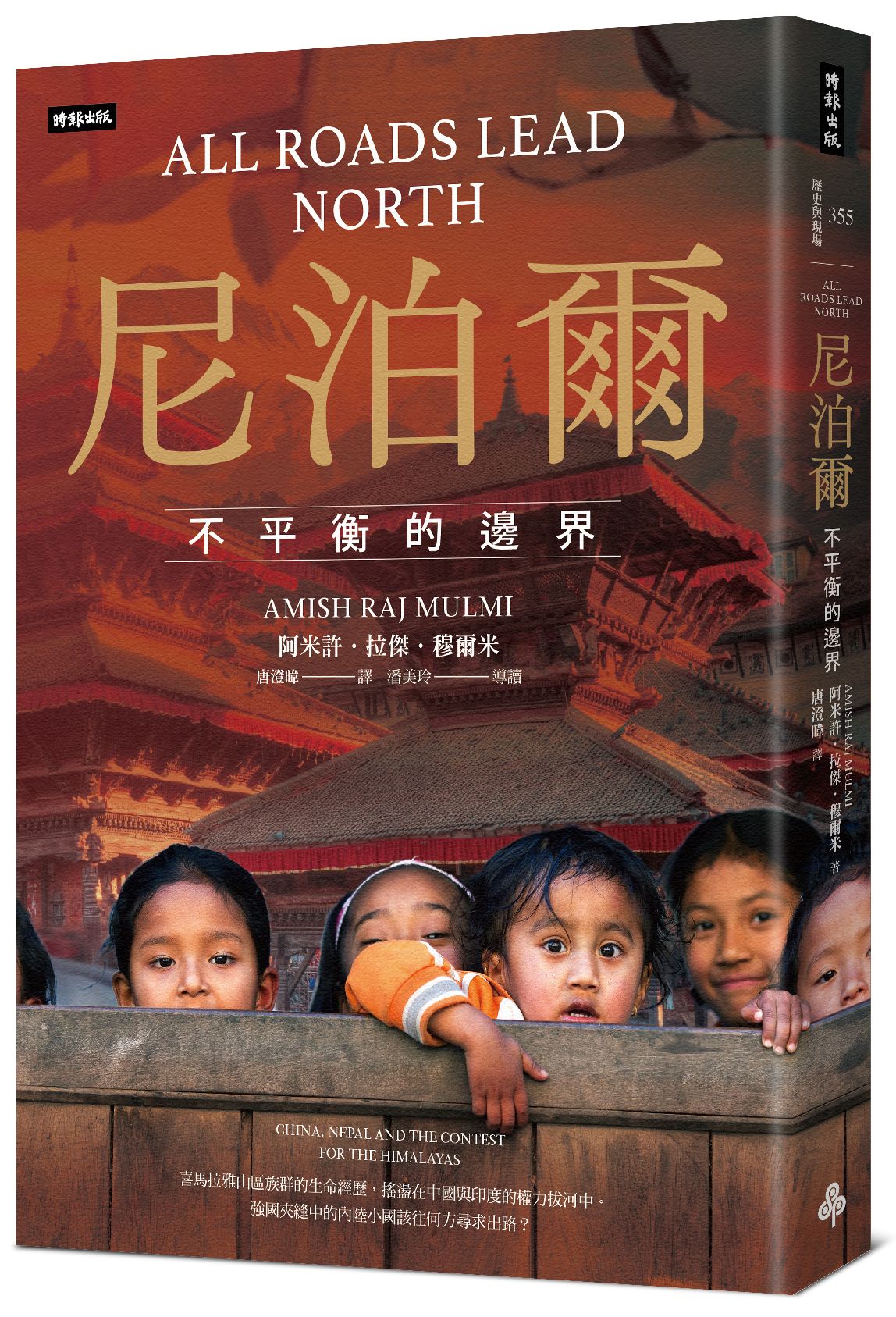

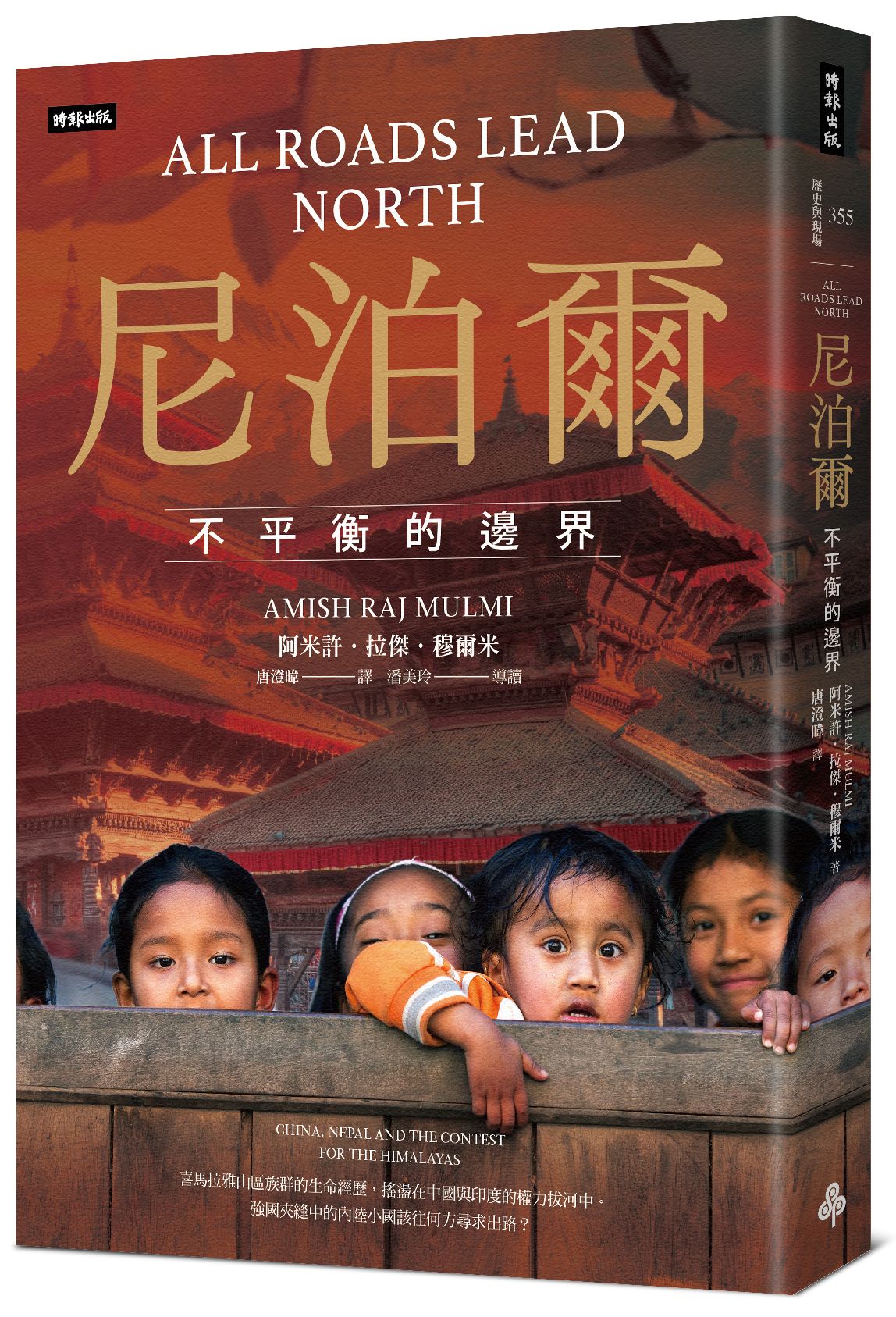

喜馬拉雅山區族群的生命|尼泊爾: 不平衡的邊界

喜馬拉雅山區族群的生命經歷

搖盪在中國與印度的權力拔河中

強國夾縫中的內陸小國該往何方尋求出路?

2020年六月,卡拉帕尼發生領土爭議,印度責怪尼泊爾引起局勢緊張,這時候的尼泊爾開始敢於為自己發聲,與中國的關係也日漸加深。但在種種指控與政治上的裝腔作勢之外,這反映了一個新的現實:南亞的權力局勢已經在重構,為中國騰出了空間。

尼泊爾轉而求諸北方並非一夕之間發生的事。尼泊爾與中國的連結有著奠基於佛教的深厚歷史淵源,可追溯至西元紀年早期。印度在2015年對尼泊爾展開非正式的封鎖,給了尼泊爾與印度分道揚鑣的動力,但尼泊爾早就渴望與北京深化關係,以反制印度具有壓迫感的親近。在中國對南亞和全球不斷漲大的野心之下,尼泊爾如今有了一個新的重要雙邊夥伴──而尼泊爾人正在靠著中國的幫助打造通往現代性的路,不只在偏遠的邊界是如此,在城市裡亦然。

針對尼泊爾對外關係的這個主題,這本書提供了深遠細密的觀察,而今日尼泊爾的對外關係,是由中國的世界強權地位所支撐。尼泊爾政治分析家阿米許.拉傑.穆爾米檢視了一段段將中尼邊界兩側高山族群緊繫在一起的歷史,分享從未被述說的那些關於藏人游擊隊、跨喜馬拉雅商人以及失敗的政變領袖的故事。他的這本專著同時包含歷史與報導文學,既複雜又精彩,並且經過嚴謹調查,細膩呈現出兩個鄰近強國夾縫中的尼泊爾。

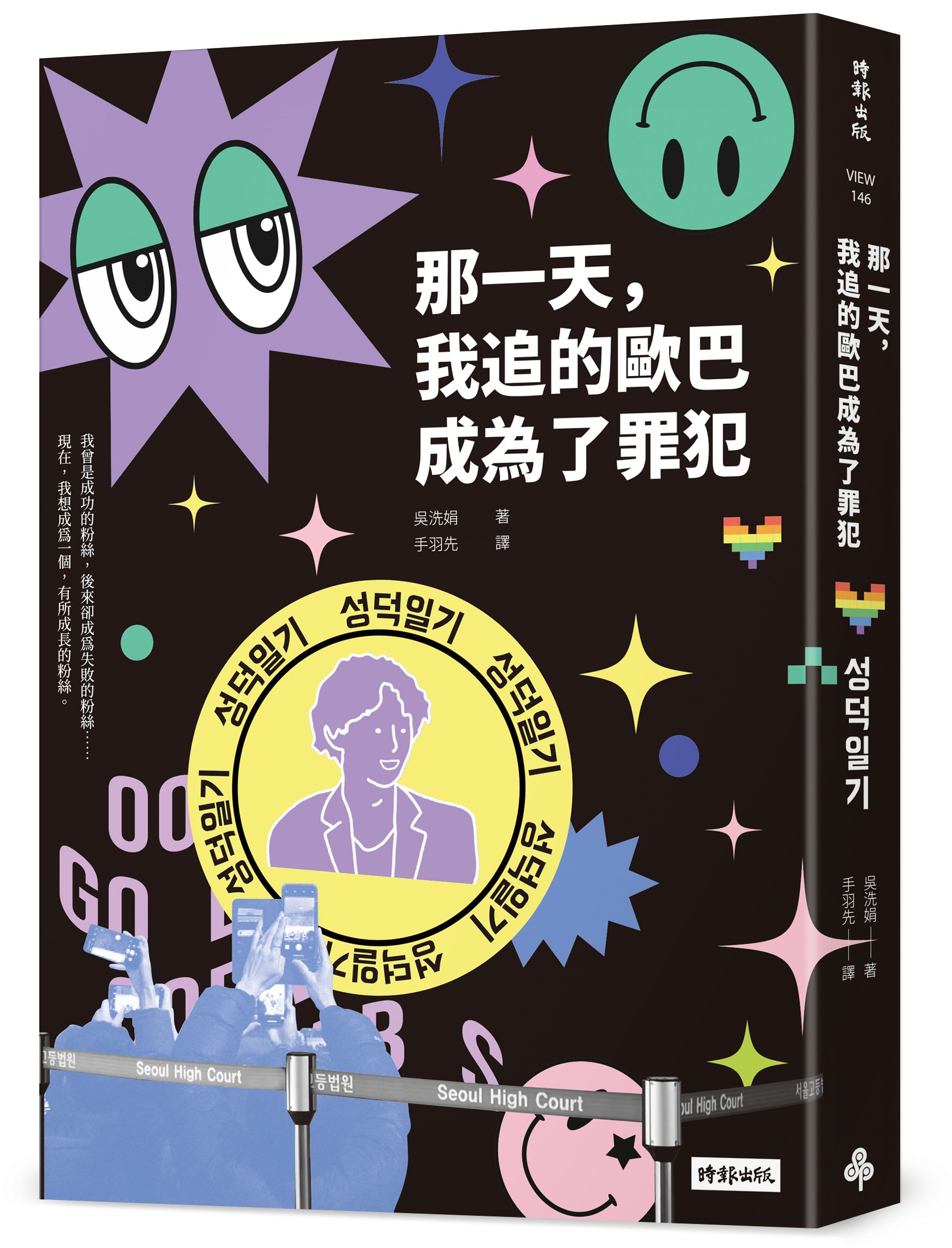

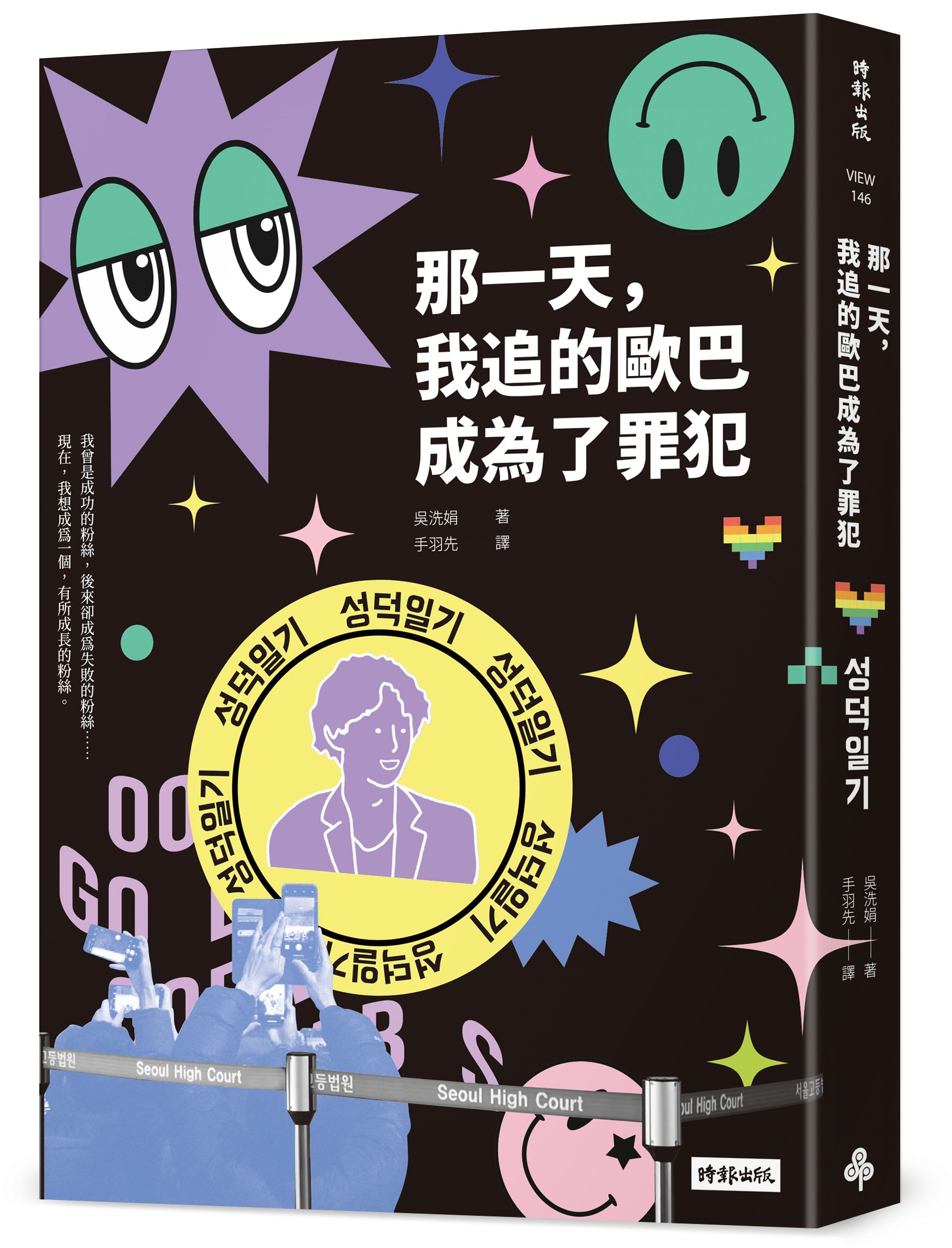

釜山國際影展話題之作|那一天, 我追的歐巴成為了罪犯

我曾是成功的粉絲,後來卻成為失敗的粉絲……

現在,我想成為一個,有所成長的粉絲。

獻給所有曾經愛、正在愛的你,讓我們找回愛的勇氣!

※作者訪台與電影特別放映活動,詳情請鎖定Facebook「時報悅讀俱樂部」※

★第26屆釜山國際影展話題之作

★劉在錫「You Quiz On The Block」節目專訪

★售出日文版權,電影日本熱映中!

★榮獲第23屆釜山獨立電影節評委特別獎

★入圍第58屆大鐘獎電影節、遠東國際影展、倫敦亞洲電影節、光州女性影展、釜山獨立影展、首爾獨立影展、仁川人權影展

偶像與粉絲,我和你

美好的回憶就這樣變成了黑歷史。

明明犯罪的是你,為何我如此悲傷、憤怒與自責?

【成粉,成功的粉絲】

作者吳洗娟就是一個「成粉」。為了讓歐巴記住,她穿韓服去參加簽售會,還以鐵粉身分上節目;歐巴一句「妳用功唸書,我努力唱歌」,更讓她穩拿全校榜首,考上理想大學。

【她喜愛的偶像,就是鄭俊英】

2019年,鄭俊英與BIGBANG勝利等人的聊天群組曝光,被發現散布多名女性的非法拍攝影片,之後鄭俊英被判5年有期徒刑。

【歐巴犯罪入獄,她成為失敗的粉絲】

回憶被剝奪,更彷彿自我被否定,她憤怒、難過又羞愧,也很好奇──其他粉絲也有相同感受嗎?偶像犯下厭女罪行,為什麼還是有女性粉絲願意相信他?

【敗粉成長之旅,是為了再次去愛】

她找到許多有相同境遇的粉絲,一起回看各自失敗追星的經驗,以及界線逐漸模糊的偶像與粉絲文化,希望讓這些撼動社會的偶像犯罪,不僅止於個人情感的損耗,也能獲得療癒與勇氣,找回自我,再次盡情去愛!

─【成粉內心話】─

❤沒有人是想追星才追的,而是像突如其來的命運般,打開了新世界的大門。沒在追星應該很難理解吧,這不是人生中能經常體會到的情感。

❤追星是熱烈的單戀。只看到他展現的樣貌就足以支持、喜歡他,想為他做很多很多。

❤以前覺得能被喜歡的偶像認出來才是成粉,但我現在認為,透過這份愛使自己的人生更加成長,才是真正成功的粉絲。

❤追星就是走入一個人的人生,再轉化為自己的人生。但必須牢記,偶像跟我一樣是平凡人,應該更客觀的看待,才能健康追星。

❤其實我能理解那些希望他徹底贖罪後,未來能好好生活的粉絲,我覺得那份心意非常美好。

❤現在我明白了,世上哪有完美的人啊。他究竟是怎麼樣的人,對我已不再重要,因為更重要的是喜歡他的過程。

❤即使一切的開端是他,我的主角仍是自己。沒有了他,我的世界也不會崩塌。若未來再喜歡上誰,我也會從他身上汲取些什麼,讓我的世界不斷擴大。

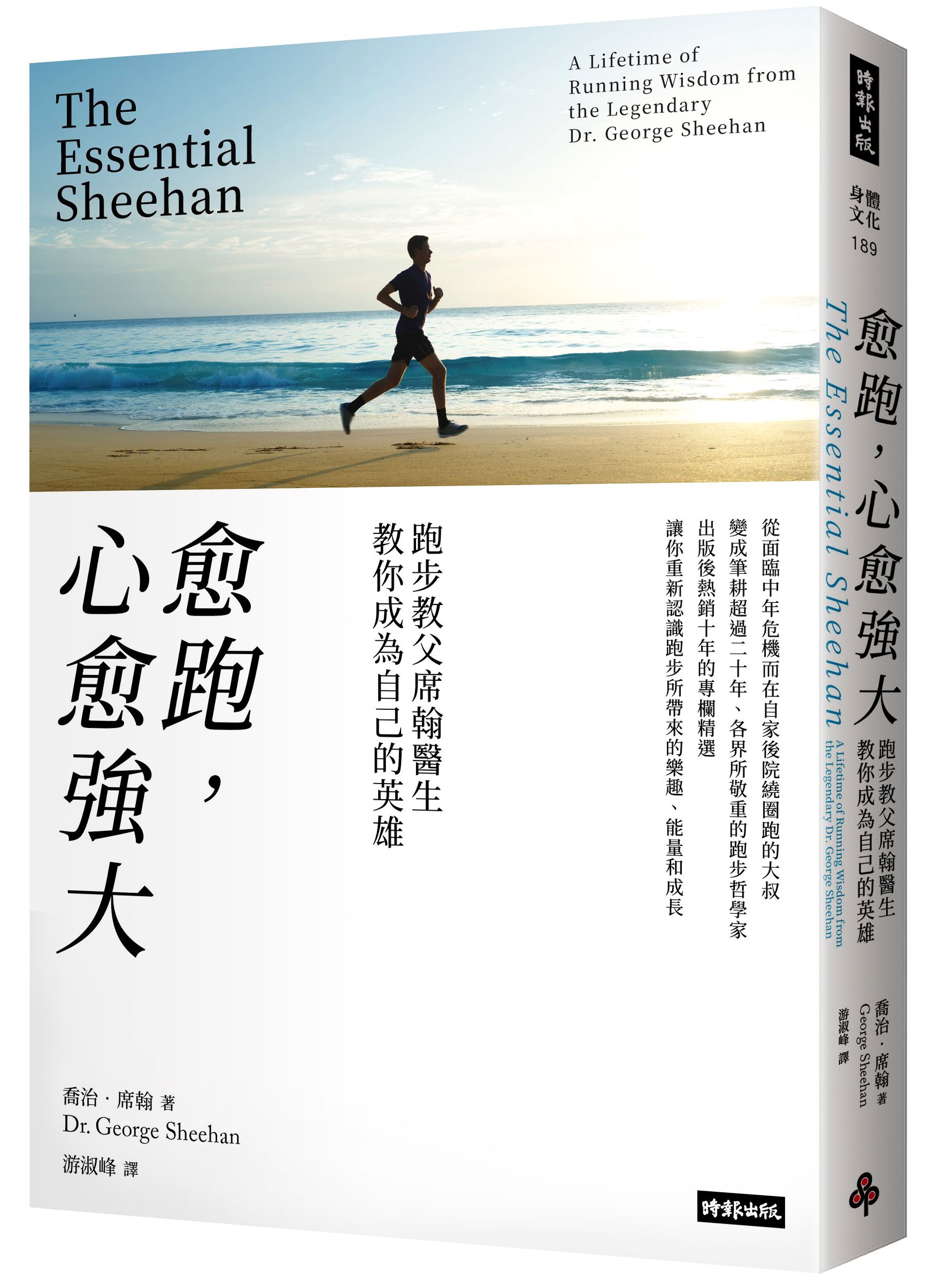

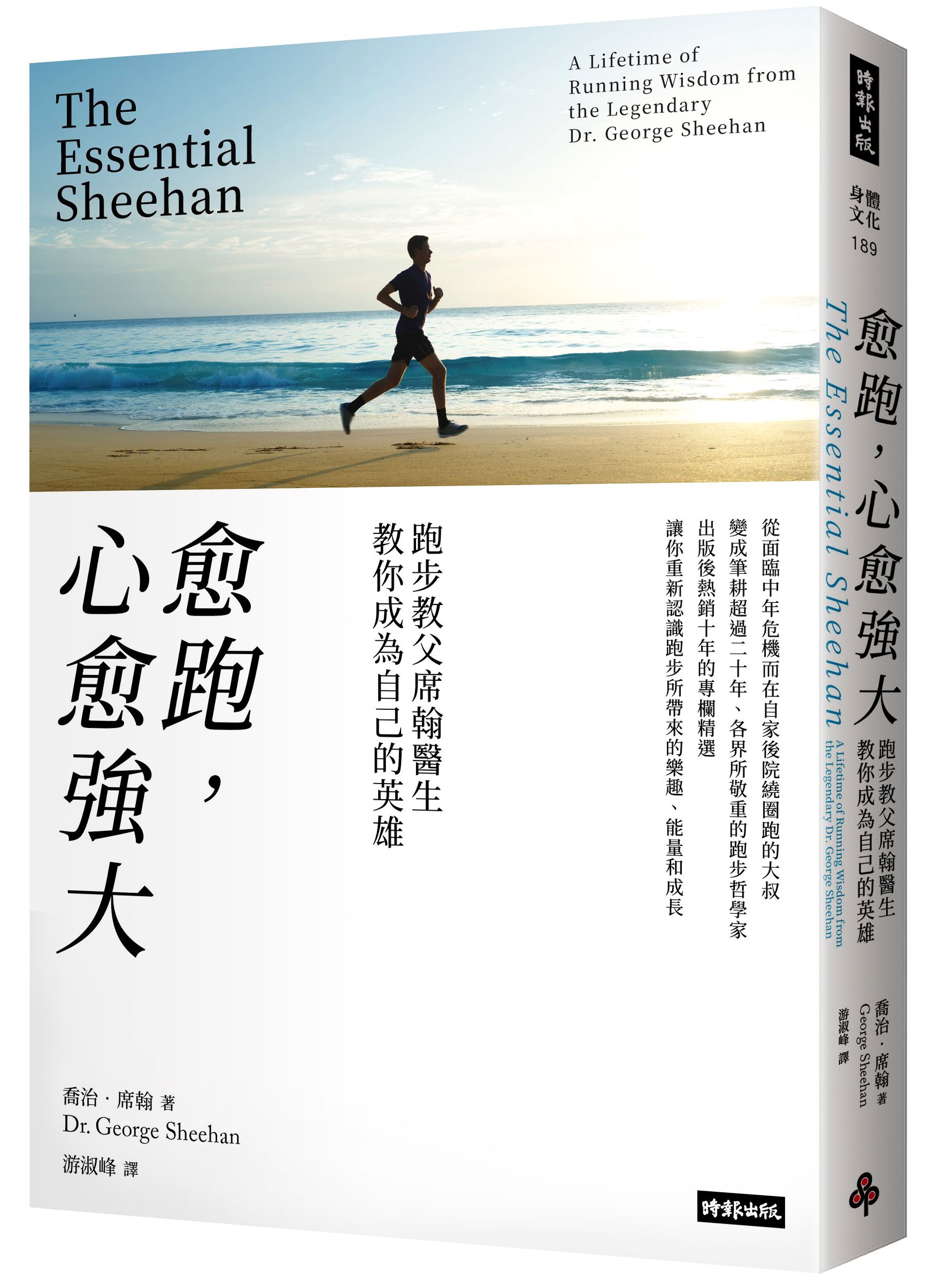

運動界最重要的哲學家|愈跑, 心愈強大: 跑步教父席翰醫生教你成為自己的英雄 (再戰十年版)

★《運動畫刊》譽為「運動界最重要的哲學家」

★ 出版十年,在美國與台灣跑步界最為推崇的心智訓練書,長銷再版!

「看完席翰的專欄文章後,我馬上衝出書報攤,返回租屋處,用最快的速度換好衣服,出門跑步。」──運動專欄作家約翰.布朗特(John Brant)

「跑步讓我自由。它讓我拋開別人的觀點,拋開外界加諸於我身上的教條與規範。跑步讓我從零開始。」──《跑者世界》總編輯大衛.威利(David Willey)

「一小時的跑步時間,成了我逃離日常事務的遊戲與享受。過程中,我重新發現自己、接納了我自己。」――喬治.席翰

一九七○年代,席翰醫生在四十五歲事業有成之時,回想起學生時代的田徑生涯,便在自家後院開始繞圈圈、接著在大街上跑、在河濱奔馳。接下來的二十五年,他投注極大的心力在跑步、比賽與打字機上,最後掀起了美國第一波的跑步風潮,而他本人更被奉為「跑步教父」。

很少有跑者像他一樣學問淵博,但又能簡潔有力、真誠地解釋跑步人生的哲理。透過他的領悟與闡述,跑步不再只是左右腳交替前進的單調運動,而是心的鍛鍊,與一趟「找到自己」的自由之旅。他為大眾開啟了新的運動思維,教大家把自己的人生發揮到極致。

本書集結席翰自一九七五年至一九九五年間撰寫的專欄文章,從他中年開始重新跑步說起,涵蓋訓練、比賽、馬拉松,最後也談罹癌的心路歷程以及對家人的愛,充分體現了「人生是一場馬拉松」的真諦。

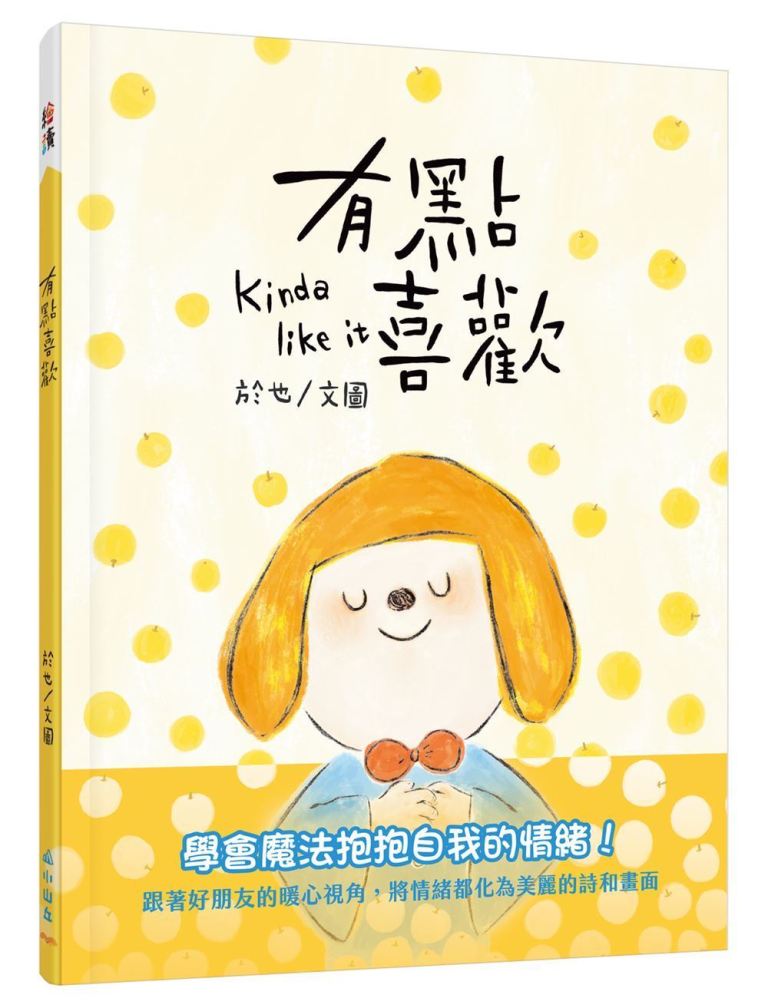

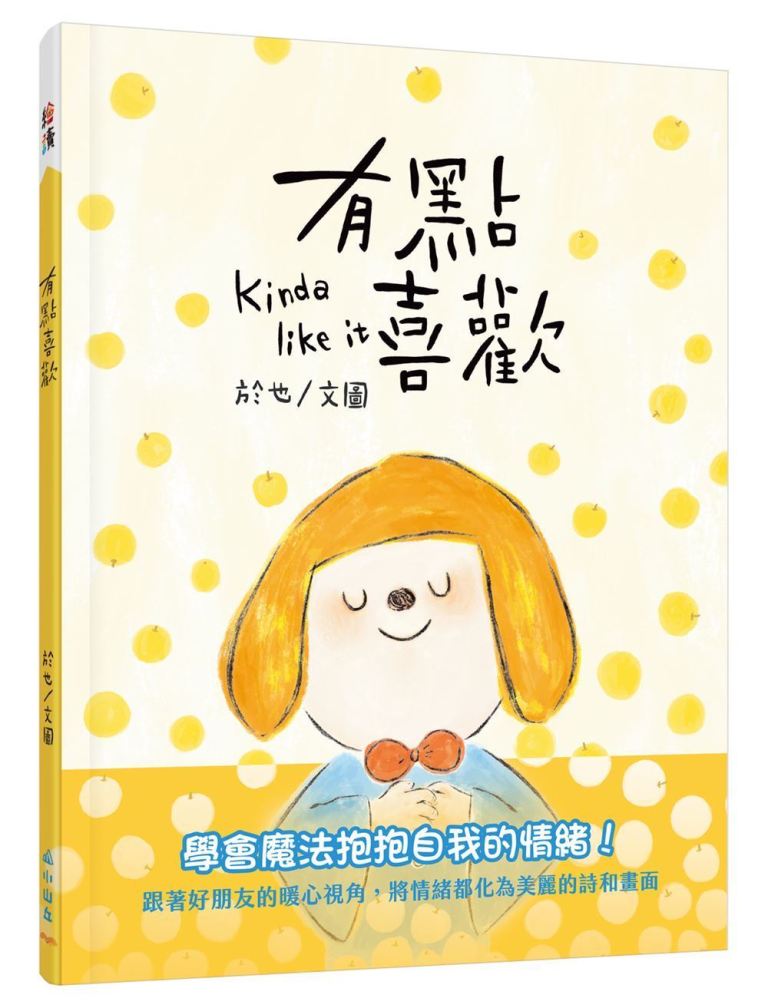

任二本買就送獨家明信片|有點喜歡

最美好的時刻,

是最糟糕的時候,知道有你相伴。

為了迎接一年中最美好的一天,

小巫師小心翼翼、悉心準備,

用一點冒險、一點勇氣,還有一點相信做好了美好蛋糕,

期待和好朋友們分享這份美好。

可是,卻發生了小意外!

小巫師躲進自己小小的情緒黑洞裡……

「我討厭我的不小心、討厭我的憤怒、討厭我的脆弱!」

本書特色

\美麗的情緒轉化:從全新視角認識自己/

全書從好朋友的暖心新視角重新詮釋,陪伴主角面對自己的小缺點,並將每份心情都轉化為美麗的畫面與小詩篇。感受純粹的愛與陪伴。

\情緒認知與表達繪本,學會魔法抱抱不完美/

給正在經歷低潮、懷疑自我、常常糾結錯誤的你一份同理的力量,溫柔的與你同在。家長也能引導孩子認識各式各樣的情緒和感受,並鼓勵表達出來。

\從追逐特別到日常:學習欣賞平凡的美好/

作者選用草莓與果子來做對比。日常就像「果子」一樣點點堆積而成,有點酸、有點甜的美好。一起想想,你的魔法果子是什麼呢?

*有注音

*推薦閱讀年齡:3歲~7歲親子共讀、7歲以上可自行閱讀。

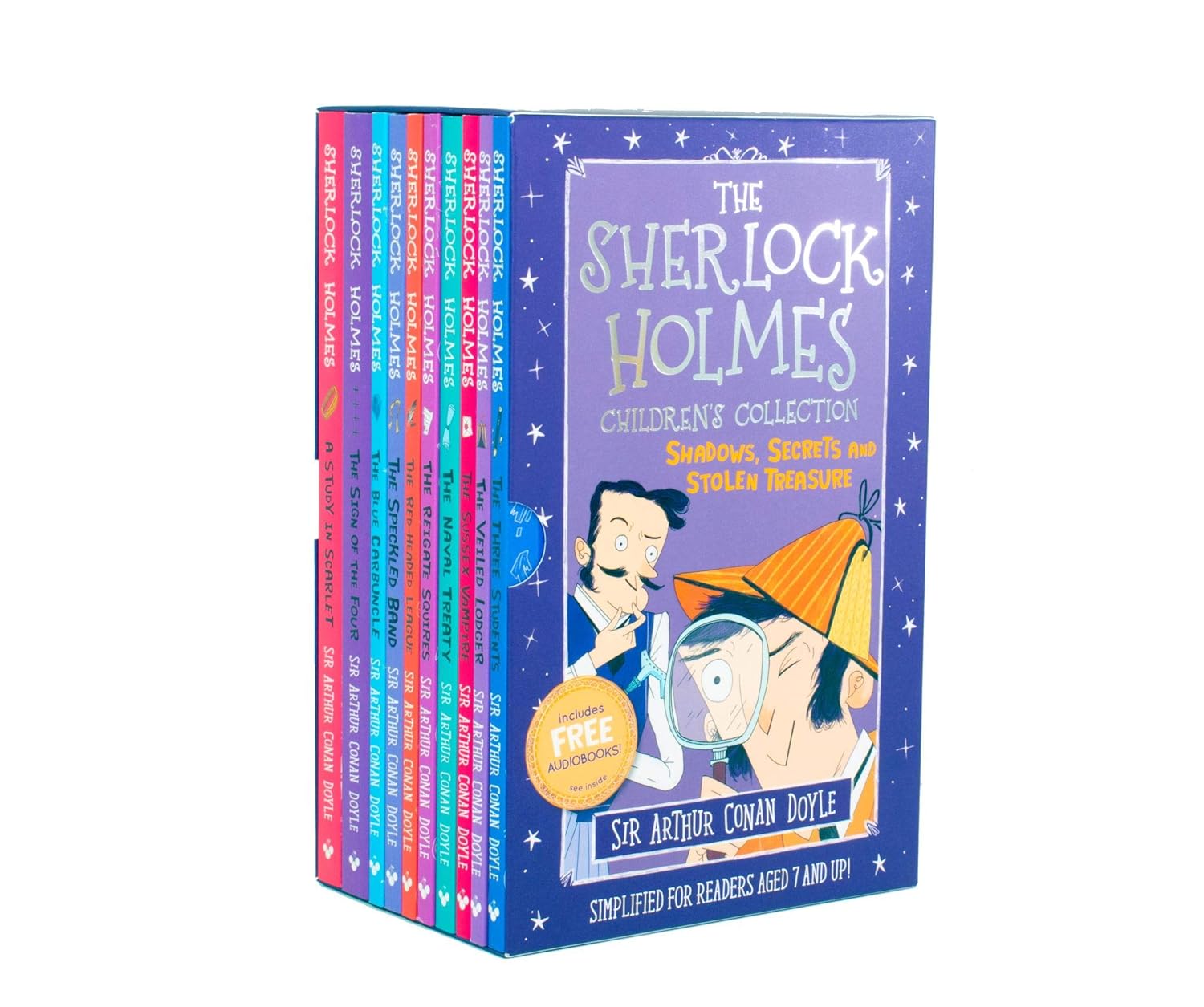

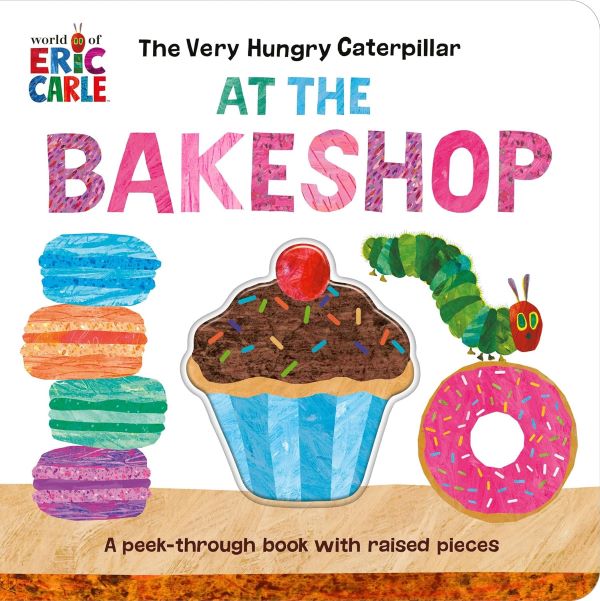

與好餓毛毛蟲吃遍甜點店|The Very Hungry Caterpillar at the Bakeshop

《好餓的毛毛蟲逛甜點店》厚紙板書

和毛毛蟲一起找找最喜歡的甜點吧!

杯子蛋糕、甜甜圈,馬卡龍......,每一樣甜點看起來都好好吃!好餓的毛毛蟲在甜點店逛了一圈,要選哪個好呢?

1969年誕生的《好餓的毛毛蟲》已經陪伴世界各地的小朋友50多年了。作者艾瑞.卡爾總是以獨特的拼貼藝術呈現豐富多彩的畫面。他所創造的故事充滿了詩意及童心。

這本為幼兒設計的厚紙板書,簡單的句子搭配上精美插畫與趣味小洞,讓小寶貝動動小指翻閱時,也能輕鬆認識甜點單字。

好康優惠

新書報到 | 馬上選購

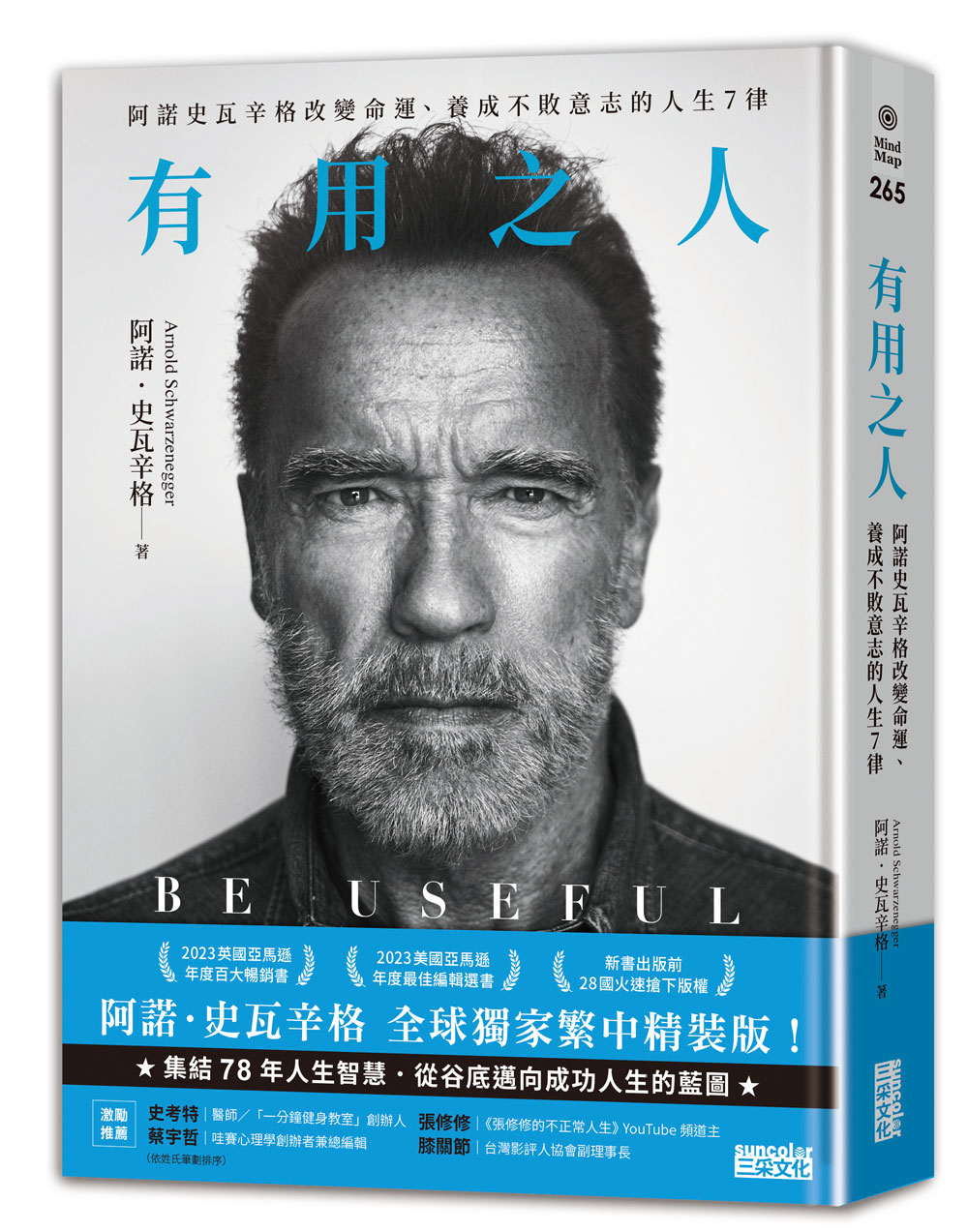

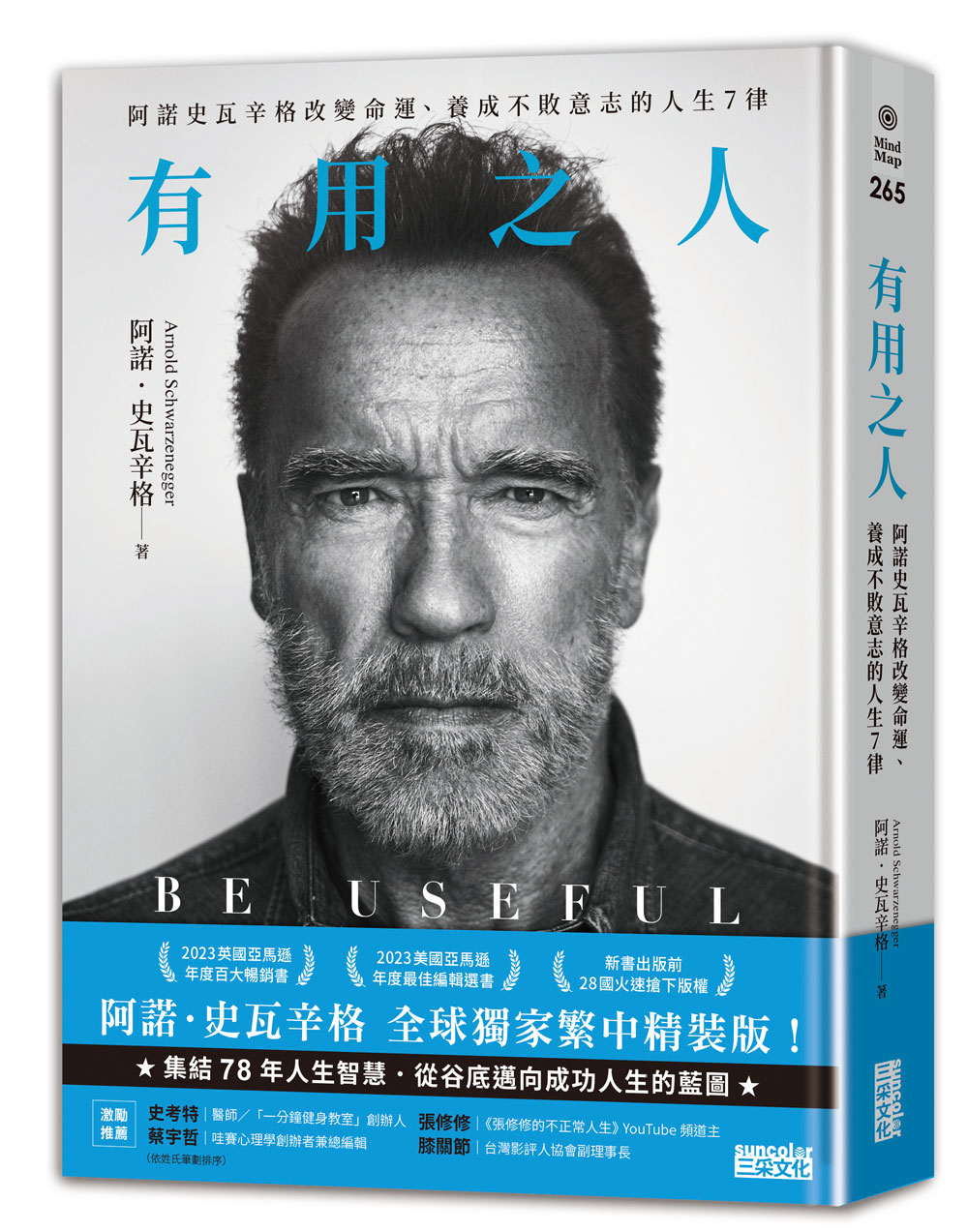

全球獨家精裝典藏版|有用之人: 阿諾史瓦辛格改變命運、養成不敗意志的人生7律 (全球獨家精裝典藏版)

從身無分文的美國移民到眾望所歸,

卸下健美之神、傳奇巨星、政治人物光輝,

阿諾.史瓦辛格將 78 年奮鬥淬鍊為 7 大原則,

帶領迷茫之人站穩腳跟、挺過風浪,實現有意義的人生!

★《紐約時報》NO. 1 暢銷書

★ 英國亞馬遜「2023 年度百大暢銷書」

★ 誠品外文館「編輯推薦選書」

★ 出版前,火速售出 28 國版權

★ 美國亞馬遜編輯精選「2023 年度最佳書籍」,連續 6 週總榜 TOP 20

★ 阿諾.史瓦辛格唯一繁體中文著作,硬漢精神掀起全新勵志風潮

他,曾是背包裡僅有 200 塊錢的美國移民,

一步步練成橫掃大獎的健美之神、跨世代傳奇巨星、斜槓政壇的加州州長。

走過無人看好的荊棘之路,阿諾到過低谷,承受常人難以想像的肉體與心靈疼痛,

始終堅守父親的唯一教誨───「成為有用之人」,持續回饋世界。

► 找到使命、仰望自我、鍛鍊毅力、校正心態、面對挫敗、選擇聽眾、練習回饋 ◄

7 大原則,開啟阿諾.史瓦辛格的人生坦途,今後也將改變你的一生!

#擁有明確的願景、清晰的圖像,也別忘了照照鏡子

青少年時期,阿諾只是憧憬美國的一切,金門大橋、帝國大廈、肌肉海灘……

直到在健美雜誌封面上看見當時的環球先生兼演員雷格.帕克,通往美國的路才變得清晰。

他看到自己手持冠軍獎盃,受群眾景仰,而一旦「看到」,就能「做到」。

#沒有 B 計劃!既然要做,就豁出去做

1987 年,阿諾已然成為好萊塢最具代表性的動作片演員,不過接下來,他想演喜劇。

沒有人看好這個想法,媒體一片唱衰,最後在他的堅持和縝密計劃之下,

獲得環球公司總裁支持,打造出票房破億的喜劇片《龍兄鼠地》。

#百分之百值得追求的目標,絕對需要百分之百的努力

身為健美運動員,阿諾每天鍛鍊 5 個小時,持續 15 年。

為了演出《魔鬼終結者》,他練習射擊的次數之多,以至能蒙眼完成每一場槍戲。

擔任公職後,他親力親為,坐鎮指揮現場,一夜完成數十萬人的安置、救護工作。

#想讓自己成為暢銷商品,先搞清楚要向誰推銷

阿諾在候選人辯論會初登場,就面臨大批質疑:又是健美選手,又是演員,可靠嗎?

但他抓住對手銳利的提問,將其化為向選民推銷的語言,

最終在選舉拿下 48.6% 得票率,三年後更以高達 55.9% 得票率連任加州州長。

#屈服於負面情緒,就等於讓它偷走你的時間

2018 年,阿諾因心臟瓣膜置換意外進行開胸手術,術後被迫停工、停止重訓。

在連呼吸都有灼燒感的處境下,他將負面情緒「換檔」,

最後只在加護病房待了六天,便如期回歸片場拍攝《魔鬼終結者:黑暗宿命》。

#你懂的不如你以為的多,所以閉上嘴巴,打開胸懷

穿梭於父親、運動員、演員、政治人物等多重身分中,阿諾始終認為,世界就是最好的教室。

於是,他把握每一次跟健身同伴閒聊的時刻,積極向達賴喇嘛、戈巴契夫等各界人士請益。

事實證明,好奇心和謙卑不僅為他帶來人脈,還有隨時可以運用的知識力量。

#人生不是零和博弈,你付出越多,往往得到越多

與健友互相監督動作,演員之間不吝指教,無償培訓特殊奧運舉重選手,

打破「以我為重」這面鏡子後,阿諾開始看見需要幫助的人,

同時也領悟到,回饋賦予生命意義,最終引導他成為「有用之人」。

唯有成為對自己、對這個世界有用的人,人生才有改變的可能。

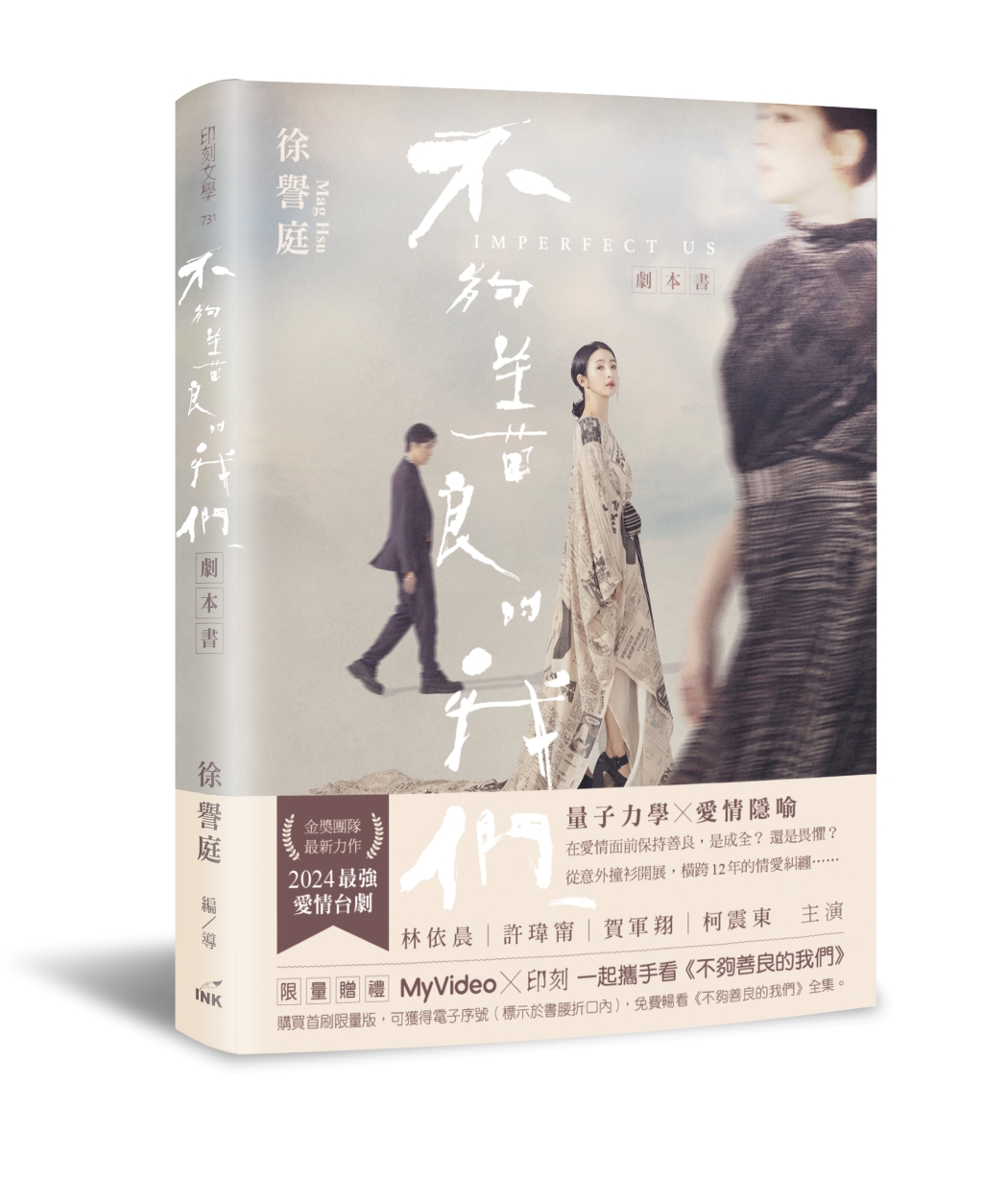

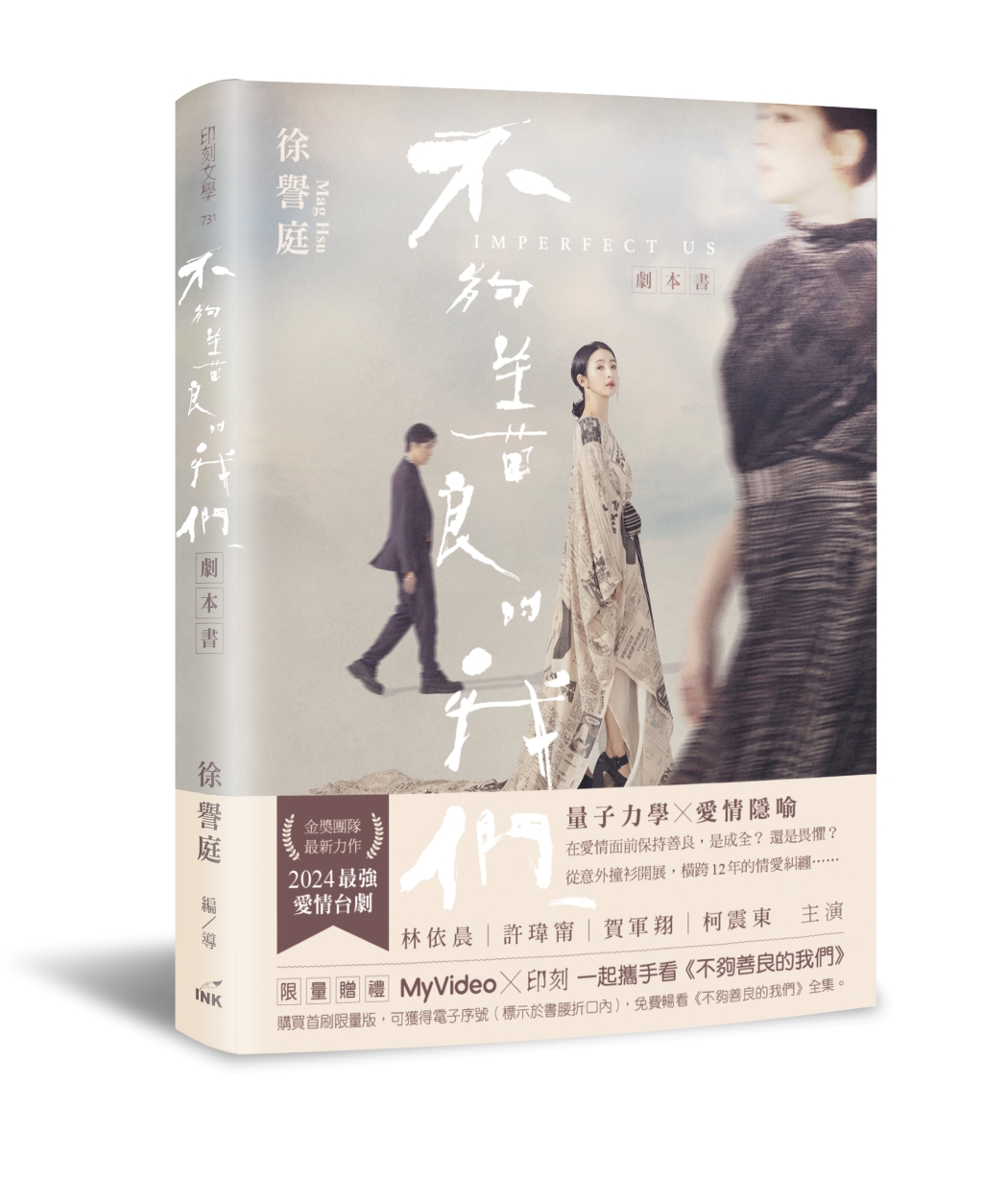

限量贈看片兌換碼|不夠善良的我們劇本書 (攜手看劇版/附贈MyVideo電子兌換序號)

量子力學X愛情隱喻

在愛情面前保持善良,是成全?還是畏懼?

從意外撞衫開展,橫跨12年的情愛糾纏……

金獎團隊最新力作 2024最強愛情台劇

林依晨|許瑋甯|賀軍翔|柯震東 主演

‧耗時一年打造劇本,完整收錄八集創作,及編寫心路歷程

‧搭配精彩劇照與幕後工作影像

‧人氣編導+黃金演員卡司,詮釋愛情裡的小心機,訴盡婚姻裡諸多無奈

--

我們為人生定下了一個又一個的目標,為了成全那一個又一個很剎那的快樂,但你發現了嗎?其實大部分的時間,我們都活在痛苦裡。

四十不惑的簡慶芬很幸運的達到人生設定的目標──老公體貼、孩子聽話的幸福家庭。不過她卻發現,即使自己很努力的放大了微小幸福,但日子似乎只是千篇一律、日復一日,找不到下一個需要達成的目標。

沒有追求目標的痛苦,就失去了「痛快」。就這樣,她想起了一個人──當年被她打敗的情敵Rebecca,並在臉書上找到了她。

Rebecca的臉書貼文字數不多,從動態隱約得知她未婚、有個小鮮肉男友,生活充滿驚奇。但,那是「臉書上的她」。實際上的Rebecca,剛被房東通知要搬遷,時間被忙碌的工作填滿,成為屬下口中的「人生負面教材」。

這兩位從年輕時屢屢撞衫,又同天生日的女孩,如同「量子糾纏」般的她們又愛上同一個男人,展開了這場橫跨12年的愛恨情仇……

限量贈禮

MyVideo*印刻 一起攜手看《不夠善良的我們》

購買首刷限量版,可獲得MyVideo電子兌換序號(標示於書腰折口內,7 31前須兌換完畢),免費暢看《不夠善良的我們》全集。

《不夠善良的我們》MyVideo全集熱播>>https: twm5g.co D3bE

最新刊!|Kinfolk 51

Kinfolk第51期

【關於Kinfolk】2011年創立於波特蘭,Kinfolk 以其獨特審美和深刻生活理念,成為設計師、攝影師、廣告人及藝術家的靈感泉源。這份季刊,最初只是一個分享晚餐與聚會照片的部落格,在兩週內以超過200萬的點擊量,展現了它獨特的魅力和吸引力。Kinfolk 以其獨有的攝影風格與精緻排版聞名:人物不笑、時間仿佛靜止、綠植與餐桌的獨特視角,透過一種冷靜而克制,簡潔卻溫馨的美學,巧妙地詮釋了現代生活的精緻藝術。《Forbs》雜誌對其評價為“獨立雜誌的新聲音”,充分肯定了其在小眾出版界中的顯著成就。對於讀者而言,Kinfolk不只是一本雜誌,更是一種生活態度與風格的展現,代表了追求美好生活的不懈努力和獨到見解。

Since 2011 Kinfolk has established itself as a leader in art and culture, design and aesthetics, architecture, and homes and interiors. Our quarterly lifestyle magazine is sold in over 100 countries, published in three languages and makes the perfect coffee table magazine or gift for a creative. Featuring inspiring photography, fashion and style, as well as examinations of slow living, Kinfolk is an art and design publication that seeks to promote quality of life and connect a community of creative thinkers.

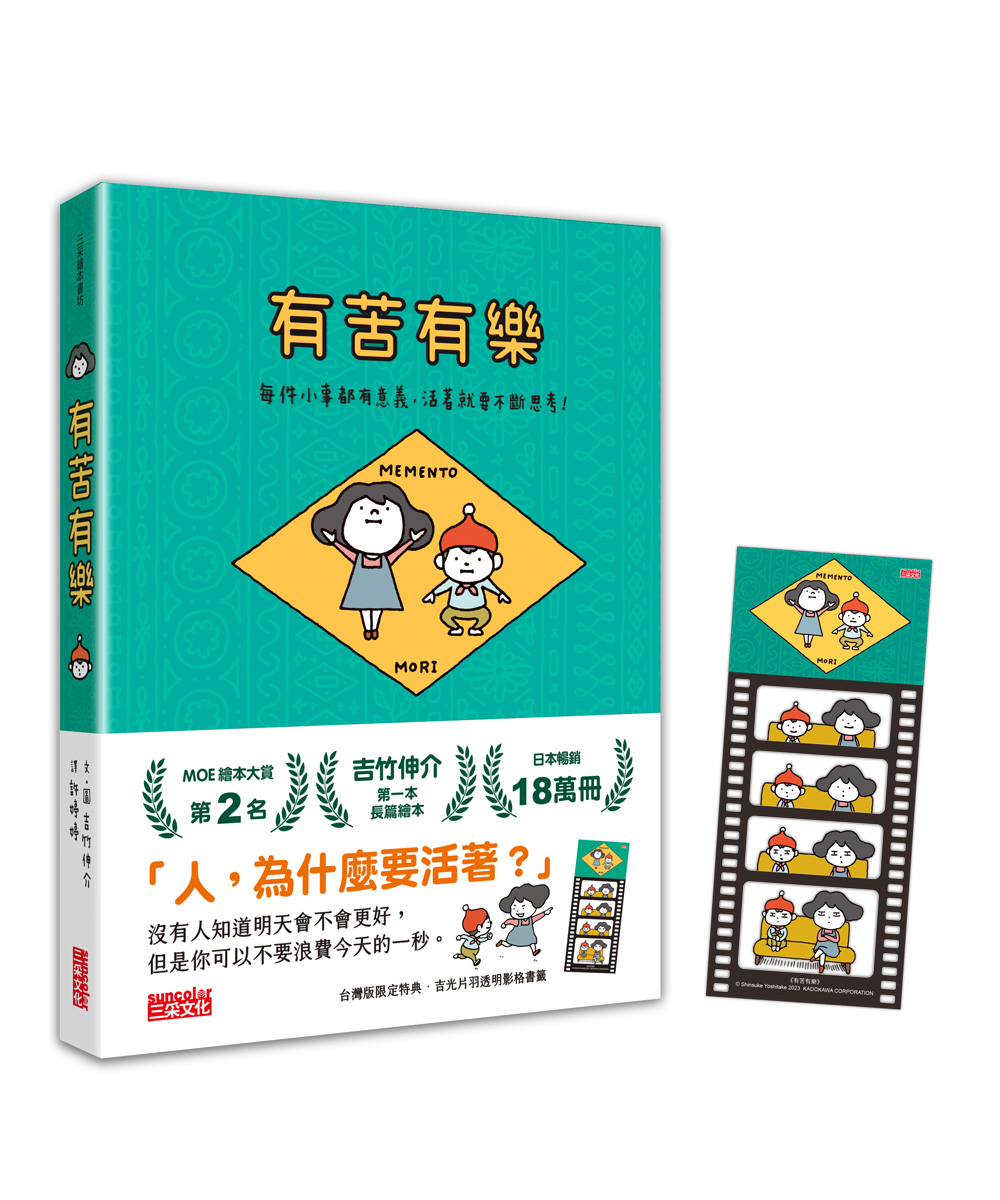

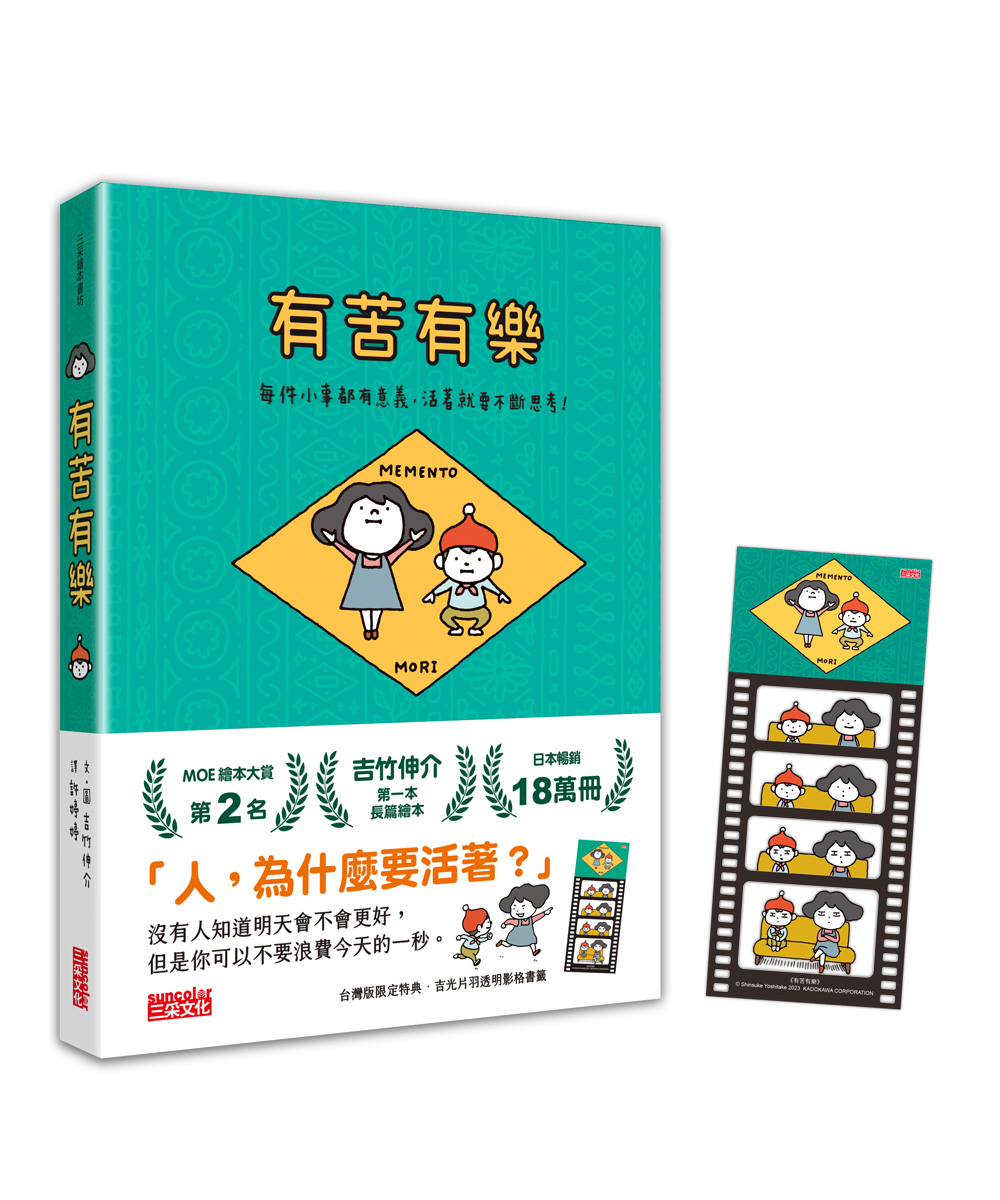

台灣版限定特典|有苦有樂: 每件小事都有意義, 活著就要不斷思考! (附吉光片羽透明影格書籤)

日本暢銷18萬冊

吉竹伸介第一本長篇繪本!

「人,為什麼要活著?」

人生啊,有苦也有樂,

沒人知道明天會不會更好,

但是你可以不要浪費今天的一秒。

★台灣版限定特典【吉光片羽透明影格書籤】

【國外暢銷佳績 得獎紀錄】

\榮獲各大日本繪本獎/

★2024年 紀伊國屋Kinobes!Kids 第1名

★2023年 MOE繪本大賞 第2名

★第11回 静岡書店大賞 兒童書新作部門 第2名

美妙的味道,是甜中帶有一點苦……

好看的故事,是笑中帶有一滴淚……

3篇小故事、3段童言童語,一起思考活著的意義。

1〈破掉的盤子〉

弟弟不小心打破姊姊手作的盤子……

弟弟覺得很抱歉,姊姊為什麼不在意?

珍貴的物品雖然想永久保存,

但世界上其實有更重要的東西……

2〈髒髒的雪人〉

雪人髒髒的,

它知道,只要冬天一結束,

自己就會融化消失,

於是開始自言自語……

我,為什麼存在這個世界上?

如果可以,有沒有別的選擇?

3〈無聊的電影〉

姊弟倆看完一部無聊的電影,

弟弟開始煩惱,如果以後的人生……

一直遇到無聊的事情怎麼辦?

這時,姊姊提出了不同的想法,

這個世界或許和人們想的不一樣喔!

【本書特色】

1.超人氣插畫家自寫自畫,用輕鬆的圖文思考生命的意義。

2.對日常小事有敏銳的觀察力,學習感受日常的每時每刻。

3.天馬行空的人生哲學,讓人意識到自己存在的價值。

【隨書好禮】吉光片羽透明影格書籤

★日本獨家授權★三采團隊精心設計★台灣版限定★

將書籤夾在任何頁面,任何筆記,

每個瞬間都變得閃閃發亮!

●尺寸:6.5X15公分

【書籍介紹】

◎有注音,8歲以下親子共讀,8歲以上自行閱讀。

◎六大領域分類:情緒、社會。

◎六大能力分類:表達溝通、關懷合作。

領券買書 | 閱讀推薦

町田苑香極治癒之作|即使你不在這裡 (親筆簽名版)

本屋大賞得主町田苑香寫給大人的極致治癒之作。

五篇關於離別之後的故事

無數個被溫柔牽起的瞬間。

如果難以想像遙遠的未來,請想起我。

我會在那裡等你,我知道你一定很努力。

所以放心地受傷,放心地生活,放心地前進吧。

◇ 守靈夜之夜

突然接到奶奶過世的消息,清陽暌違半年回到北九州的老家。

奶奶生前一直想看看孫女交往的對象,

但只要想到一喝醉就易怒的爸爸、沉迷拉霸機的媽媽、吵鬧的叔叔一家,

清陽就始終無法向男友介紹自己的家人……

◇ 阿婆進行曲

自從在前公司遭到霸凌和性騷擾,香子和別人相處都會感到害怕。

個性積極卻強硬的男友,希望她趕快找份「像樣」的工作,並計畫結婚。

我真的這麼差勁嗎?──香子不斷想著這個問題。

這時,她遇見每天都會在後院敲打大量碗盤杯壺的「交響樂阿婆」。

當香子向她搭話,阿婆竟說:

「妳也有吧。只要是停下腳步的人,都有想放在這裡的東西。」

◇ 黑洞

和我外遇的男人,拜託我做栗子澀皮煮給他太太吃。

我一顆一顆地剝著栗子皮,一邊想著我應該要和他分手才對。

有顆栗子被蟲蛀了一個小洞,照理說這種栗子要丟掉。

黑洞不斷冒出帶有澀味的浮渣,奶奶說這些浮渣都是壞東西。

噗咚。我把有黑洞的栗子裝進了給他的瓶子。

◇ 積雨雲誕生的時刻

我經常會在某個瞬間,突然什麼都不想要。這次的分手也是。

同一時間,我得知老家的藤江姑婆過世了。

意外的消息不只這個,藤江姑婆竟然是爺爺的情婦,

三十八年來,以「藤江」這個名字悄悄地在這裡生活著。

我跟著妹妹整理藤江姑婆的遺物,卻在不知不覺中梳理起至今的人生──

◇ 人生前輩

直到發現青梅竹馬藍生戀愛了,加代才意識到原來自己喜歡藍生。

更晴天霹靂的是,她無意間得知藍生很快就要搬家了。

焦躁的加代,打聽到藍生最近和一位叫作「死神婆子」的老太婆走得很近。

加代決定跟蹤藍生來到死神婆子的家。

沒想到,開門的竟是一位年輕迷人的女人……

◇

很多事物經過整理才能找得到,幸福也是。

於是才明白,原來幸福不必完美無缺,未必得克服一切。

也不只是一味灑脫或執著,而是放手要比緊握來得多。

每個充滿智慧的人生,都曾在迷惘與孤獨中跌撞。

那些無法如願的關係、無力解決的問題,他們走過,更比誰都感同身受。

讓他們擁抱你的踉蹌,憐愛你的傷痛。他們說不要緊,要聽進去。

原來也有一種幸福是,有人溫柔地向你保證——你會幸福的。

◇

他們也在這裡推薦

樂團|青虫aoi

作家|陳曉唯

作家|馮國瑄

作家|楊富閔

演員|簡嫚書

(依姓名筆畫序排列)

小說裡提出專業詞彙:「重啟症候群」,這樣的人就像游牧民族,必須不斷重啟生活。每當內心荒蕪的時候,必須再度離開,尋找水草豐美的棲息地,才能舒坦活下去。我好奇上網搜尋想了解更多,結果被小說家騙了,原來是小說家自創的詞彙,但我相信這只是一個還沒被廣受討論的議題。必須不斷歸零重新開始,才有辦法活下去。

我對這篇小說如此著迷,因為我也是這種人。

──作家.馮國瑄(摘錄自推薦序)

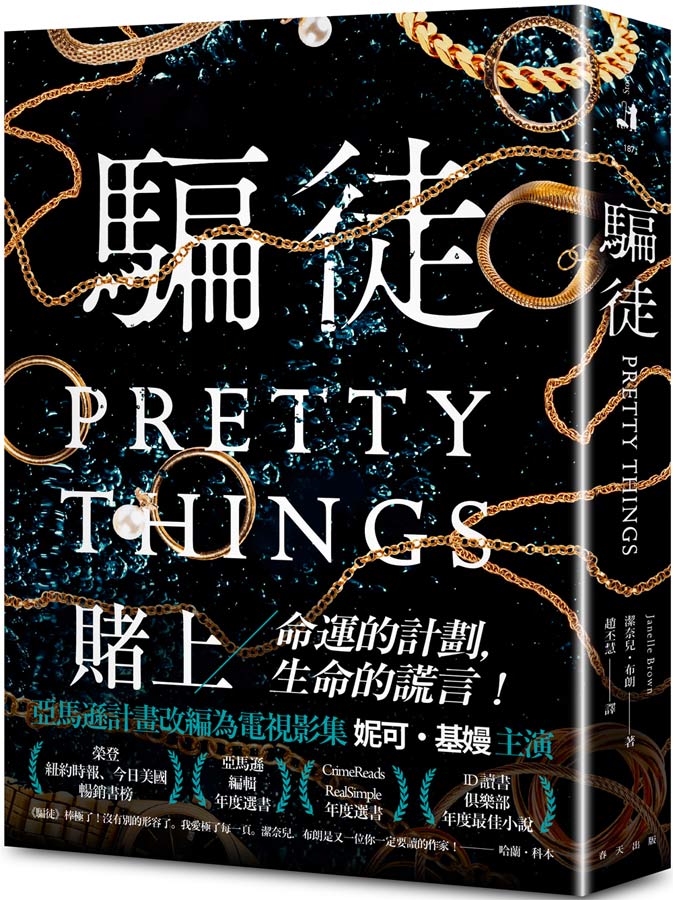

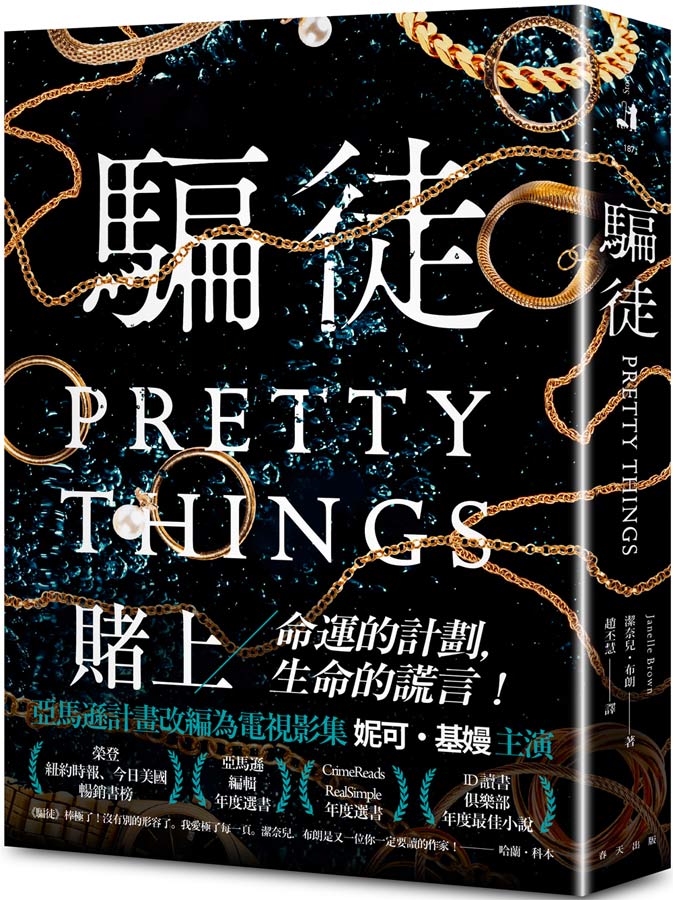

改編影集妮可基嫚主演|騙徒

賭上命運的計劃,賭上生命的謊言!

亞馬遜計畫改編為電視影集 妮可.基嫚主演

.榮登紐約時報、今日美國暢銷書榜

.亞馬遜編輯年度選書

.CrimeReads 、RealSimple年度選書

.ID 讀書俱樂部年度最佳小說

窮困潦倒的騙子vs.權貴富有的名媛

兩名女子的慾望、嫉妒、復仇,引發畢生最大的騙局……

妮娜一度以為她的學歷能夠讓她有個發揮長才的事業,可是這個夢想破滅了。為了擺脫窮困生活,妮娜選擇承襲母親的專才──詐騙。因應母親天文數字般的醫藥費,她正在尋找目標中,這時妮娜想到了凡妮莎,一個上流社會的女繼承人,同時也是華麗而且人人羨慕的名媛。

十幾年前,兩人之間有著因為家人而糾結的秘密。

財富和慾望、嫉妒和憤怒,復仇心使然,妮娜決定展開她最危險的騙局──偽裝成新的身分,開始接近凡妮莎……

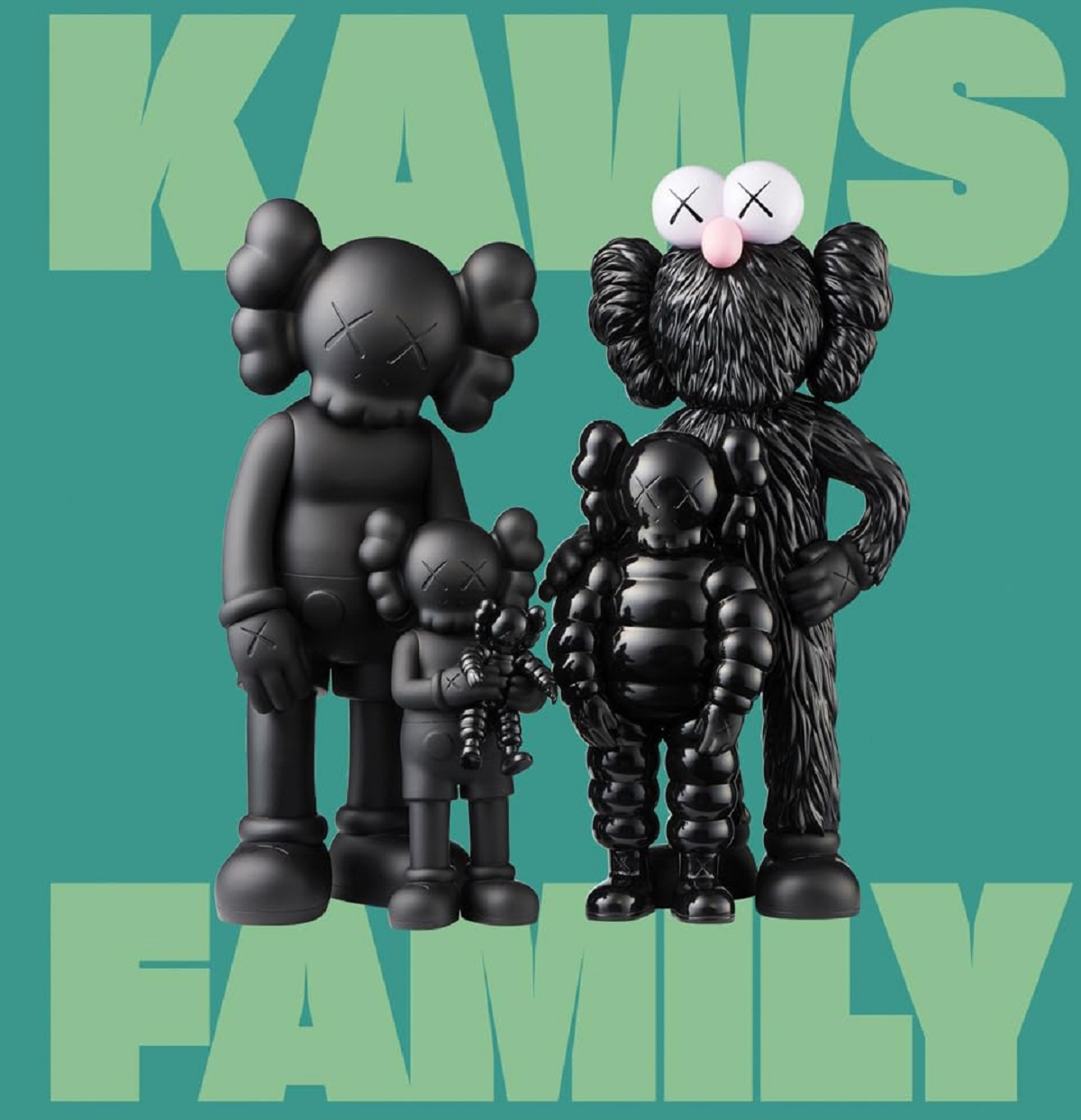

著名當代藝術家|KAWS: Family

【KAWS: Family】 ✰KAWS 粉絲必備收藏。KAWS,被視為當代的藝術巨擘,以其獨特的視覺語言和大型雕塑,席捲了藝術界、時尚圈與流行文化領域。他將街頭文化與流行藝術巧妙結合,顛覆了傳統藝術的疆界,為觀眾帶來耳目一新的視覺體驗。《KAWS: Family》 是 KAWS 首次於加拿大舉辦的大型個展,由多倫多安大略美術館主辦,本書收錄他過去二十多年的60多幅作品,涵蓋素描、繪畫、雕塑及精選商品,以及展覽現場照片、安大略美術館副館長兼首席策展人 Julian Cox 的文章,以及安大略美術館策展人兼總編輯 Jim Shedden 與 KAWS 的深度訪談。透過這些內容,讀者可以深入瞭解 KAWS 的創作脈絡,一窺他如何跨足於藝術、流行文化、產品設計與時尚等領域,發揮深遠的影響力。

American artist KAWS is one of the most famous living contemporary artists today. Renowned for his iconic visual language and larger-than-life sculptures, the artist draws on beloved pop culture icons to create a new and recognizable cast of characters of his own. The broad appeal of KAWS’ style has made his artwork accessible to collectors, museum visitors and the general public alike, and has led to collaborations with coveted global brands and immense commercial success.

KAWS: FAMILY, organized by the Art Gallery of Ontario, Toronto, marks the artist’s Canadian institutional exhibition debut with an array of his drawings, paintings, sculptures and selected products. The catalog features over 60 works from the past two decades, including installation photography; essays by Julian Cox, AGO Deputy Director and Chief Curator; and an interview with KAWS by Jim Shedden, AGO Curator of Special Projects and Director of Publishing. Together, this material provides new insights into KAWS’ influences and creative process as well as the impact his work has made across the spheres of fine art, pop culture, product design and fashion.

A graffiti artist since adolescence, Brian Donnelly (born 1974), known professionally by his moniker KAWS, received his BFA in illustration from New York’s School of Visual Arts in 1996. He has collaborated with brands such as Supreme, Nike and Comme des Garcons, and his work can be found in the collections of the High Museum of Art in Atlanta, the Modern Art Museum of Fort Worth, the Brooklyn Museum and the Museum of Contemporary Art in Los Angeles. KAWS lives and works in Brooklyn, New York.

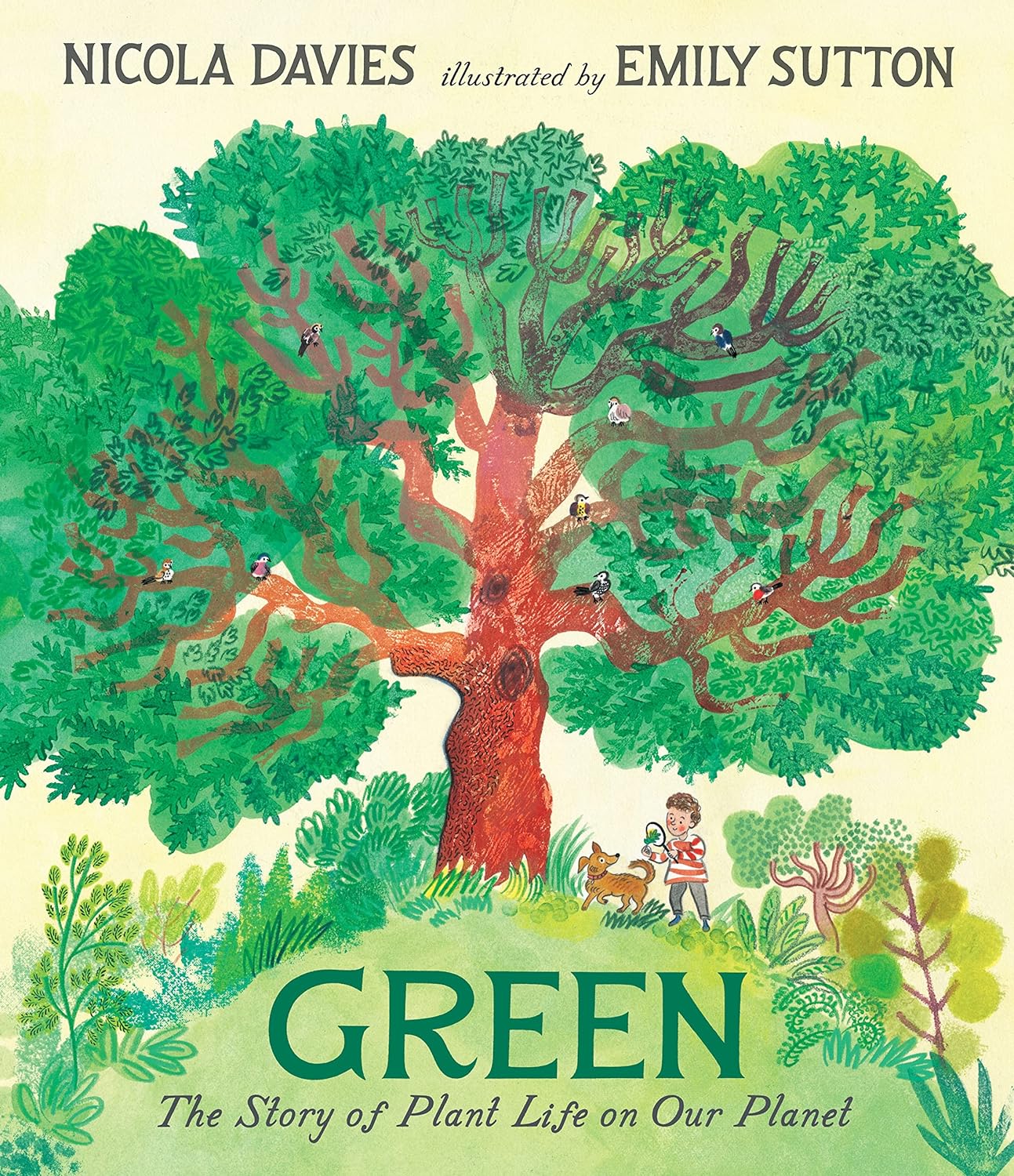

認識植物的神奇世界|Green: The Story of Plant Life on Our Planet

陽光下,樹木靜靜矗立。但是它可不像外在看來那樣悠閒。樹可是忙得很……。這本書要帶領讀者回到地球上開始出現植物的時候,看植物是怎麼進化成樹木,並認識植物的神奇世界。

A magnificent look at the science of plants from the internationally bestselling and multi award-winning team behind Tiny, Lots and Grow.

生活好物 | 編輯精選

杏仁粉+隨行杯果汁機|【林銀杏】母親節寵愛禮盒B款-芝杏經典禮盒

📣限時活動📣即日起下單贈

🎁粮芽棒共享盒 南瓜藜麥口味-168g壹盒

母親節寵愛禮盒B款-芝杏經典禮盒

💖100%天然杏仁研磨製成|給媽媽滿滿的愛🌷💖

🔹精選美國大杏仁,帶皮研磨細緻粉末

🔹不添加奶精、香精、防腐劑以及化學添加物

✔B款-芝杏經典禮盒

經典杏仁粉*2

經典杏仁粉(甜)*2

經典黑芝麻杏仁粉*2

KINYO隨行杯果汁機*1

Driver咖啡豆匙*1

誠品下單獨家贈品-粮芽棒共享盒 南瓜藜麥口味-168g壹盒

時尚選物 | 超值登場

煥膚保濕淨透明亮|綠藤生機無酸煥膚保濕組

新品上市首周熱銷破千支!新客推薦組

煥膚 x 保濕,實證淨透明亮

針對毛孔、粉刺、暗沉等肌膚問題,以獨特「三重煥膚機制」由內而外調理,從源頭中斷毛孔堵塞的惡性循環,三方實證使用 28 天 100% 細緻毛孔、86% 減少粉刺、81% 減少痘痘。

搭配最受新客歡迎、只有 12 個純粹成分的純粹保濕精華液,組成「荷包蛋保養法」,2 步驟高效補水、深入調理油脂與角質,達成淨透明亮的美好膚況。

✔罕見 0% 酸,敏感肌、醫美術後肌、孕婦皆能天天早晚使用。

✔特別推薦給推薦混合到油性肌的朋友。

使肌膚細緻光滑有彈性|ORIGINS品木宣言毛孔救星潔顏組

『泥娃娃活性碳潔顏露』添加同系列經典成分活性碳,磁鐵般的神奇吸力深層吸附100倍的毛孔裡的環境污染毒素、髒污、多餘油脂,徹底淨化,由再搭配經典泥娃娃面膜,讓肌膚更細緻光滑有彈性,黑頭掰掰毛孔白白,以無瑕美肌迎戰夏天!

【抗痘調理】 添加水楊酸,溫和有效煥膚,去除老廢角質,改善毛孔阻塞,防止粉刺生成。有效預防痘痘,毛孔細緻,膚質更平滑

【毛孔深清】 添加「天然黑鑽石」活性碳,磁鐵般的神奇吸力深層吸附環境污染毒素、髒污,毛孔徹底淨化

贈品牌眼鏡包|Overcorrection/ 太陽眼鏡/ OCEB01/琥珀

• Overcorrection無風格限制、無性別限制、無年齡限制、簡單生活,經典時尚。

• 使用"polarized 偏光鏡片",有效消除強反射光線及散色光,使光線變得柔和、景物更自然清晰。

• 墨鏡片拍攝因光線角度而有不同色澤,請以實品顏色為主。

• 墨鏡鏡鏡片皆有抗 UV400 功能

• 符合本標準總號:CNS15067

• 合格檢測指定代碼:D56123